Ripple Price Prediction: XRP bears battle key supports above $0.4400

- Ripple bears keep the reins for third consecutive day.

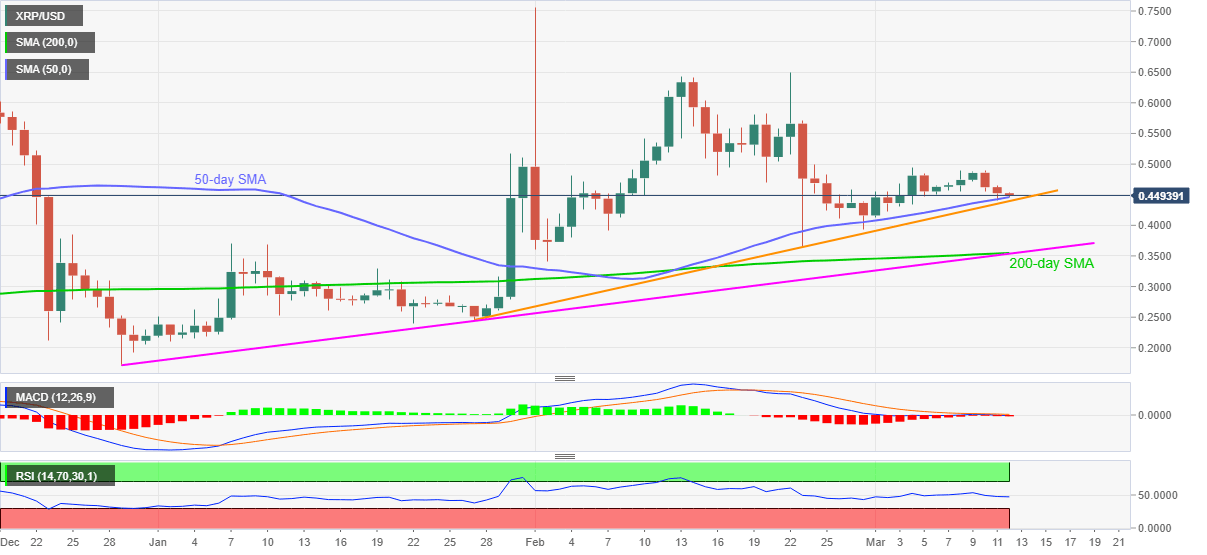

- 50-day SMA, six-week-old ascending trend line test sellers.

- Bulls need to overcome the $0.5000 level for conviction.

Ripple sellers are dominant for the third day in line as the XRP/USD quote refreshes intraday low with $0.4468 level, currently down 0.95% near $0.4480, during early Friday.

Failures to cross the $0.5000 threshold join bearish MACD and neutral impression from the RSI line to keep the XRP/USD bears hopeful.

However, a clear break below an ascending trend line from January 27, currently around $0.4400, needs to be printed on the chart to confirm further downside. Meanwhile, a 50-day SMA level of $0.4460 offers immediate support to the quote.

In a case where XRP/USD drops below the $0.4400 support line, lows marked during February around $0.3930 and $0.3650 can entertain the sellers ahead of challenging them with a confluence of 200-day SMA and an ascending trend line from December 29, 2020.

On the contrary, the monthly high near $0.4950 guards immediate upside ahead of the $0.5000 hurdle, a break of which will recall the XRP/USD bulls targeting the $0.5800 area.

XRP/USD daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.