SHIB Price Prediction: Shiba Inu risks further falls, as critical 200-SMA caves in

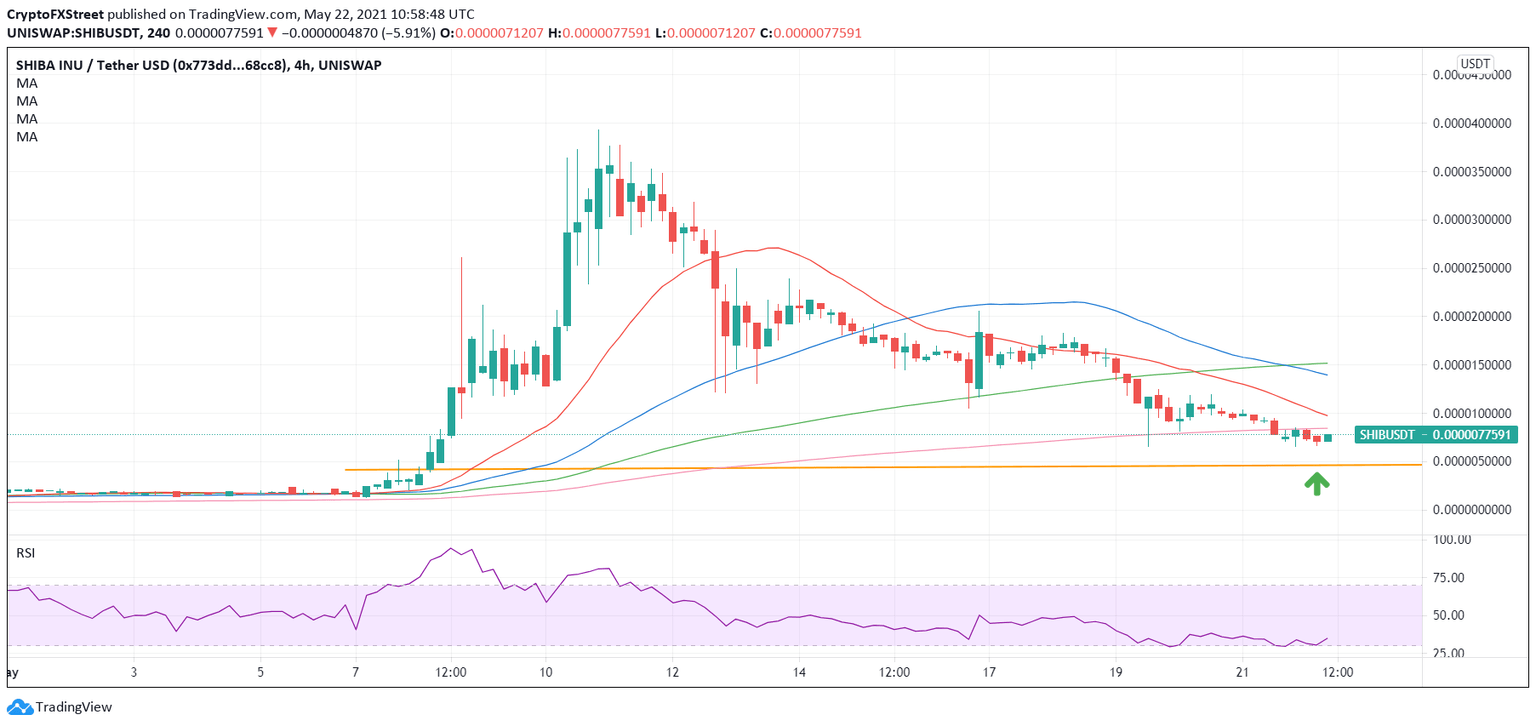

- SHIB price breaches 200-SMA on the 4H chart, calls for more downside.

- A test of the horizontal trendline support at $0.00000463 remains on the cards.

- Bear cross keeps the sellers hopeful while RSI remains bearish.

The Shib price is looking to extend Friday’s sell-off, as China’s regulatory implications continue to haunt the cryptocurrency market, keeping the buyers on the sidelines.

The canine-themed coin is shedding nearly 11% so far this Saturday, having lost about 70% of its value from record highs of $0.000039.

SHIB price braces for more declines

The Shib price is consolidating the latest leg down to $0.0000065 lows, as the bears gather strength for the next push lower.

At the time of writing, Shiba Inu is trading around $0.0000070, having breached the last line of defense for the bulls, which is the critical 200-simple moving average (SMA) on the four-hour chart. That level is now seen at $0.0000084.

The Relative Strength Index (RSI) is seeing an upturn but remains way below the central line, suggesting that any pullbacks are likely to remain short-lived.

Meanwhile, an impending bear cross on the said time frame, with the 21-SMA approaching the 200-SMA, also boosts the odds for a fresh downswing.

It’s worth mentioning that the Shib price met fresh supply and breached the 200-SMA on a sustained basis after the 50-SMA pierced the 100-SMA from above and confirmed a bear cross during Friday’s European hours.

This implies that if the 21 and 200—SMAs bearish crossover materializes, any chance of a bullish reversal could get invalidated, exposing the $0.00000654 low, reached due to Wednesday’s market collapse.

A firm break below the latter could trigger a steep drop towards the key horizontal support at $0.00000463.

SHIB/USDT: Four-hour chart

Alternatively, the Shib buyers need acceptance above the 200-SMA support now resistance for any recovery attempts.

Further up, the bearish 21-SMA cap of $0.00000972 could be challenged.

All in all, the path of least resistance for the Shib price appears to the downside.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.