SafeMoon price hints at a 40% crash as bulls go extinct

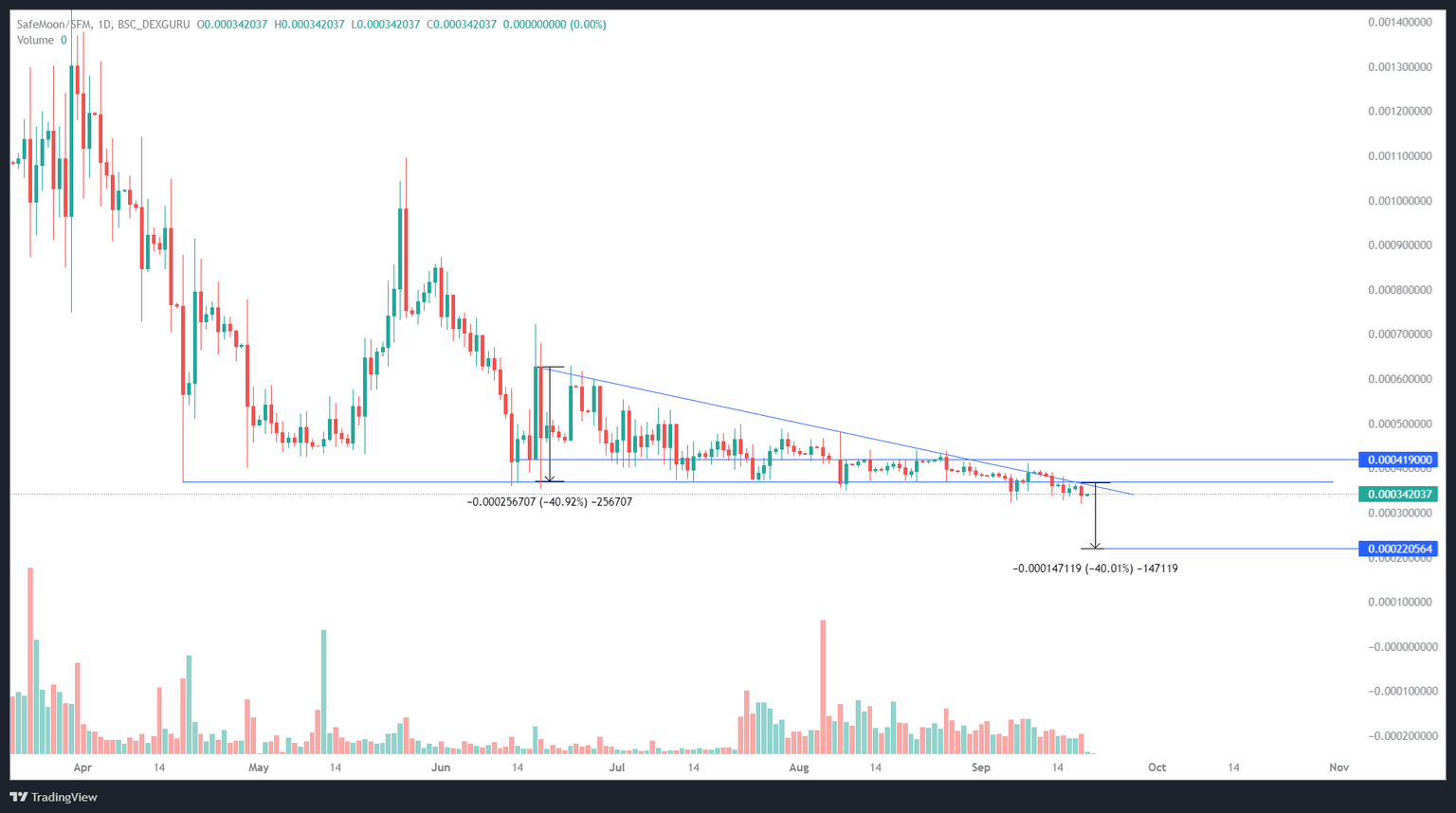

- SafeMoon price shows a lack of volatility as it trades around the $0.000342 level.

- A breakdown of this barrier could result in a 40% drop to $0.000220.

- A daily candlestick close above $0.000342 will invalidate this bearish thesis.

SafeMoon price has seen a significant drop in volatility as it trades around a significant support level. This outlook could change quickly due to the bearish scenario that has been cooking for quite a while.

SafeMoon price ready to slide lower

SafeMoon price has been on a downtrend since the start of 2022, but since April 18, it has been stabilizing at the $0.000342 support floor. So far, the altcoin has retested it nine times and broke below it on September 13.

When the lower highs and equal lows formed between June 18 and September 13 are connected using trend lines, it reveals that SafeMoon price is in a descending triangle formation. This technical setup forecasts a 40% crash to $0.000220, obtained by measuring the distance between the first swing high and swing low to the breakout point at $0.000342.

Since SafeMoon price breached this setup on September 13, the bearish outlook is already in place and will continue to slide lower.

SAFEMOON/USDT 1-day chart

On the other hand, if SafeMoon price produces a daily candlestick close above $0.000342 and flips this hurdle into a support floor, it will invalidate the bearish outlook. This development will indicate that the buyers are back and ready to push SAFEMOON higher.

In such a case, investors can expect SafeMoon price to trigger a recovery rally to retest the immediate hurdle at $0.000415. This move would constitute a 21% gain and is likely where the upside will be capped due to the heavy consolidation in the aforementioned region.

Note:

The video attached below talks about Bitcoin price and its potential outlook, which could influence SafeMoon price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.