Solana Price Forecast: SOL kick-starts its journey to $115

- Solana price is bouncing off the $65.91 to $82.00 demand zone, hinting at a 40% upswing.

- The recent uptick is just the start, and SOL is likely to tag the $115.51 hurdle.

- A daily candlestick close below $65.91 will invalidate the bullish thesis.

Solana price has faced an intense rejection by a crucial hurdle, leading to a steep correction. This move has pushed SOL to a launching pad, however, signaling the potential for a reversal that undoes the recent losses.

Solana price vies to recover lost ground

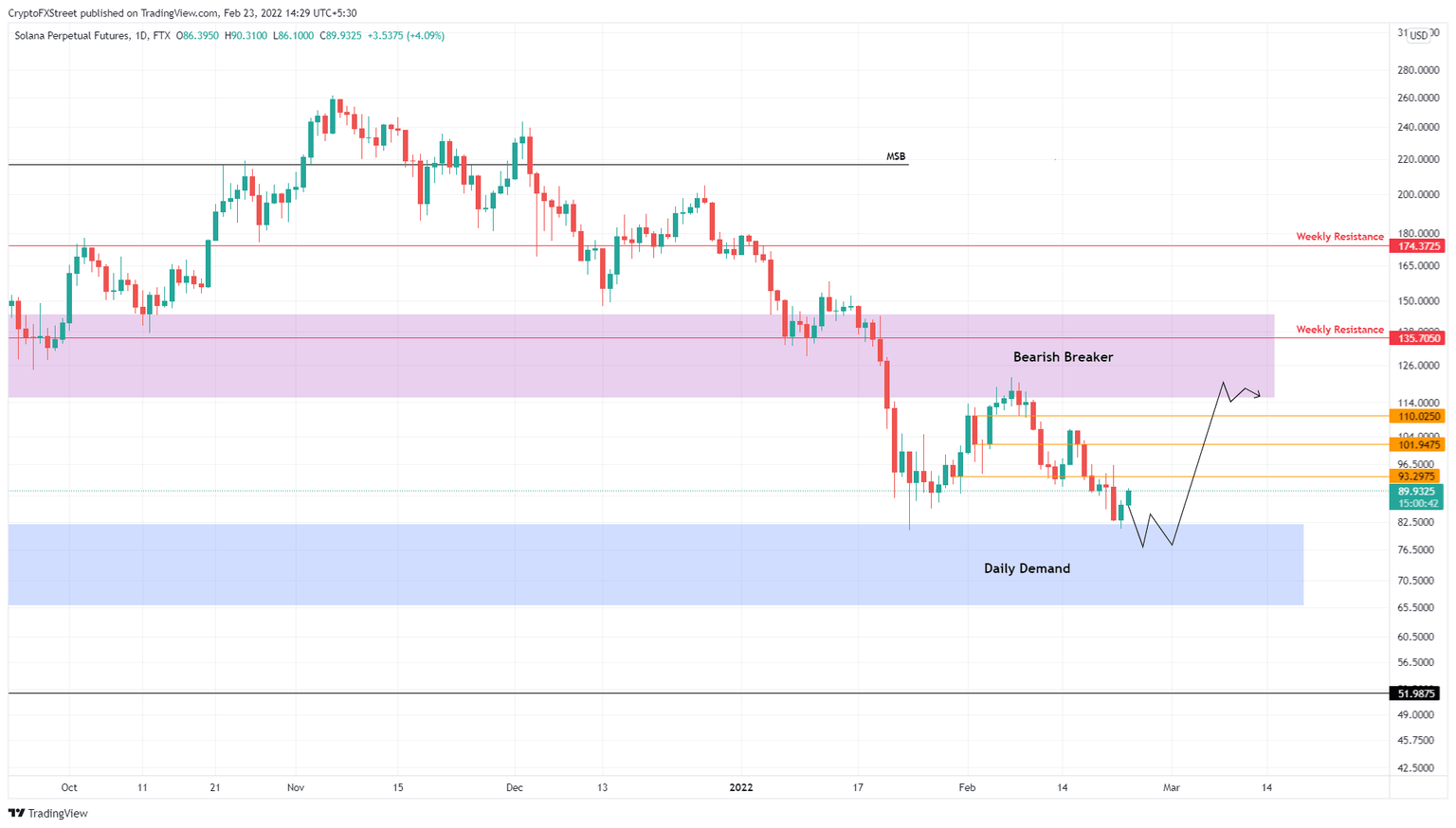

Solana price tagged the $65.91 to $82.00 demand zone, twice over the last month. The second retest was due to a rejection at the breaker’s lower limit at $115.51. Regardless, SOL is already showing signs of recovery after rallying 8% over the last 24 hours or so.

A continuation of this momentum seems plausible in the near future. Interested investors can open a long position at the current level and expect to book profits as SOL moves higher. Although it might take days, Solana price needs to slice through the intermediate resistance barriers at $93.29, $101.95 and $110.03 to make its way to the breaker’s lower limit at $115.51.

This move would constitute a 43% ascent in total and is where the upside for SOL is capped. Any move beyond this hurdle seems unlikely and that is where investors can book profits.

SOL/USDT chart

Optimistic as it sounds, this trade will take a few days, which increases the uncertainty in already volatile markets. A potential spike in selling pressure that knocks Solana price to produce a daily candlestick close below $65.91 will invalidate the bullish thesis.

In this situation, Solana price could continue to collapse until it retests the $51.98 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.