Shiba Inu price has more room to move higher

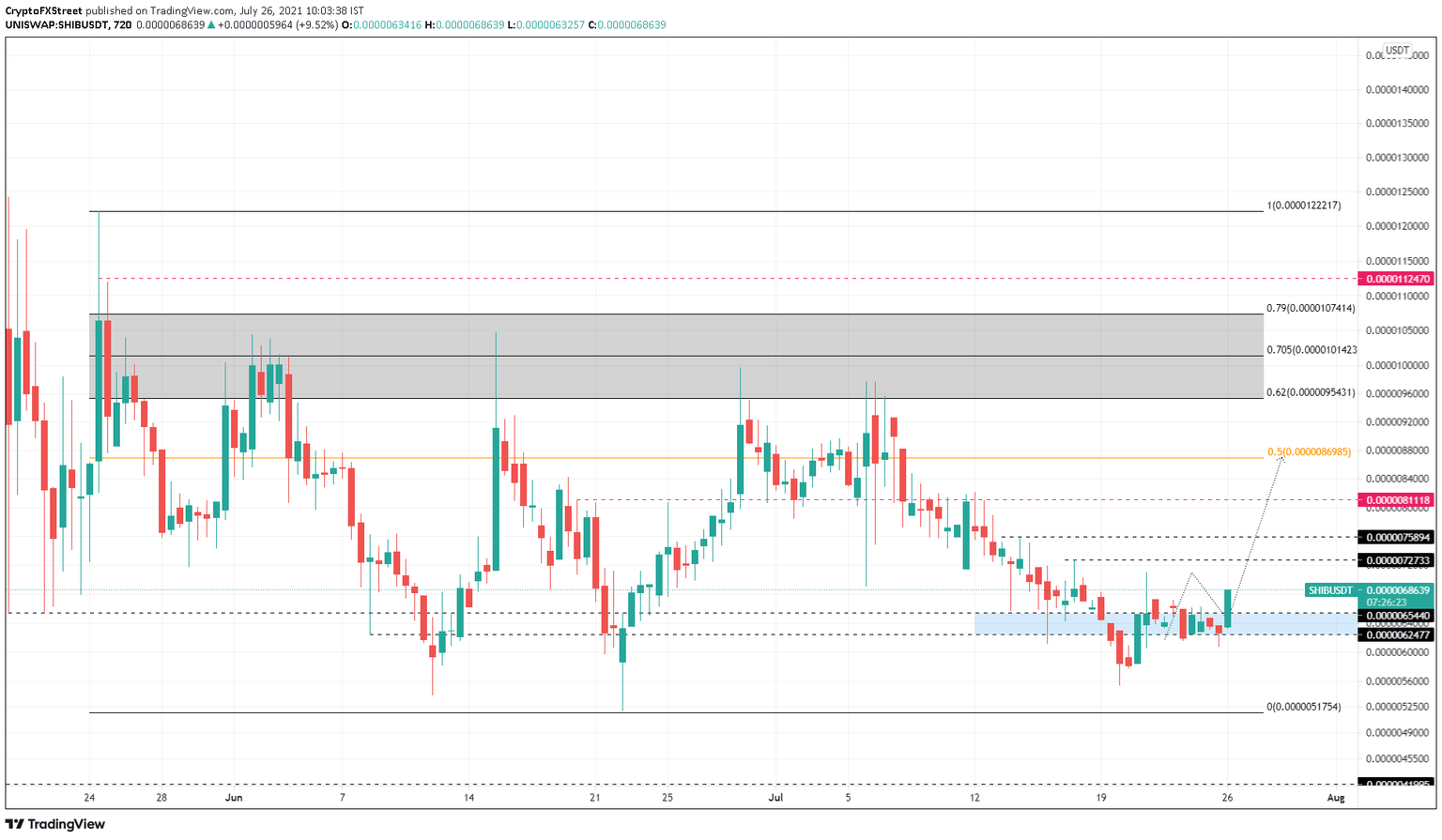

- Shiba Inu price has sliced through a crucial resistance level ranging from $0.00000625 to $0.00000654.

- A decisive 12-hour candlestick close above this level will open up the path for an 18% upswing.

- If SHIB breaks below the July 20 swing low at $0.00000555, it will invalidate the bullish thesis.

Shiba Inu price broke out of its consolidation phase as it rallied 12% today. This upthrust of buying pressure has also cleared a crucial ceiling that will be flipped to support after a retest. Therefore, investors need to watch out for a bounce from the said demand zone.

Shiba Inu price signals bullish momentum

Shiba Inu price tried breaching through a supply zone ranging from $0.00000625 to $0.00000654 on July 21 but failed. This development led to a consolidation phase that lasted roughly three days.

However, as of July 26, Shiba Inu price saw a massive inflow of capital, which has pushed it up by 9.5% so far. A decisive 12-hour candlestick close above $0.00000654 will confirm the evolution of the supply zone into demand.

Such a move will confirm the presence of buyers and hint at an ascent toward the subsequent resistance levels at $0.00000727 and $0.00000759.

In a highly bullish case, the buying pressure might even catapult the meme coin toward $0.00000811 or the trading range’s midpoint at $0.00000870. This uptick would constitute a 26% climb from the current position – $0.00000686.

SHIB/USDT 12-hour chart

On the other hand, if the bulls fail to defend the coin from piercing the demand zone ranging from $0.00000625 to $0.00000654, leading to a decisive 12-hour candlestick below the July 20 swing low at $0.00000555, it will invalidate the optimistic narrative.

Such a move might even trigger selling pressure, pushing Shiba Inu price down to the range low at $0.00000518.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.