SafeMoon: Why patience is key around the current price levels

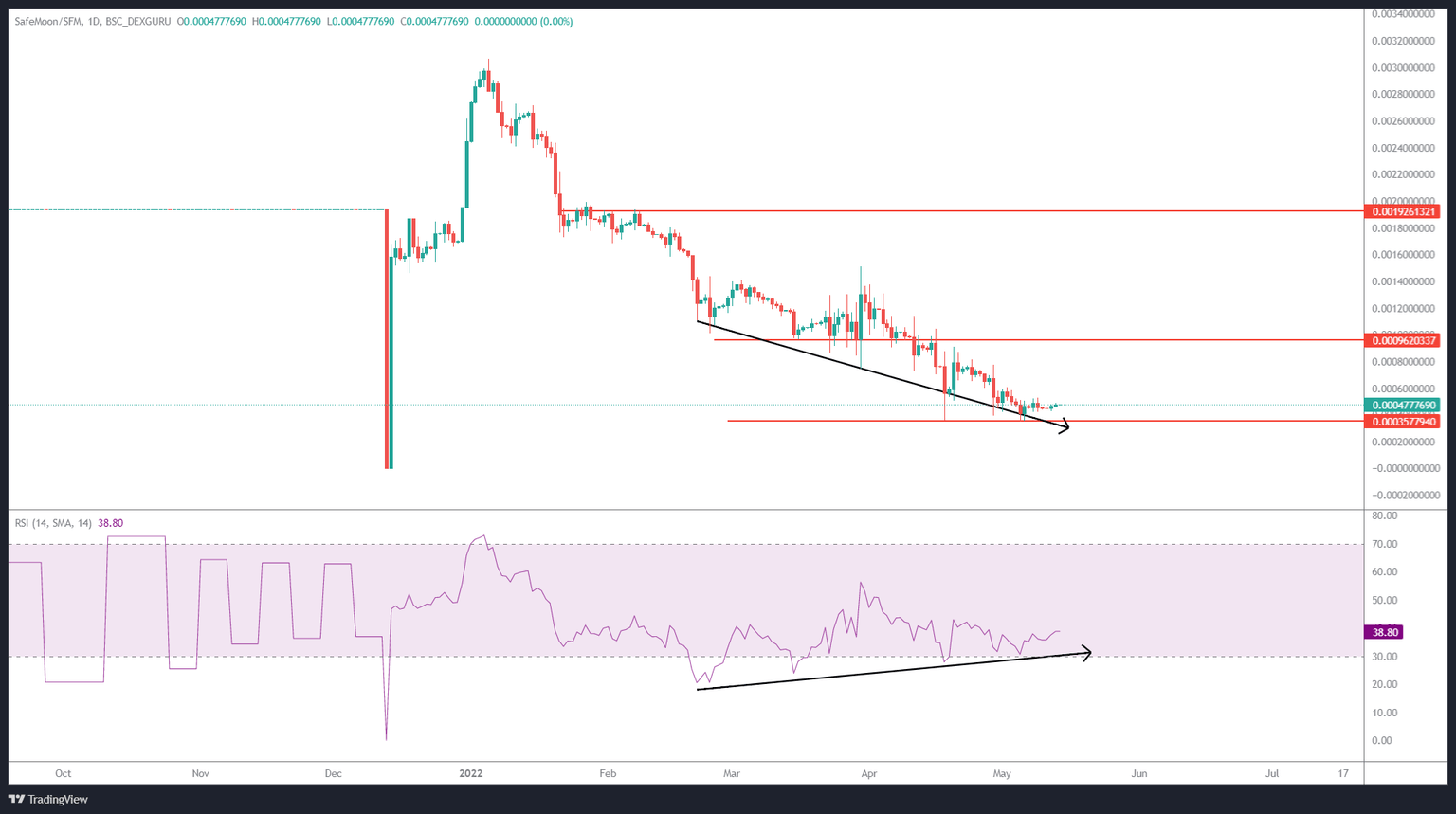

- SafeMoon price has crashed 85% since January 5 and is currently coiling up.

- While the technicals present a bullish signal, investors need to exercise caution.

- A daily candlestick close above the $0.0009 resistance barrier will invalidate the bearish thesis.

SafeMoon price has shown no restraint in heading south since 2022. This downswing has caused the altcoin to lose the majority of its value, but one silver lining is that it may now be so oversold, Safemoon price could be ready to trigger a minor rally.

SafeMoon price at the precipice

SafeMoon price has sliced through the $0.00096 support level and crashed 65% to tag the new barrier at $0.000357. While the downtrend since January 2022 may have become familiar to holders, there could be a small ray of hope for investors betting on Safemoon price recovering.

The SafeMoon price has formed lower lows since February while the Relative Strength Index (RSI) has set up higher lows. This technical formation is termed a bullish divergence and often results in a spike in the underlying asset’s value.

It is an interesting contrarian outlook considering the bearish narrative, but it is also unlikely. However, if Bitcoin price makes a quick run-up, that could help improve the odds, and increase the chance SafeMoon price will do the same. In such a case, the altcoin could trigger a 103% upswing to retest the immediate hurdle at $0.000962.

SAFFEMOON/USDT 1-day chart

While the crypto space is expecting a relief rally and is partially bullish in the short-term, a sudden spike in selling pressure could spell trouble for SAFEMOON.

In such a case, a daily candlestick close above the $0.0009 resistance barrier will be required to invalidate the bearish thesis for SafeMoon price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.