Ripple Price Prediction: XRP depicts downside risks as uptrend falters

- XRP downside risks persist as the price extends the pullback and tests the $2.27 support level.

- The SEC's third conference on digital assets and tokenization will bring together asset managers, regulators and academics on June 5.

- SEC Commissioner Hester Peirce is expected to participate in the conference along with other panelists.

- Ripple submitted a letter to the SEC's Crypto Task Force, stressing the importance of a new and clear regulatory framework for digital assets.

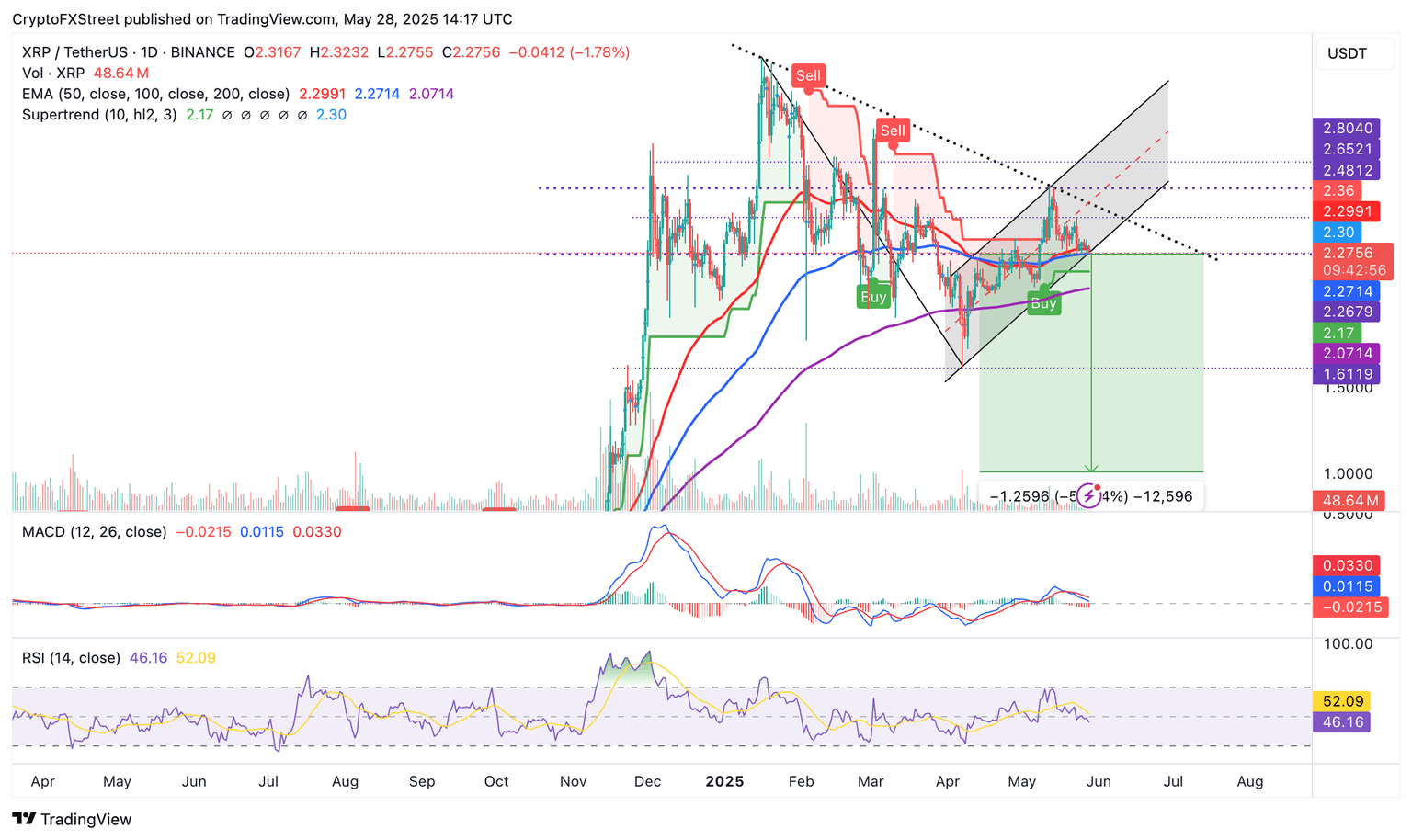

Ripple (XRP) has been trading in a narrow range between $2.65 and $2.27 for nearly three weeks, with a bias toward the support level. The short-term technical outlook suggests that the current market value of $2.28 on Wednesday could pave the way for extended losses. The doldrums may continue into the weekend, ahead of the release of the Federal Reserve's (Fed) May meeting minutes later on Wednesday and the Personal Consumption Expenditure (PCE) Price Index inflation data on Friday.

Beyond the range support, trader interest could shift to the demand zone at $2.07 as bulls seek liquidity to make make another attempt at recovery.

SEC to host third conference on emerging trends

The United States Securities and Exchange Commission (SEC) has announced that the next conference on digital assets and tokenization will be held on June 5. According to a press release, the conference, hosted by the Commission's Division of Investment Management, will bring together various asset managers in the industry, regulators and academics.

Key topics likely to take center stage include digital assets and tokenization, product proliferation and innovation, as well as access to private markets. SEC Commissioner Hester Peirce and Investment Management Division Director Natasha Vij Greiner will be among the panelists present.

Meanwhile, Ripple's Chief Legal Officer, Stuart Alderoty, said on X that the company has submitted a letter to the SEC's Crypto Task Force, addressing a pivotal question from "Commissioner Peirce's 'New Paradigm' speech: When does a digital asset separate from an investment contract?"

According to Ripple, which reiterated an analysis by Lewis Cohen, "there is no current basis in the law relating to 'investment contracts' to classify most fungible crypto assets as 'securities' when transferred in secondary transactions because an investment contract transaction is generally not present and these assets neither create nor represent the necessary cognizable legal relationship between an identifiable legal entity on the one hand and the owner of the crypto asset on the other that is the hallmark of a security."

