Ripple Price Prediction: XRP gearing up for a 35% breakout

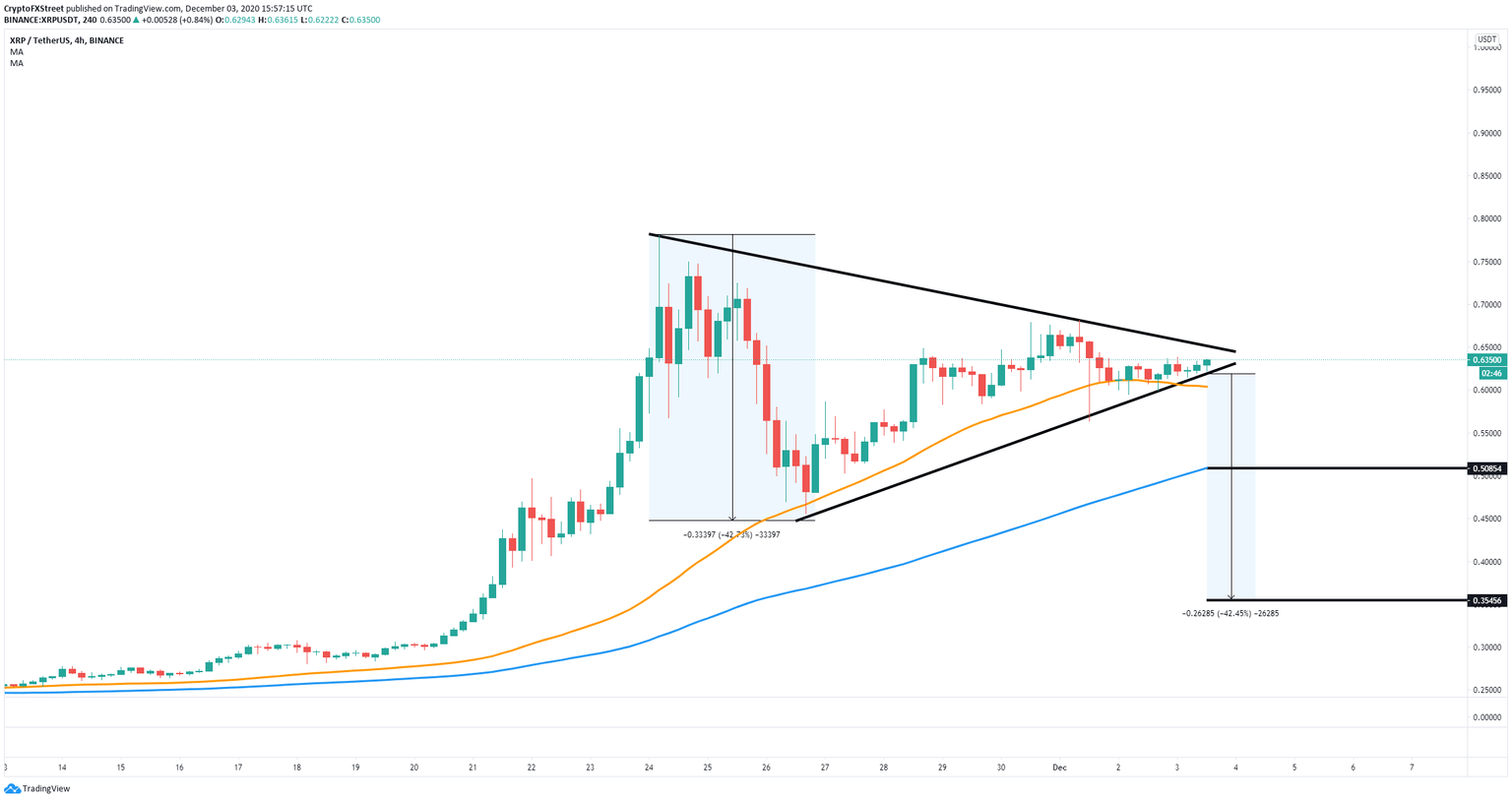

- Ripple price seems to be contained inside a symmetrical triangle pattern on the 4-hour chart.

- A breakout is nearby if the 50-SMA support level continues holding.

XRP has been trading sideways for the past three days consolidating after establishing a new 2020-high at $0.78. Bulls are holding a crucial support level in the short-term, which gives them better odds to see a breakout in the next few hours.

Ripple price on the verge of a breakout or breakdown

On the 4-hour chart, XRP has established a symmetrical triangle which seems to favor the bulls as they have been holding the 50-SMA support level. The upper trendline is located at around $0.65 while the current price is $0.634.

XRP/USD 4-hour chart

A breakout above the upper boundary of the pattern can quickly drive Ripple price towards a new 2020-high above $0.90 using the height of the triangle as a reference. Bulls need to hold the 50-SMA to see the breakout.

XRP/USD 4-hour chart

On the other hand, a breakdown below the lower trendline of the pattern at $0.62 and failure to hold the 50-SMA support can push Ripple price towards the psychological support level at $0.5 and as low as $0.35 in the longer-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.