SUSHI price poised for an 18% rise as SushiSwap sets sight on becoming “market-leading DEX” in 2023

- SUSHI price has climbed the charts by nearly 40% since the start of the year to trade at $1.259.

- SushiSwap currently has over $455 million in total value locked on the platform.

- SushiSwap plans to expand its DEX aggregation efforts and improve scalability and sustainability.

SUSHI price is reacting to the bullish momentum observed in the broader market as the altcoin rose to monthly highs on Monday. Going forward, this rise is expected to continue, given SushiSwap’s focus on becoming the market-leading decentralized exchange (DEX) this year.

SushiSwap doubling down in 2023

SushiSwap is currently the sixth biggest DEX in the world, having more than $455 million locked on the platform. Although at its peak in November 2021, the total value locked on the decentralized exchange was more than $10 billion, the consistent crashes and downfalls of the crypto market since then reduced its Total value locked (TVL) by 94.38%.

SushiSwap TVL

SushiSwap’s CEO, Jared Gray, intends to change this and bring the DeFi protocol back to its former glory this year. In accordance with the same, in a blog post on Monday, Gray announced the focus the decentralized exchange would have in 2023. The first of these is becoming a market-leading DEX. Talking about the same, Gray stated,

“We will maintain decentralization’s best principles, like self-custody, equitable governance, & permissionless trading. Ultimately, we will provide deep liquidity, optimal pricing, sustainable tokenomics, & an easy-to-use platform, placing you first in everything we build.”

In addition, SushiSwap will also be entering the DEX aggregation business in the first quarter of 2023. By building deeper liquidity in its pools as well as permitting liquidity pools to enjoy increased swap volume and fees, SushiSwap will drive the DEX aggregation.

SUSHI price takes a hike

SUSHI price has been increasing for over two weeks and has established a stable position at its highest level for the month. The altcoin is now looking to climb higher and inch closer to invalidating the losses the DeFi token bore during the FTX collapse in November 2022.

Positive developments, such as the bunch mentioned above, would keep the bullish momentum going. Trading at $1.259, the SUSHI price would be able to kick start an almost 18% rally once the immediate resistance, at $1.335, is breached and flipped into a support floor.

From here on, the next major resistance for SUSHI will be at $1.478, reclaiming which will complete the 18% rally and set SUSHI up to recover prior losses.

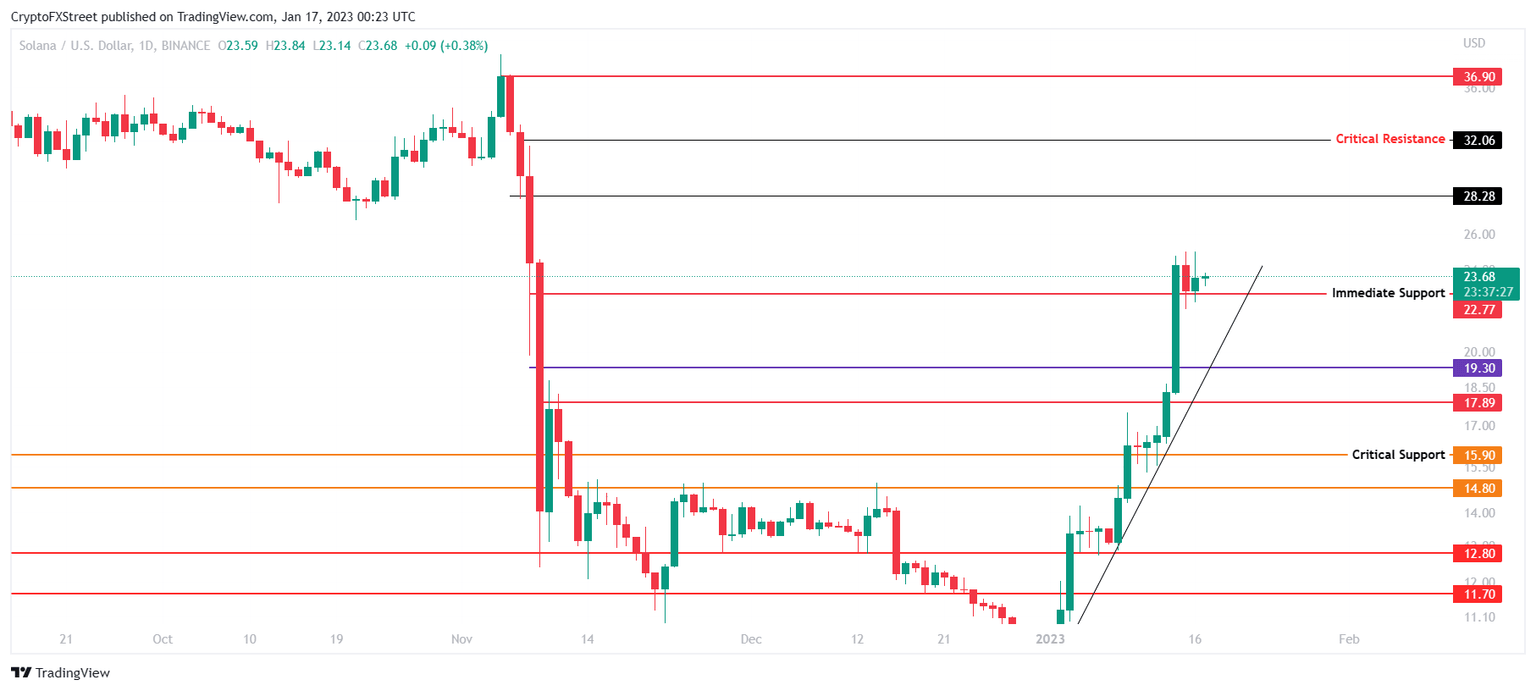

SUSHI/USD 1-day chart

However, if corrections due to a market cool-down begin over the next few days, this rise could end up in trouble. Losing the support at $1.242 and slipping off the critical support at $1.090 would wipe out half of the recent gains. A daily candlestick below this level would invalidate the bullish thesis, setting SUSHI price up for a decline to $0.988.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.