Solana price needs to rise above this level to mark a 40% rally and invalidate losses from FTX collapse

- Solana price jumped by more than 32% towards the end of last week, bringing the price to $23.68.

- Solana price needs to maintain the bullishness noted over the last two weeks as it still needs to rise to $36.90 to recover FTX-induced losses.

- Enthusiastic traders must watch out for a decline in price, as losing the $15.90 support level would invalidate the bullish thesis.

Solana price emerged as one of the best-performing assets among the top cryptocurrencies maintaining its uptrend that began at the end of December 2022. Following in the footsteps of Bitcoin and Ethereum, SOL is also close to gaining back all its losses caused by the November 2022 FTX crash. But traders must be wary of a change in the active trend.

Solana price is far from the top

Solana price managed to rise by almost 140% in the span of 17 days, rising from $9.63 to trade at $23.68 at the time of writing. However, investors waiting to recover their losses might have to wait a while longer as SOL is still pretty far away from its November highs.

Solana price still needs to push by another 40% in order to reach $36.90, the value it was at prior to the FTX-induced crash. In order to do so, SOL needs to first reclaim the support at $28.28, which would enable the cryptocurrency to initiate a rise to breach the critical resistance at $32.06. From here on, the altcoin can climb to $36.90 and invalidate all previous losses.

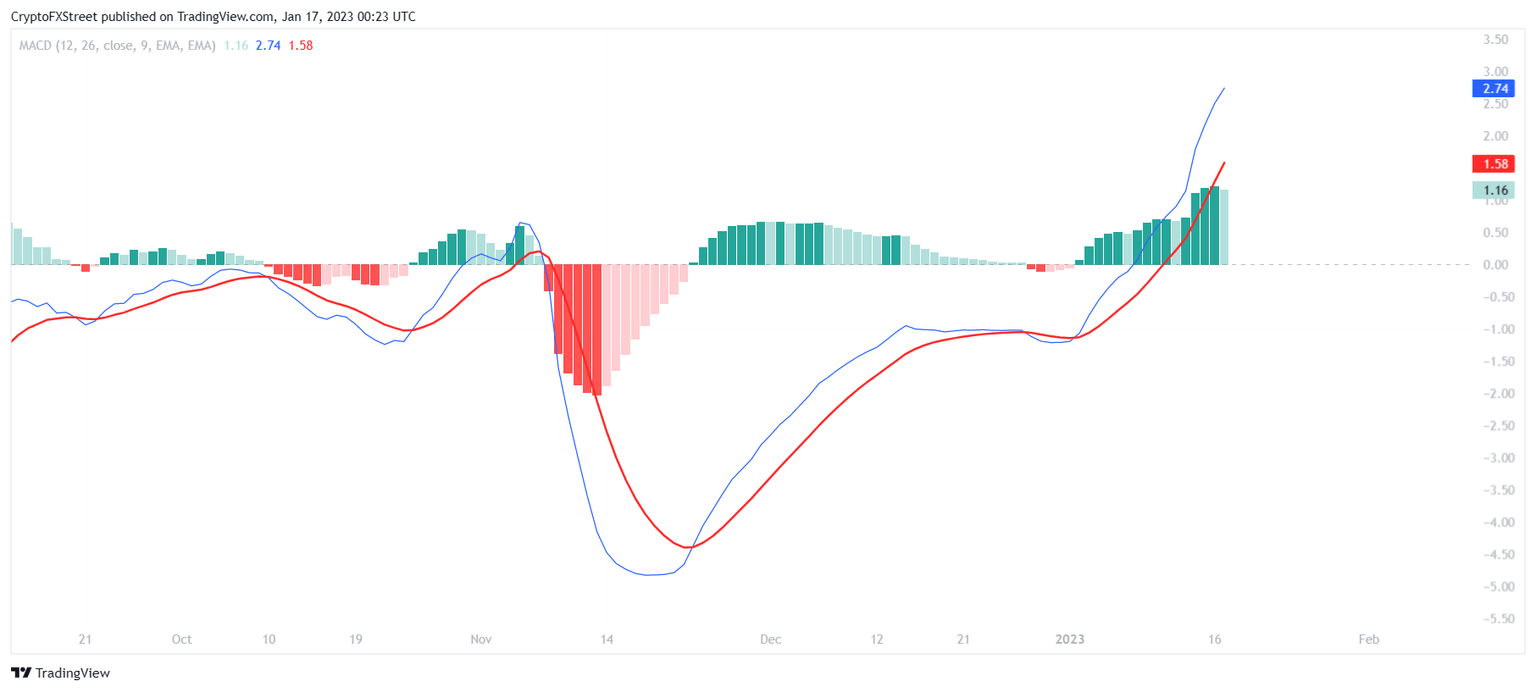

The Moving Average Convergence Divergence (MACD) also supports this bullish outlook, as the indicator is maintaining its bullish crossover at the moment. As long as the signal line (red) does not crossover the MACD line (blue), Solana price is not likely to face a sharp decline.

Solana MACD

Nevertheless, traders should refrain from getting comfortable with this possibility as the volatility of the market could pull Solana price back down. As it is, the altcoin has been teetering at the immediate support at $23.11 for the last three days.

SOL/USD 1-day chart

If this price level is lost, SOL will find support next at $19.30 and $17.89 before sinking to critical support at $15.90. A daily candlestick close below this level would invalidate the bullish thesis, resulting in the Ethereum-killer falling below $14.80.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

-638095145975685004.png&w=1536&q=95)