XRP attempts recovery but downside risks could persist

- XRP pares intraday losses, holding above the 100-day EMA on Tuesday.

- Ripple advances institutional DeFi while targeting the launch of a lending protocol in the fourth quarter.

- Retail interest in XRP sharply declines, with the futures Open Interest down to $7.64 billion.

Ripple (XRP) is stabilizing above its $2.83 short-term support on Tuesday. This support comes after a sharp drop to $2.69 on Monday, which triggered massive liquidations.

Based on the near-term technical outlook, three outcomes are likely this week: sideways price action around $2.83, a steady rebound toward the $3.00 key level, or the continuation of the downtrend toward the $2.50 round-number support.

Ripple advances institutional DeFi

Ripple has updated its roadmap, focusing on top-tier institutional Decentralised Finance (DeFi), tokenization of real-world assets (RWAs), and the launch of a native lending protocol.

In Monday's release, Ripple stated that the XRP Ledger (XRPL) has grown to become a top-ten chain for RWAs, surpassing $1 billion in monthly stablecoin volume. At the same time, improvements on the XRPL have ensured support for stablecoin payments and collateral management.

Tokenization of RWAs stands out as the foundation for "real-world finance" with the XRPL expected to continually scale with a curated blend of features that balance innovation, compliance and reliability.

As for institutions, Ripple believes that "regulatory compliance is not an optional layer, it is the gateway to adoption." Key features of this layer include Decentralised Identifiers (DID), which ensure organisations can verify identities without relying on centralized intermediaries and credentials, allowing trusted issuers to comply with Know Your Customer (KYC) requirements. Other key features include permissioned domains, which are used to create user-controlled environments, and a permissioned DEX, which enables secondary markets for RWAs or FX.

Ripple is also working towards the launch of a native lending protocol called Credit On-Chain. The protocol will introduce pooled lending, supported by underwritten credit at the ledger level.

Credit-On Chain will enable short-term, uncollateralized loans, featuring preset amortization schedules. This product is designed for institutions using mature models, where underwriting and risk management remain off-chain.

"The lending protocol enables exactly that, pooling liquidity from a global base of smaller investors into institutional-sized loans while maintaining compliance. Borrowers gain access to more efficient, lower-cost funding. Lenders earn yield on otherwise idle assets," Ripple stated.

Meanwhile, retail interest in XRP has declined over the past few days, with the futures Open Interest (OI) dropping to $7.64 billion from $8.79 billion on Friday. The drop in OI, which represents the notional value of outstanding futures contracts, indicates a lack of conviction in XRP sustaining an uptrend in the short term. In other words, traders are increasingly closing their positions amid fears of an extended decline.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: Can XRP bulls renew uptrend?

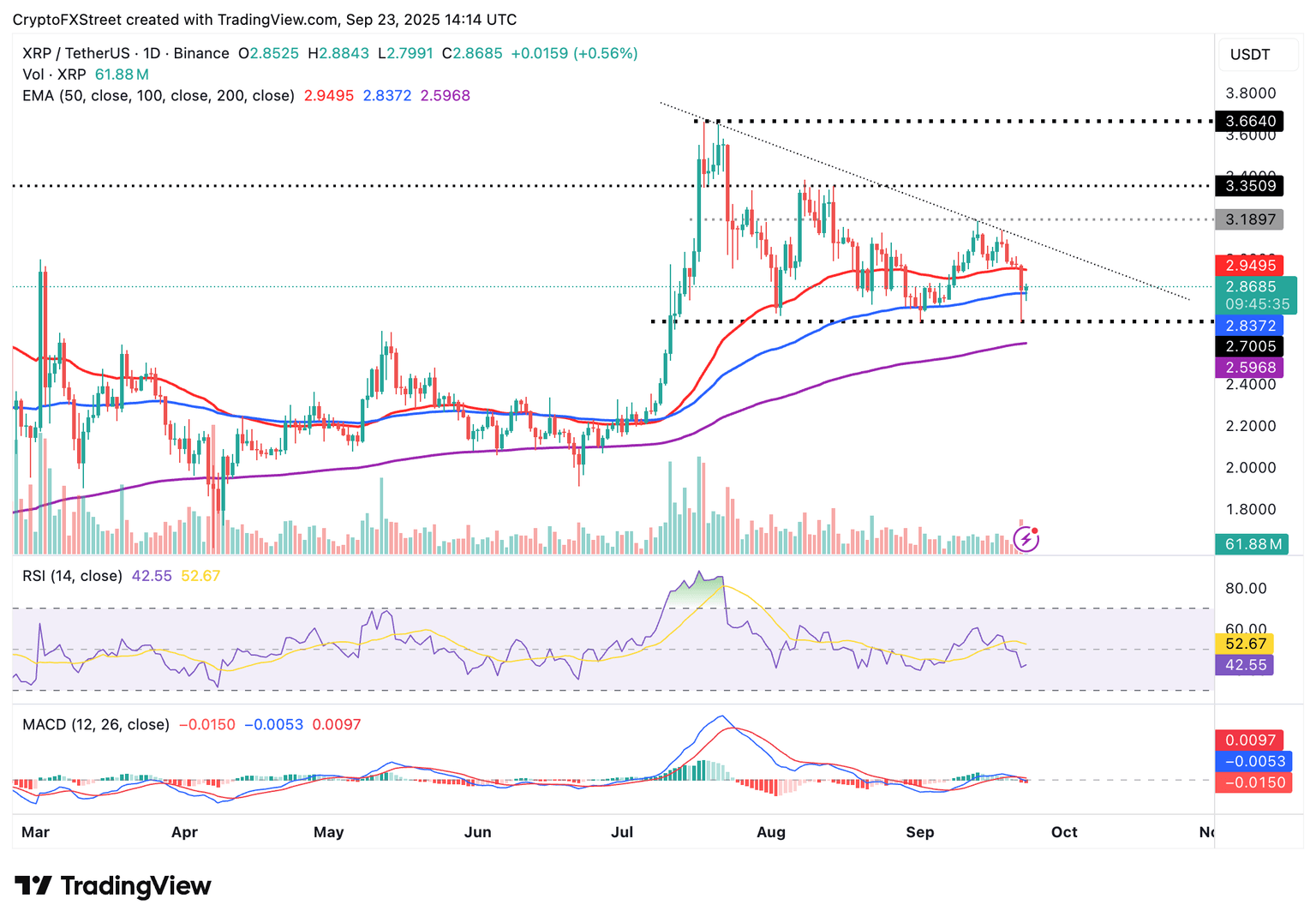

XRP hovers above the 100-day Moving Average (EMA) at $2.83 at the time of writing on Tuesday, after a sharp decline to $2.69 the previous day. The Bulls are pushing to regain control, with the Relative Strength Index (RSI) reversing upward to 42.

A daily close above the 100-day EMA could help confirm the bullish grip and encourage risk-on sentiment. Price action above the 50-day EMA, currently holding at $2.94, could reinforce the bullish grip and bring the $3.00 level within reach.

XRP/USDT daily chart

On the other hand, if bulls fail to maintain gains above the 100-day EMA, trading below it could shift attention to $2.70, a level last tested on September 22. Extended declines will likely test the 200-day EMA at $2.59.

Traders should also watch out for a potential buy signal from the Moving Average Convergence Divergence (MACD) indicator. This signal would occur when the blue line crosses above the red signal line, encouraging investors to increase their exposure. For now, the indicator has been displaying a sell signal since Monday.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren