Solana price can whip up 30% gains under these conditions

- Solana price prepares for a recovery rally after collecting liquidity resting below June 30 swing lows at $30.83.

- A quick bounce followed by a higher high above $33.14 will indicate a shift in market structure and kick-start the run-up.

- Investors can expect SOL to rally roughly 30% to retest the POC at $40.33.

Solana price has been on a downtrend since August 14 and has recently started showing signs of a recovery. However, investors should wait for a confirmation before jumping on hopeful attempts.

Solana price ready to make changes

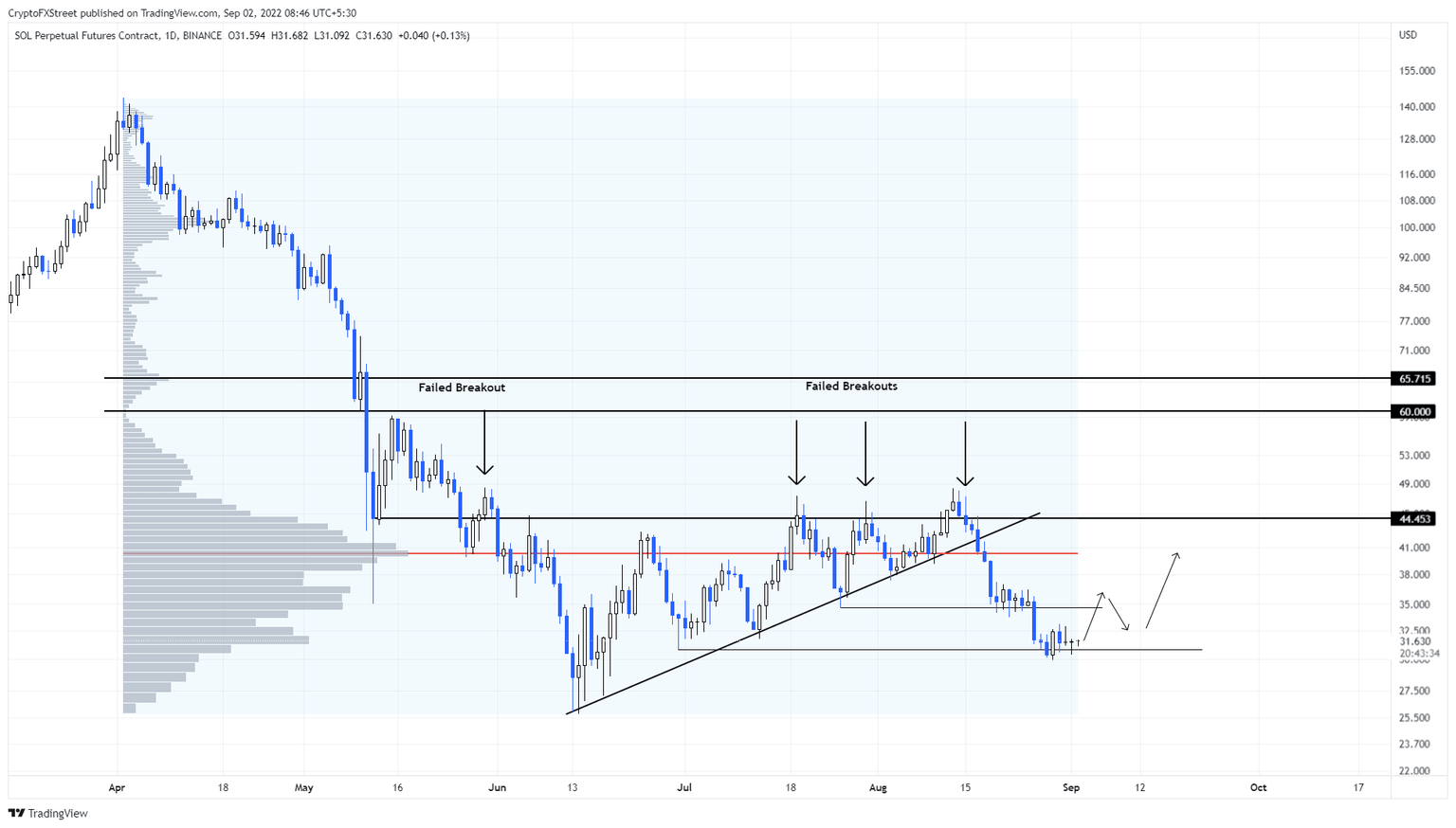

Solana price has crashed nearly 38% and collected the sell-stop liquidity resting below the higher lows formed since June 30. The $30.83 swing low was the victim of a liquidity run, and SOL has already started its recovery rally.

A resurgence of buying pressure that produces a higher high above the August 30 swing high at $33.14 will confirm a shift in market structure favoring the bulls. This development will be followed by a quick pullback, which will signal buyers to jump in.

After this development, Solana price will kick-start its recovery rally to the first hurdle around $35.41, but clearing this level would open the path to retest the volume point of control (POC), which is the highest volume trader level since April 2.

Although unlikely, investors can expect Solana price to revisit the $44.45 hurdle if the bullish momentum is strong, especially if Bitcoin price shifts its momentum.

SOL/USDT 1-day chart

On the other hand, if Solana price fails to produce a higher high above $33.14, it will denote a weakness in buying pressure. A daily candlestick close below the August 29 swing low at $29.94 will create a lower low and invalidate the bullish thesis. This development will likely be followed by a crash to the $25 psychological level to find support.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.