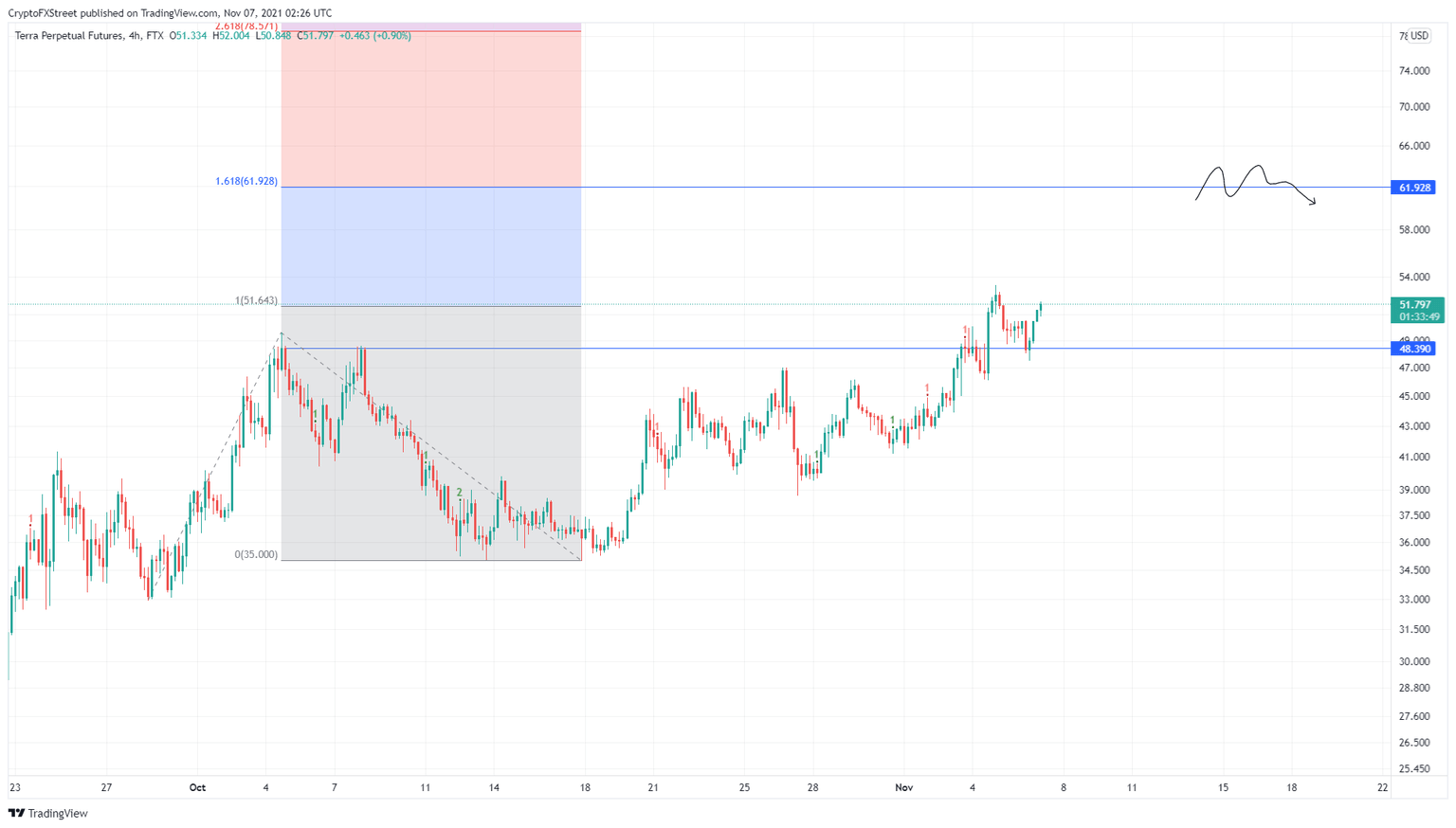

Terra Price Prediction: LUNA bulls to set new highs at $60

- Terra price has recently flipped the $48.39 resistance barrier into a support floor, indicating the start of a new uptrend.

- This move will soon follow a 20% upswing to $61.92, where LUNA will set a new all-time high.

- A breakdown of the $46.20 support floor will invalidate the bullish thesis.

Terra price was stuck under a crucial resistance level for roughly a month, preventing it from any gains. However, on November 4, LUNA breached this barrier, kick-starting an upswing. This move will likely continue, helping the altcoin set a new all-time high.

Terra price to enter unexplored territory

Terra price set up a new all-time high at $49.57 on October 4 but closed the four-hour candlestick at $48.39. Since then, LUNA tried to overcome this barrier four times but failed each time, making it a stiff resistance level.

However, on November 4, Terra price saw a massive surge in buying pressure that pushed it past this hurdle, kick-starting a 15% ascent that set up a new high at $53.29. Since then, LUNA has dropped 10%, but the recovery is going well and shows promise of continuing this uptrend.

In this case, investors can expect Terra price to make a run at the 161.8% trend-based Fibonacci extension level at $61.92 after a 20% ascent from its current position.

Although LUNA could extend its upswing, market participants should exercise caution as the volatility is typically high during the weekends.

LUNA/USDT 4-hour chart

While things are looking up for Terra price, a breakdown of the $48.39 resistance barrier will indicate indecision and weakness among buyers. This move will suggest that a further downtrend is likely.

If LUNA bulls recover quickly to make a comeback, the upswing will likely continue. However, a breakdown of the subsequent support floor at $46.20 will invalidate the bullish thesis for Terra price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.