Shiba Inu price hits six-month low, leaving $2 billion in unrealized losses

- Shiba Inu price fell victim to a broader market drawdown caused by SEC suing Binance and Coinbase.

- More than 430,000 investors bought SHIB at around $0.00001000, way above current price levels.

- The price crash of June 5 adds to the week-long decline, leading to an 8% increase in loss-bearing addresses in 24 hours.

Shiba Inu price, like the rest of the market, has been recovering from the crash witnessed a day before. In these couple of hours, the SHIB holders’ situation changed significantly, with a large chunk of the investors facing losses unseen since December 2022.

Shiba Inu price dip brings more losses

Shiba Inu price noted a steep dropoff over the last 24 hours following the market-wide crash, induced by news of the US Securities and Exchange Commission (SEC) filing a lawsuit against Binance. The meme coin dipped by more than 7% during the intraday trading hours before recovering slightly to close just above the December 2022 lows of $0.00000791.

SHIB/USD 1-day chart

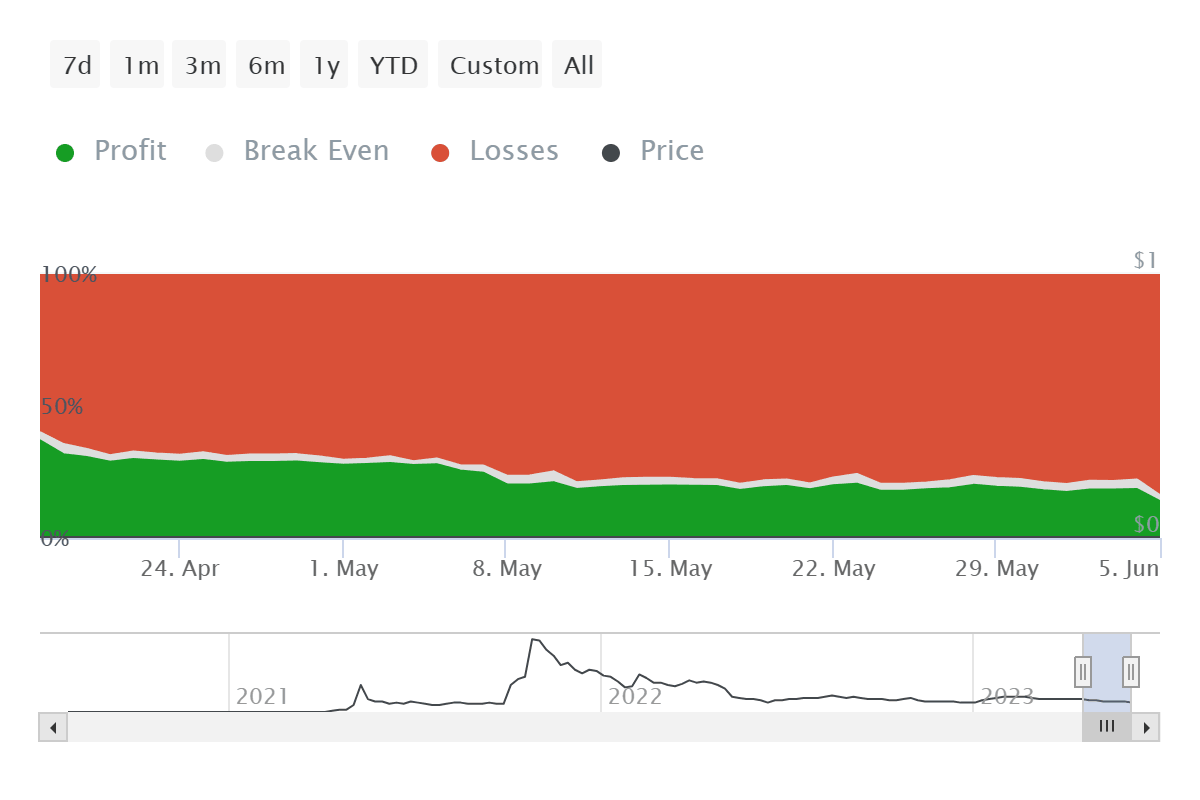

While losses were borne by all the investors, a particular group of 437K addresses is some of the biggest losers. Their supply was acquired at an average price of $0.00001000, and as it is, these investors were moving farther away from profits before the crash made a recovery even more difficult.

These addresses altogether hold close to 300 trillion SHIB worth over $2.3 billion, which, when it becomes profitable again, would be the biggest trigger for recovery. But given the bearish developments in the market at the time of writing, recovery might be a while.

Shiba Inu GIOM

A day after the SEC sued Binance, the regulatory body went after the second biggest cryptocurrency exchange in the world, Coinbase. The exchange was alleged to have been acting as an unregistered broker and further violated securities laws by defying the regulatory structures and evading the disclosure requirements.

This led to an increase in the concentration of investors in losses. Over the past 24 hours, the total percentage of investors in loss has risen from 78% to 84%, making SHIB holders some of the biggest losers in the crypto market at the moment.

Shiba Inu investors at loss

Shiba Inu price, for now, needs to flip the 50-day Exponential Moving Average (EMA) line into a support floor in order to restart recovery. However, a failure to breach might bring it down to December 2022 lows and even push it further below.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.