Solana Price Analysis: SEC Approval odds hit 88% ahead of SOL ETF Futures

- Solana price rose 12% on Wednesday, crossing the $135 mark for the first time in ten days.

- Volatility Shares announced the launch of Solana Futures ETFs set to begin trading on Thursday.

- SOL open interest rose 39% in 24 hours and hit $8.3 billion, as traders position for the futures ETF launch.

Solana price surged 12% on Wednesday, hitting $136 as traders positioned for the futures ETF launch, and rising spot ETF approval odds. Deritvatives trading signals suggest the SOL price rally could advance further.

Solana Futures ETFs set to launch, raising SEC approval odds

Volatility Shares is a US-based investment firm that specializes in developing and managing innovative leveraged ETFs.

According to reports, Volatility Shares is set to launch the first-ever Solana futures ETFs on Thursday.

Volatility Shares is rolling out two distinct funds: the Volatility Shares Solana ETF (SOLZ), which tracks Solana futures, and the Volatility Shares 2X Solana ETF (SOLT), offering twice the leveraged exposure. According to filings these ETFs will carry expense ratios of 0.95% and 1.85%, respectively.

In response, Solana price rose to a new 10-day peak above $136 on Thursday, up 12% from the recent lows of $121 recorded on Tuesday.

How will Solana Futures ETF Impact SEC verdict on Spot ETFs

Solana futures ETF launch announcement follows the regulatory precedent set by Bitcoin and Ether, where futures-based ETFs gained approval before spot ETFs.

Earlier in March US President Donald Trump also included SOL in the proposed crypto strategic reserve.

Both events have evidently boosted institutional interest in Solana, potentially setting the stage for a spot ETF approval later this year.

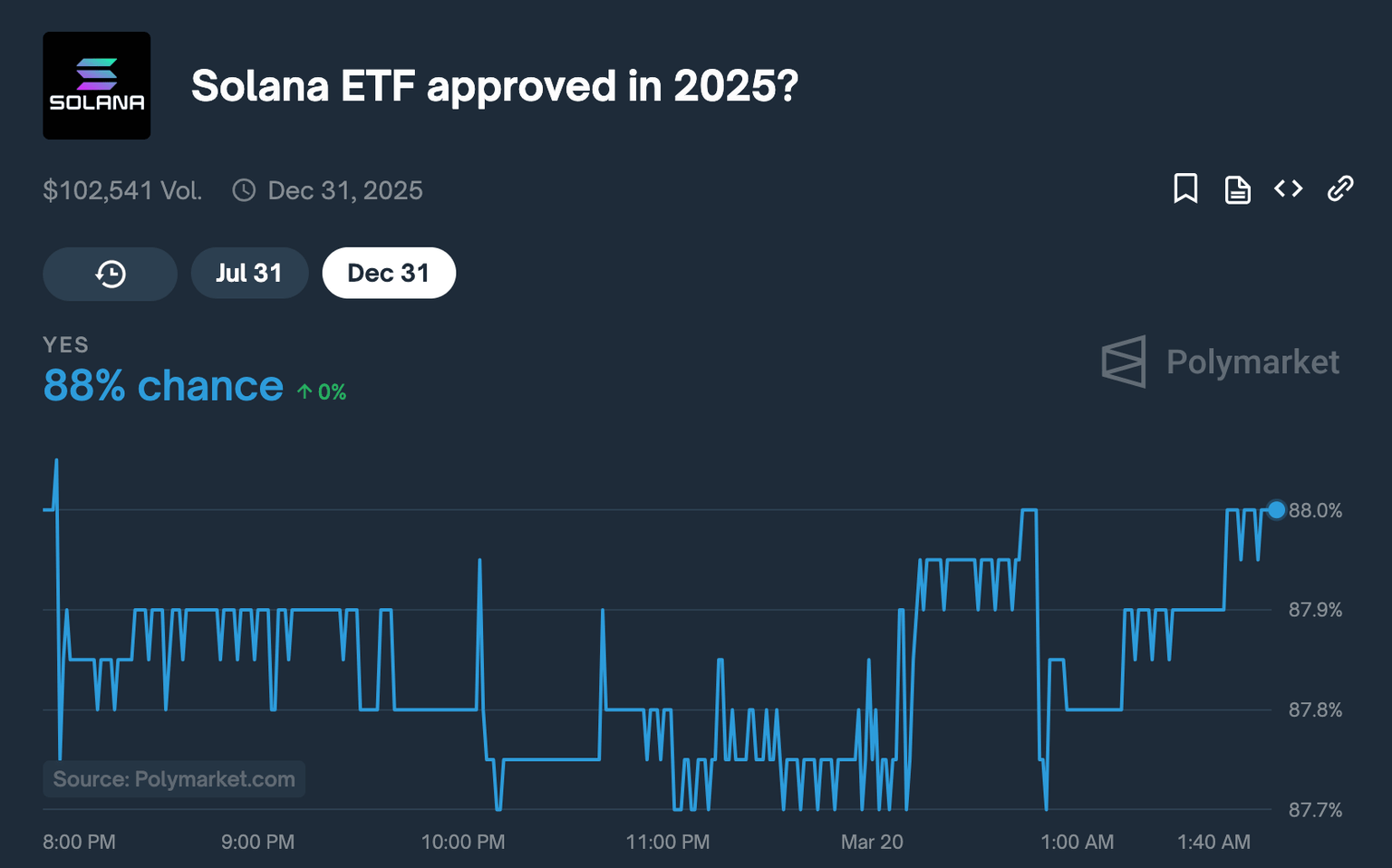

Solana ETF Approval Odds hit 88% | March, 19 2025 | Source: Polymarket

Traders have raised odds on SOL ETF approval to 88% according to real-time data culled from crypto-based predictions market platform Polymarket on Thursday.

Bloomberg analysts also estimate a 75% probability that a spot Solana ETF could receive approval in 2025.

As the Solana ETF approval odds approaches the 90% mark, it could accelerate market demand for SOL, especially among corporate investors.

How will Futures ETF launch impact Solana price ?

Solana’s futures ETF launch comes just days after the network marked its fifth anniversary.

Beyond that, it also comes at a critical time for Solana price, which has underperformed, facing looming sell-offs linked to repayment to victims of FTX’s collapse in 2022.

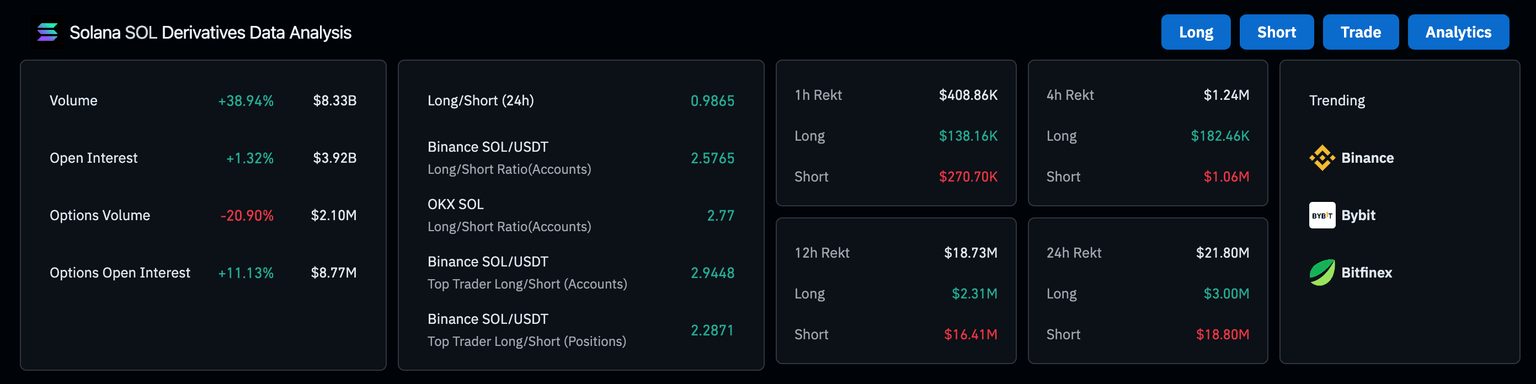

The solana derivative markets data trends on the Coinglass chart shows signals that the could spark positive price action for the coming days.

Solana’s derivatives market is witnessing a notable surge in activity, as indicated by the latest Coinglass data. SOL futures trading volume has climbed 38.94% in the last 24 hours to $8.33 billion, suggesting heightened interest from institutional and retail traders.

Solana Liquidation Map, March 2025 | Source: Coinglass

Open interest has also ticked up 1.32% to $3.92 billion, signaling that new positions are being established ahead of the futures ETF launch.

While options volume has dipped by 20.90%, options open interest has jumped 11.13% to $8.77 million, reflecting a growing appetite for leveraged bets on SOL’s price trajectory.

Additionally, the long/short ratio on major exchanges like Binance and OKX remains skewed towards longs, with Binance’s top trader positions showing a 2.29 ratio.

This indicates that dominant market participants are positioning for an upward move in SOL’s price.

However, liquidation data highlights short-term risks, with $21.8 million in total rekt positions over 24 hours, predominantly from short sellers.

If bullish momentum sustains, SOL could experience a breakout as leveraged shorts get squeezed.

Solana Price Outlook:

With the Solana futures ETF launch aligning with rising institutional interest and an 88% approval probability for a spot ETF, SOL’s price trajectory appears poised for further gains, potentially reaching $200 in the coming weeks.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.