Solana price eyes a 30% rally after shooting up to $11

- Solana price shot up by 13% in the last 24 hours after dipping below $10 around New Year's eve.

- Solana price could continue its rise if the active bullish pressure in maintained.

- Solana price would end up in trouble if it loses its critical support of $8.76, as it would invalidate the bullish thesis.

Solana price is charting its own route, painting green, despite the broader market noting no such reaction. However, as the bullishness continues to build up, the cryptocurrency faces a threat of a trend reversal in the short term, which could be avoided if the following happens.

Solana price inches closer to recovery

Solana price noted a sudden increase in itsvalue as the asset traded at $11.16. The 13% rise observed in the last 24 hours came after the altcoin registered an almost 16% dip towards the end of 2022.

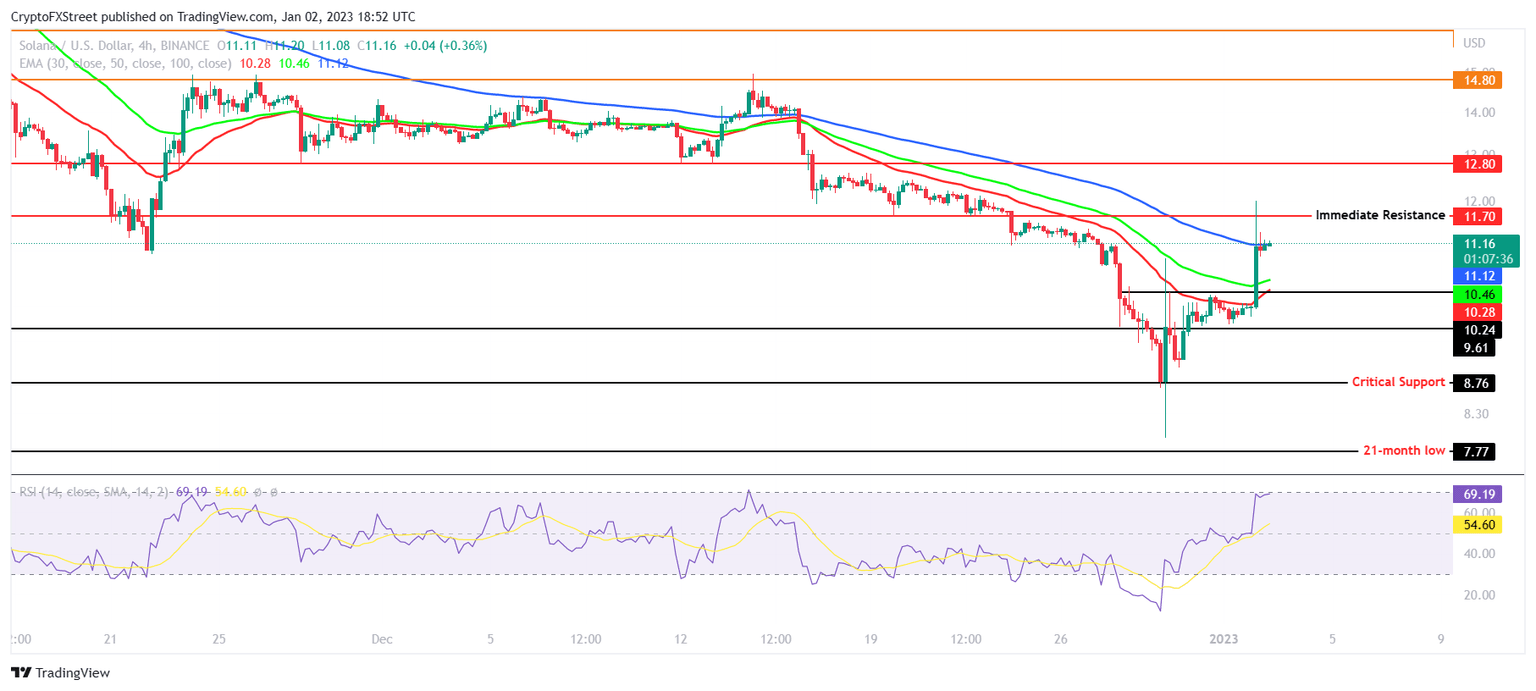

Recovering from the same, Solana price shot up from the low of $7.96 to trade at $11.16 at the time of writing. Currently, the cryptocurrency is very close to flipping the 30-day Exponential Moving Average resistance into support.

If Solana price manages to turn the immediate resistance level into a support floor at $11.70, it could be able to initiate a recovery and push the prices higher. A rise from this point could see a hurdle around $12.27. Breaching these would give SOL the momentum necessary to rise toward $12.80 and mark a 30% rally.

In order to do so, the buying pressure must remain strong. While on the 4-hour chart, the cryptocurrency might be near the overbought zone, on the daily timeframe, the Relative Strength Index (RSI) is just rising from the oversold zone.

SOL/USD 4-hour chart

If the recovery attempt falls apart and Solana price trickles, it should find enough support levels to bounce off of and slow down the price decline. Support levels at $10.24 and $9.61 would stand as the first lines of defense. However, if the price falls below the critical support of $8.76, the bullish thesis would be invalidated, resulting in Solana falling to the 21-monthly low of $7.77.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.