Ripple may be ready for another bull's run as BitPay adds XRP support

- BitPay will allow Ripple's XRP users to pay with the coin at Amazon.

- XRP/USD is positioned to further decline as long as it stays below SMA100 daily.

Ripple's XRP, now the third-largest digital asset with the current market value of $10.1 billion has lost nearly 6% in recent 24 hours. The coin touched the highest level of 2020 at $0.2540 on January 18 and retreated to $0.2326 by the time of writing. The coin has been moving in sync with the global cryptocurrency market, driven by a strong bearish wave after a move to new highs.

XRP may become a payment option on Amazon

The integration with the crypto payments service BitPay will allow Amazon users to purchase gif cards with XRP as early as this week. BitPay co-founder Tony Gallippi confirmed the news that was first discovered by XRP enthusiasts and retweeted by Gallippi.

Run! $XRP added to BitPay! Starting next week, gift cards can be purchased with $XRP -even for Amazon! Download the app, get comfy, hit up your favorite retailers to start accepting #XRP!

Meanwhile, BitPay's director of product, Sean Rolland praised the speed and scalability of XRP, saying that these features set the cryptocurrency apart from other digital assets.

BitPay customers are leveraging the promise of blockchain payment technology and with XRP can offer a payment option that is fast, cost-effective and scalable. The addition of XRP as the next blockchain asset supported by BitPay expands blockchain choices across the payments space.

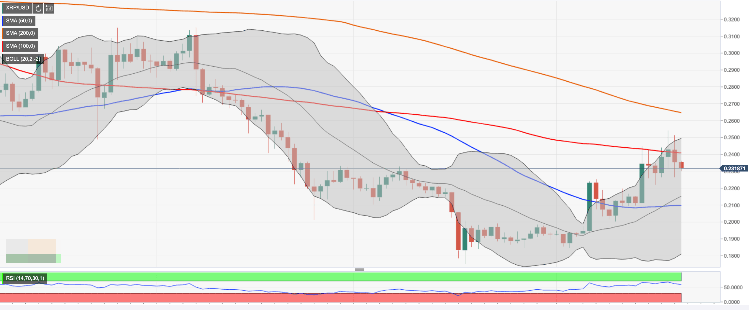

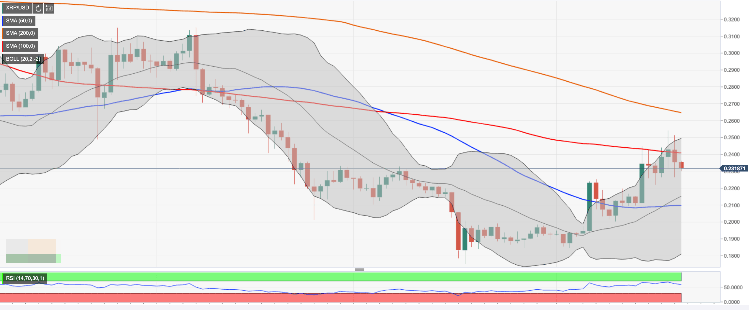

XRP/USD: technical picture

XRP/USD bottomed at $0.2266 on Sunday, January 19, and recovered to the area above $0.2300 by the time of writing. However, the coin is still below a critical resistance created by SMA100 daily at $0.2400. We will need to see a sustainable move above this handle for the upside to gain traction towards $0.2500 and the recent high of $0.2540.

On the downside, the initial support is created by SMA50 4-hour at $0.2285 reinforced by the upside trendlibe from January 3 low at $0.1846. Once it is out of the way, the sell-off is likely to gain traction with the next focus on psychological $0.2200 closely followed by SMA100 4-hour at $0.2171.

XRP/USD, daily chart

Author

Tanya Abrosimova

Independent Analyst