Ripple (XRP), Ethereum, Cardano lead $200B crypto market rebound as Canada and Mexico end Trump trade war

- Ripple (XRP), Ethereum (ETH), and Cardano (ADA) all posted double-digit gains in the last 24 hours.

- The global crypto market's aggregate valuation increased by 2.1% to $2.3 trillion as US President Trump postponed tariffs imposed on Mexico and Canada.

- Technical indicators highlight key levels to watch as investors begin to reallocate capital following the upturn in market sentiment.

Crypto market rebounds as Trump pauses tariffs on Mexico and Canada but not China

The crypto market rebounded sharply, adding over $190 billion to its aggregate valuation on Tuesday per Coingecko data as US President Donald Trump postponed tariffs imposed on Mexico and Canada.

This decision triggered a rally in top Layer-1 cryptocurrencies such as XRP, ETH, and ADA, which led to the recovery phase.

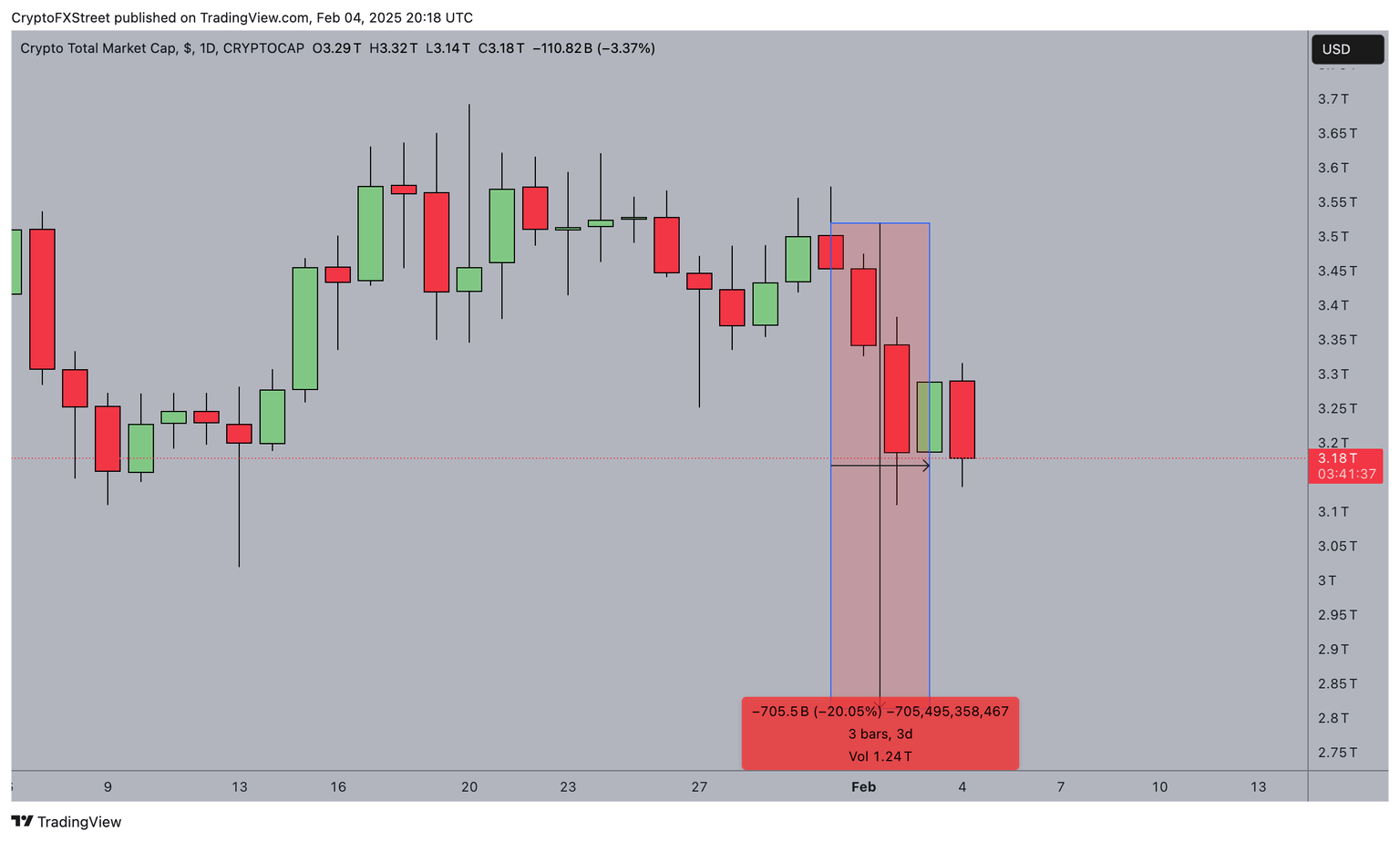

The global crypto market experienced a rough start to February, facing multiple bearish catalysts that suppressed investor confidence.

One key trigger was the DeepSeek vs. OpenAI dispute in late January, which sent shockwaves through AI-related stocks, wiping out over $600 billion from NVIDIA’s market cap.

The spillover effect impacted the broader crypto sector, as investors feared potential AI market instability would slow blockchain adoption.

Further exacerbating market jitters, President Trump announced sweeping tariffs on imports from China, Mexico, and Canada, raising fears of retaliatory economic measures.

Anticipating price increases on consumer goods, US investors began pulling funds from risk assets such as stocks and cryptocurrencies, bracing for economic turbulence.