Still, Ripple insists in the letter that there is a gap in existing laws corresponding to securities offerings, urging guidance from the SEC by establishing a clear regulatory framework. Such a step could reduce enforcement risk and provide clear compliance guidelines, especially during the early stages of network development.

Ripple's letter adds that the framework should seek to offer clarity where uncertainty exists rather than "blur boundaries that are already settled."

Technical outlook: What's next as XRP hangs at the edge of a cliff

XRP's price is attempting to establish support at the 100-day Exponential Moving Average (EMA), currently positioned at around $2.27, after slipping slightly below the 50-day EMA at approximately $2.29.

Based on the daily chart below, the path with the least resistance is downward. A sell signal from the Moving Average Convergence Divergence (MACD) indicator could encourage traders to reduce exposure to XRP, especially with sell-side pressure rising.

The signal occurred when the blue MACD line crossed beneath the red signal line on May 20. Green histogram bars expanding below the mean line (0.00) signal bearish momentum.

The Relative Strength Index (RSI) downtrend, which is now below the 50 midline, reflects XRP's intensifying bearish momentum. Should the RSI slide further down into the oversold region, XRP could fall under the 100-day EMA at $2.27, consequently validating a bear flag pattern currently projecting a 55% move to $1.00. This target is determined by measuring the flagpole and extrapolating half the distance below the breakout point.

XRP/USDT daily chart

Beyond the 100-day EMA at $2.27, key areas of interest, especially for traders watching for dips, include the 200-day EMA support at $2.07, the April 7 low at $1.61, and the bear flag breakout target at $1.00.

However, traders should consider the dynamic support offered by the SuperTrend indicator at $2.17. This is a trend-following tool that combines price and volume data to gauge volatility.

A buy signal is triggered when the XRP price crosses above the SuperTrend line, with the indicator's color changing from red to green. Targets on the upside lie at $2.65, where the XRP price was rejected on May 12, and at $3.00, a psychological resistance level.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren