Shiba Inu price is on the cusp of a 39% explosion

- Shiba Inu price could flare up to $0.00001679 if the 200-day SMA hurdle crumbles.

- A stubborn inverse head-and-shoulders neckline resistance may be the only bump between SHIB and a 39% move.

- The IOMAP metric reinforces the upside target at $0.00001700, where some investors could empty their bags.

Shiba Inu price is on the frontline of ushering in the weekend with a daily bullish candle alongside other crypto assets such as Solana, Binance Coin and Polkadot. SHIB’s trading over the last few days has been somewhat sideways. Conversely, a bullish breakout may be in the offing, especially if the token makes a daily close above $0.00001220.

Shiba Inu price’s 39% move depends on the inverse head-and-shoulders pattern

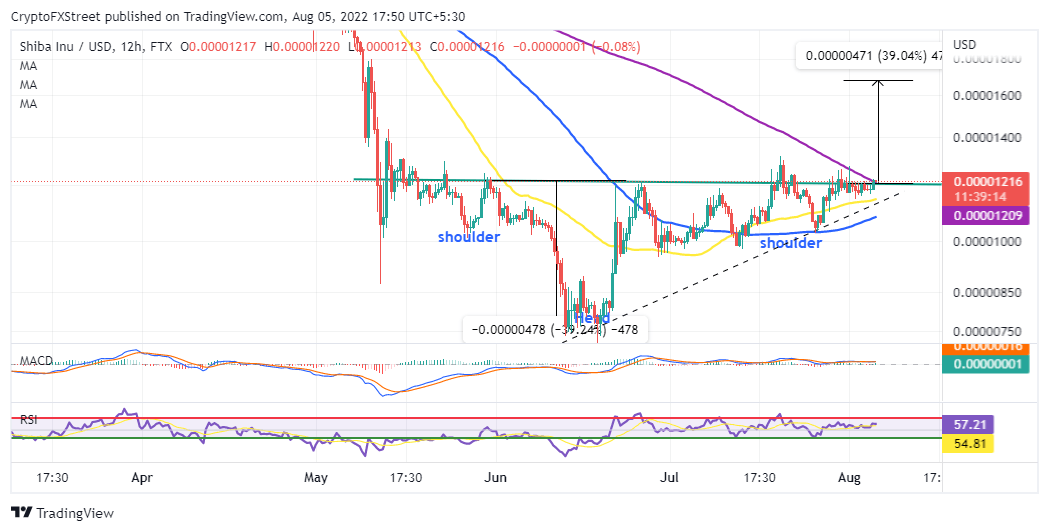

Shiba Inu price formed an inverse head-and-shoulders (H&) pattern between May and August, as seen in the chart below. Crucial support at $0.00000740 allowed buyers to regain control against the backdrop of dire losses in May. This buyer congestion zone positively influenced SHIB but only up to $0.00001220.

Since the H&S pattern is highly bullish, Shiba Inu price has a good chance of sprinting to $0.00001679 – if it can make a clean break above the neckline. For now, buyers must subdue the overhead selling pressure brought to light by the 200-day Simple Moving Average (SMA) on the 12-hour chart.

The Moving Average Convergence Divergence (MACD) in the same timeframe would be required to hold above the mean line as well as keep the buy signal intact, affirming a solid bullish grip.

SHIB/USD 12-hour chart

On the flip side, the 50-day SMA provides immediate support slightly above an ascending trendline. Therefore, in the event of a bearish reversal, Shiba Inu price may recoil at a higher low, as long as the trend line is not broken.

From a fundamental perspective, Shiba Inu may exhaust the uptrend in the region between $0.00001400 and $0.00002100. IntoTheBlock’s IOMAP on-chain metric reveals that around 101,000 addresses previously purchased approximately 445.9 trillion SHIB tokens in the range.

Shiba Inu IOMAP chart

Traders preparing to make the most out of Shiba Inu price breakout to $0.00001679 should consider taking profit at $0.00001400, with the bullish holding out till $0.00001700. These targets factor in overhead pressure as investors sell at their respective breakeven price points.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637953051762830340.png&w=1536&q=95)