Stablecoins plummet as Bitcoin surges, forces behind the recent money rotation

- Stablecoin balances on CEXs have reached their lowest point since May 2021, suggesting a potential shift towards DEXs.

- Investor confidence has waned amid regulatory scrutiny and instability in the stablecoin market.

- Meanwhile, macro factors favor Bitcoin, with the Fed hinting a potential pause to the rate hike cycle.

Stablecoins have recorded a diminishing balance, coinciding with a recent Bitcoin price surge. The move suggests a money rotation out of stablecoins and into the king crypto. Notably, this has driven the flagship cryptocurrency’s rally in 2023.

Also Read: These three catalysts are key to Bitcoin price rally to $35,000

Investors abandon stablecoins as balances stream into Bitcoin

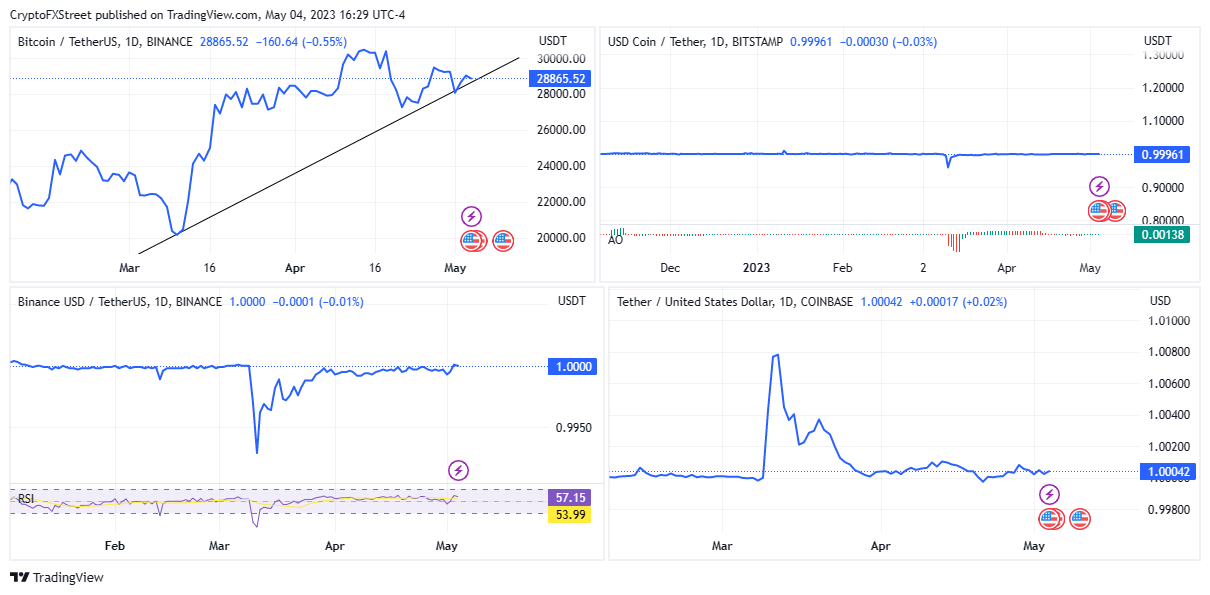

The stablecoin market has been unnerved ever since the US regulatory bodies started their clampdowns. Major players in the stablecoin market, like Binance USD (BUSD) and USD Coin (USDC), de-pegged. As a result, the stablecoin sector recorded a significant decline in aggregate market capitalization.

Based on CoinMarketCap data, the stablecoin market cap stood at $130.14 billion, down 0.02% with a balance of just $21.06 billion based on the ion Glassnode data. The blockchain analytics firm also shows that the implications have been wide-ranging, with leading stablecoins like BUSD, USDC, and Tether (USDT) affected.

The dwindling stablecoin balances on centralized exchanges (CEXs) and plummeting stablecoin market cap correspond with Bitcoin’s 70% rally this year, indicating that funds have moved from stablecoins to Bitcoin.

BTC/USDT 1-day chart, USDC/USDT 1-day chart, BUSD/USDT 1-day chart, USDT/USD 1-day chart

Nonetheless, the market has yet to witness any new capital inflows.

Investors leveraging stablecoins to avoid crypto token volatility

Over the past three years, investors have increasingly shown bias toward stablecoins for their crypto purchases to protect themselves from the volatility of crypto prices where other tokens are concerned. However, as their balances reduce on CEXs, investor caution seems to be on the rise. The same is reflected in Glassnode data, suggesting that the volume of stablecoins held in CEX addresses has plunged to its lowest since May 2021.

The data represents an over 50% drop since recording a peak of more than $44 billion in mid-December. Notably, the dwindle gained momentum after US regulators’ February clamp down on BUSD, the Paxos stablecoin, and the USDC volatility later in March.

Forces behind the money rotation from stablecoin into Bitcoin

According to Dick LO, the founder, and CEO of TDX Strategies, the drop in stablecoin balances shows skepticism among investors to take risks. This comes after US regulators cracked down on the stablecoin industry. For instance, New York regulators issued a cease and desist order against Paxos for the BUSD stablecoin. Also, the recent USDC de-pegging was tethered to regulation. As a result, the market capitalization of both stablecoins dropped steadily.

On another note, Bitcoin (BTC) price has suffered in the hands of dull macroeconomics, but the narrative seems to be changing after the Federal Reserve Open Market Committee (FOMC) meeting on May 3. After the Fed raised interest rates by another 0.25%, market players say this could be the last rate hike in the current market cycle.

If the Fed starts cutting rates, which the market is pricing in, making it highly likely that the Fed will manage a soft landing. This would see financial markets beginning to rise, with Bitcoin leading the pack. Signs already point to this narrative playing out.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.