Ripple Price Analysis: XRP/USD stalled below $0.2000, vulnerable to losses – Confluence Detector

- XRP/USD bulls lose the short-term battle to the bears.

- Strong support is created at $0.1900, which is the lowest level of the consolidation channel.

XRP price stays in the middle of the range $0.1900-$0,2000 after a failed attempt to clear the pivotal barrier of $0.2000. The third-largest digital coin hit the intraday low at $0,1930 before recovering to $0.1950 by press time. The coin is locked in a tight range amid growing market uncertainty. XRP/USD has stayed mostly unchanged on a day-to-day basis and lost nearly 1% since the beginning of Tuesday. Notably, Ripple’s XRP slipped to fourth place in the global cryptocurrency rating. The third place is now occupied by Tether.

The intraday chart shows that the RSI stays flat with a mild bullish bias. It means that the coin may continue moving in a tight range below $0.2000.

XRP/USD 1-hour chart

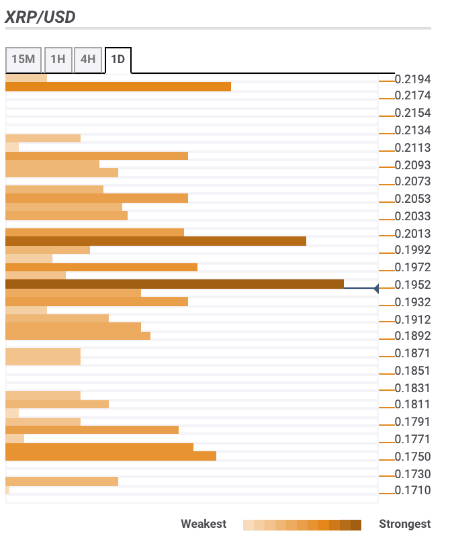

Let’s have a closer look at support and resistance levels clustered around the current price.

Resistance levels

$0,1960 – 23.6% Fibo retracement daily, the middle line of the 1-hour Bollinger Band 4-hour SMA10 and SMA5

$0,2000 – 1-hour SMA200, 4-hour SMA50 and SMA100, daily SMA50 and SMA10

$0,2050 – Pivot Point 1-day Resistance 2, 4-hour SMA200

Support levels

Author

Tanya Abrosimova

Independent Analyst

-637260923873125764.png&w=1536&q=95)