Selling the rumor? Biggest Ethereum Merge staker Lido DAO loses 40% in 30 days

Lido DAO (LDO) has declined by more than 40% in the last 30 days with more room to fall in the coming days amid a potential sell-the-news event, such as the Merge.

Lido DAO Ether deposits surge 160% in 2022

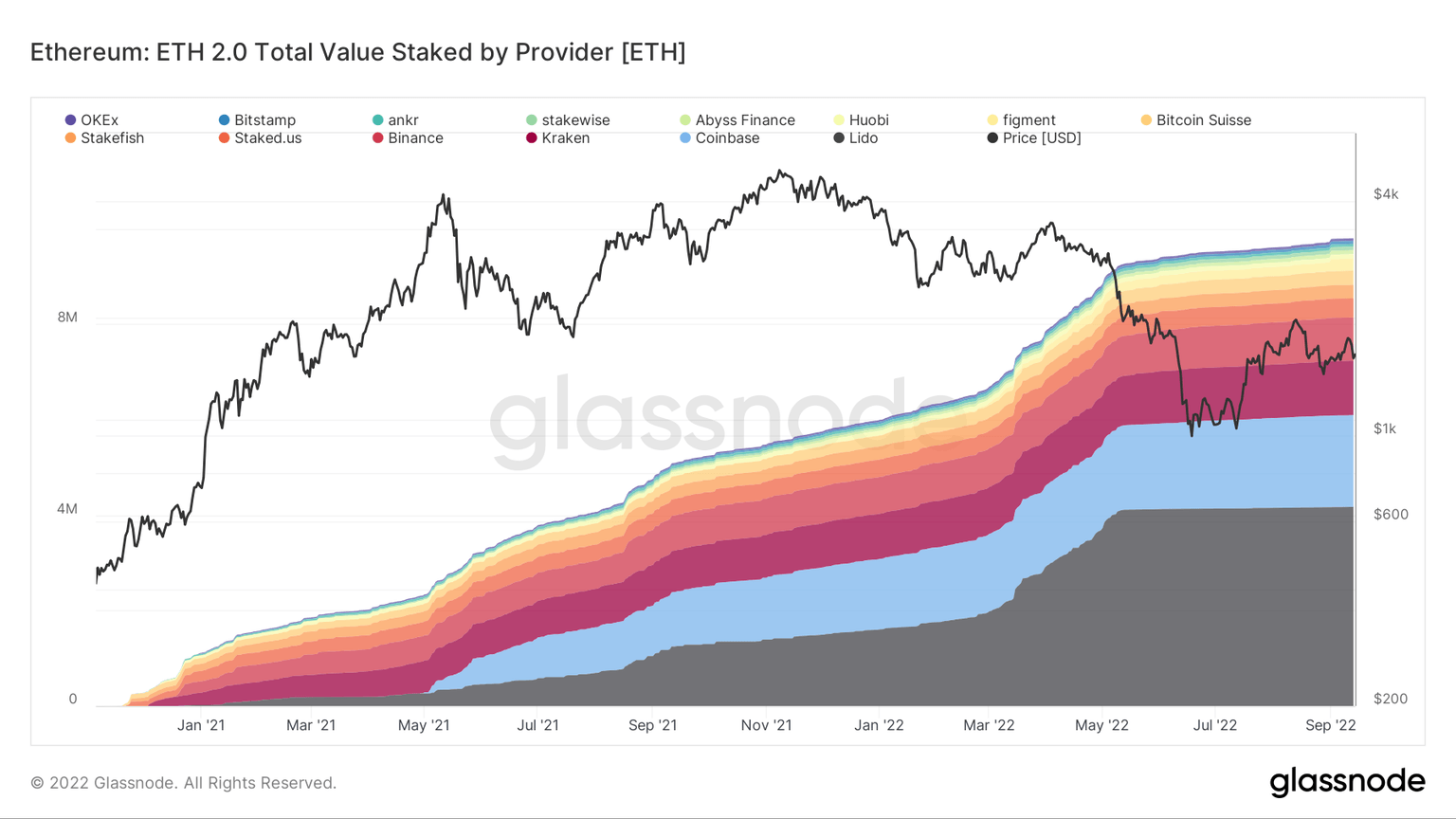

Lido DAO is Ethereum’s biggest staking service, having deposited over 4.14 million of the blockchain’s native asset, Ether (ETH), into the Ethereum 2.0 smart contract on behalf of its users, according to the latest data.

ETH 2.0 total value staked by provider. Source: Glassnode

In comparison, Lido DAO’s total staked amount was around 1.6 million ETH at the beginning of this year. The boom reflects a growing demand for Lido DAO services ahead of Ethereum’s scheduled transition from proof-of-work (PoW) to proof-of-stake (PoS) via the Merge on Sep. 15.

LDO, a governance token in the Lido DAO ecosystem, has also undergone an unprecedented price rally in recent months, up more than 350% after bottoming out at $0.39 in June.