This led to a sharp selloff, with Bitcoin (BTC) plummeting by 11% between January 31 and February 4, dropping below the $90,000 mark for the first time in 20 days.

The broader crypto market suffered as well, with over $2.2 billion in liquidations recorded across derivatives markets within a single day.

The chart above shows how the crypto market plunged 20% in three consecutive losing days between January 31 and February 3.

However, markets found relief on Monday when Trump announced a pause on the tariffs targeting Mexico and Canada, easing concerns about inflation and trade disruptions.

Despite the White House notably maintaining the tariffs on Chinese imports, the immediate rollback on North American trade restrictions was enough to restore investor confidence.

This led to a swift rebound in the crypto market, with a 5.6% increase in overall market capitalization within hours of the announcement.

Layer-1 coins lead $200B market rebound as investors remain cautious

Notably, Layer-1 tokens such as Ripple (XRP), Ethereum (ETH), and Cardano (ADA) outperformed the broader market, posting double-digit gains in the past 24 hours.

The preference for major Layer-1 assets over smaller-cap altcoins indicates that investors are opting for safer, more established blockchain projects amid ongoing macroeconomic uncertainty.

Historically, when large-cap assets attract more inflows than riskier alternatives, it suggests that market participants are prioritizing stability, positioning for market gains while also keeping an eye out for potential macro risks.

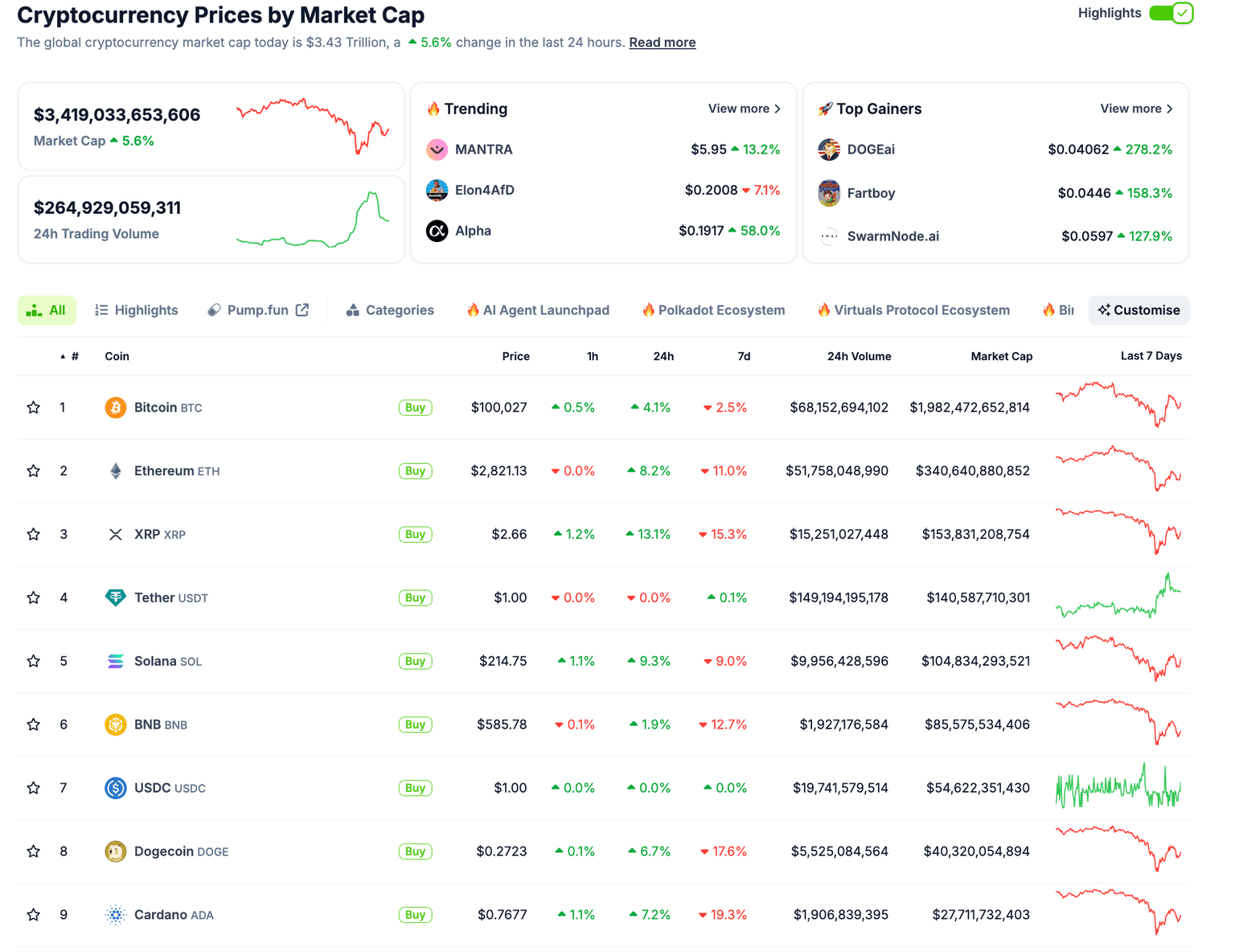

Crypto Market Performance snapshot, Feb 4, 2025 | Source: Coingecko

According to the latest market data, the total crypto market capitalization surged 5.6% within 24 hours, reaching $3.43 trillion.

Bitcoin (BTC) rebounded above $100,000 with a 4.1% daily gain, while Ethereum (ETH) climbed 8.2% to $2,821. XRP saw the largest Layer-1 gain of 13.1%, trading at $2.66. Meanwhile, Cardano (ADA) posted a 7.2% gain and Solana (SOL) rose by 9.3%, reinforcing the narrative that investors are concentrating liquidity in major blockchain ecosystems.

Trading volume also reflected this shift, with Bitcoin and Ethereum leading with $68.1 billion and $51.7 billion in 24-hour volumes, respectively. Notably, stablecoins such as USDT and USDC maintained price stability, suggesting that while capital is rotating into major Layer-1 assets, some investors are keeping liquidity on standby in case of market fluctuations.

As markets now await China's response to US trade restrictions, traders are closely watching key support and resistance levels for XRP, ETH and SOL to gauge the sustainability of the current rally. Further analysis will follow in the next phase of price action.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.