SHIB deposits to exchange fall to 30-month low - A boon or bane for Shiba Inu price?

- Shiba Inu price is sustaining above the crucial support line at $0.00000700.

- Over the past week, active deposits have seen a decline, falling to their lowest since March 2021.

- While this is a positive development for SHIB, its network growth slipped to a four-month low.

Shiba Inu price action has been rather tepid over the past couple of weeks. The bearish market conditions have not been very enticing for investors, which has led to a decline in activity. This decline seems to have intensified considerably, bearing good and bad news for SHIB investors.

Shiba Inu price safe from a crash

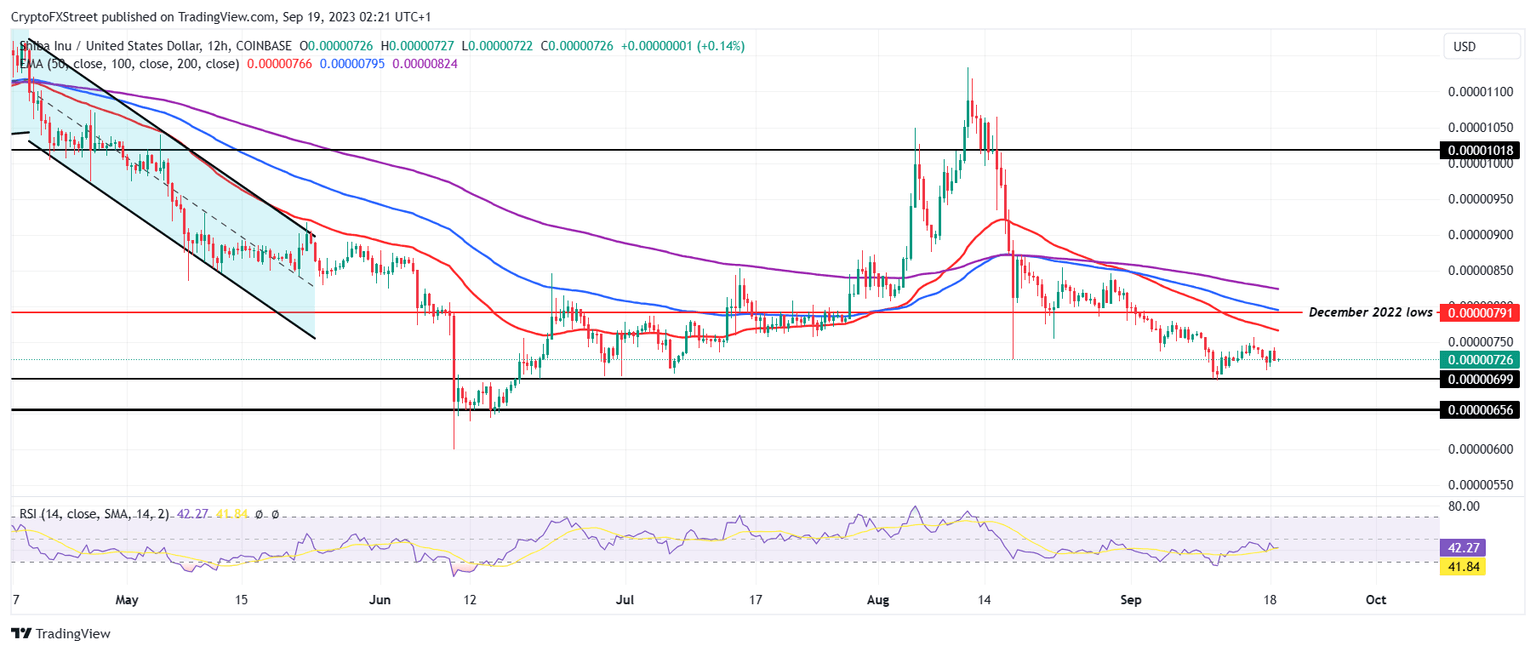

Shiba Inu price is presently dependent on the broader market cues to dictate its price action. The meme coin, trading at $0.00000726 at the time of writing, has managed to keep above the support line at $0.00000699. Now, recovery in the case of SHIB is a little difficult, looking at the lack of activity on the network, but it is not completely out of the realm of possibility.

Gradual recovery would need to SHIB flip the 50-day Exponential Moving Average (EMA) into a support line to thrust towards the barrier marked at $0.00000791. Breaching and testing it as a support floor would enable a recovery rally. This recovery rally would be confirmed if the Relative Strength Index (RSI) is also above the neutral line at 50.0

SHIB/USD 1-day chart

However, if Shiba Inu price is influenced by bearishness, a decline below the $0.00000699 support would lead to 2023 lows of 0.00000656. Falling through this level would invalidate the bullish thesis and mark fresh year-to-date lows for SHIB.

Neutral sentiment on the charts

Shiba Inu has been noting positive and negative developments, which suggests that neither a crash nor a rally might be occurring anytime soon. The first and the most important of this is the decline in the active deposits from SHIB holders. This indicator is presently at a 30-month low, highlighting the lowest deposit activity since March 2021.

This is good for the altcoin as it would keep the potential of a price action downswing at a low.

Shiba Inu active deposits

However, the network growth is also slipping and is presently at a four-month low at levels last seen in May this year. Network growth is the measure of whether the project is gaining or losing traction in the market. It does so by recording the formation of new addresses on the network.

This suggests that new investors are pulling back from joining the SHIB network as they are noting no incentive due to the lack of price rise.

Shiba Inu network growth

Thus, the lack of new addresses will keep the Shiba Inu price from noting an upswing, while the lack of deposits will prevent a decline, suggesting a sideways movement for the meme coin going forward.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B06.51.30%2C%252019%2520Sep%2C%25202023%5D-638306872412677449.png&w=1536&q=95)

%2520%5B06.56.37%2C%252019%2520Sep%2C%25202023%5D-638306872565743169.png&w=1536&q=95)