Still, the token’s sharp correction in the past month raises the possibility of an extended downtrend now that the pre-Merge hype is nearing its end. In addition, a technical setup also alerts about a potential price decline ahead.

LDO hints at descending triangle reversal

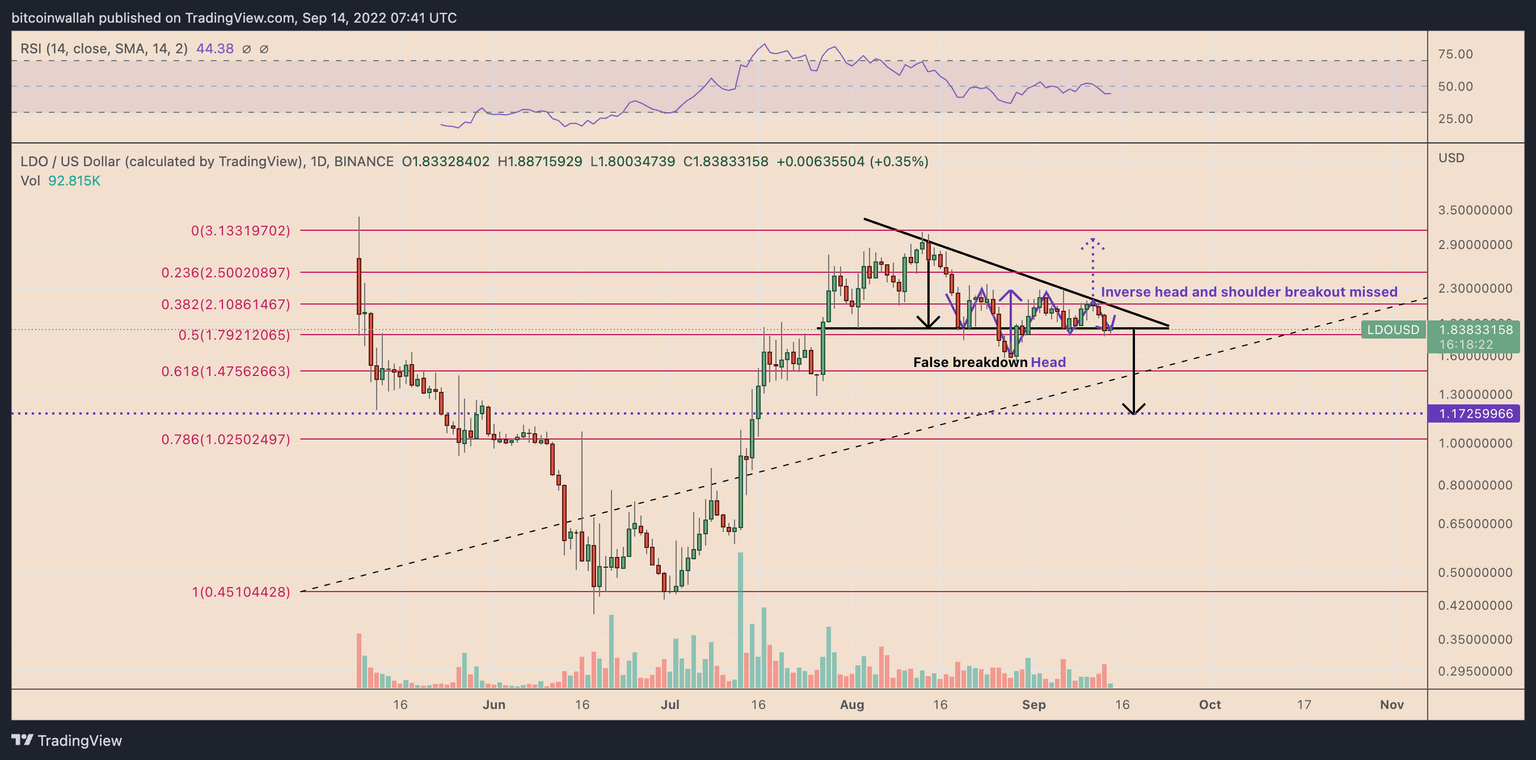

The latest selling period in the Lido DAO market started after LDO topped at $3.10 on Aug. 13. This downtrend has painted a pattern that appears to be a descending triangle.

Descending triangles that form at the top suggest bullish exhaustion. Theoretically, a descending triangle breakdown below the lower trendline could crash the price to the level at length equal to the maximum triangle height.

LDO now tests the triangle’s lower trendline area, at around $1.79-$1.82, as support. The token could drop toward $1.17 if it breaks below the support level while accompanying a rise in trading volumes. In other words, a 35% drop from current price levels.

LDO/USD daily price chart featuring descending triangle breakdown setup. Source: TradingView

Conversely, a rebound from the $1.79-182 support area could have LDO test the descending triangle’s upper trendline at around $2.10 as resistance.

Also, a decisive breakout above the upper trendline would risk invalidating the bearish setup discussed above.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.