Ripple holders' profit taking hits a 19-month high as XRP price shoots up by 42%

- The month of March proved to be prosperous for XRP investors as profit-earning transactions increased significantly.

- XRP holders' presence on the network has also increased, which suggests rising confidence in the altcoin.

- XRP price needs to hold above $0.475 to prevent a catastrophic crash when corrections begin.

XRP price has performed beyond expectations and has marked a multi-month high, restoring confidence in its investors. These holders have also made the most of the situation and turned to sell, which could backfire on the price action soon.

Ripple investors on an upward journey

The rising XRP price has brought investors back on-chain. After weeks of minimal gains, the altcoin shot up to trade above $0.500, which the holders took advantage of. While the cryptocurrency is up 9.7% in the last 24 hours, in the last 20 days, the price has increased by over 42%.

This resulted in XRP investors resorting to selling as the price is nearing a six-month high. Most of these happened to be retail investors looking to profit from their investments. The ratio of daily transactions volume in profit compared to loss rose significantly, with the former occurring 2.1 times as much as the latter.

XRP transactions in profit

The profit-taking transactions continued to rise over the last two weeks, reaching a 19-month high as such levels were last observed back in August 2021 when the XRP price was at $1.101.

The profit-seeking behavior also brought back many XRP holders that stood away during the last bearish few weeks. The average active addresses on-chain can be seen rising gradually, with the exception of a spike on March 19 when the Ripple network noted the presence of nearly 872,000 investors on the same day.

XRP active addresses

XRP price reaches a critical level

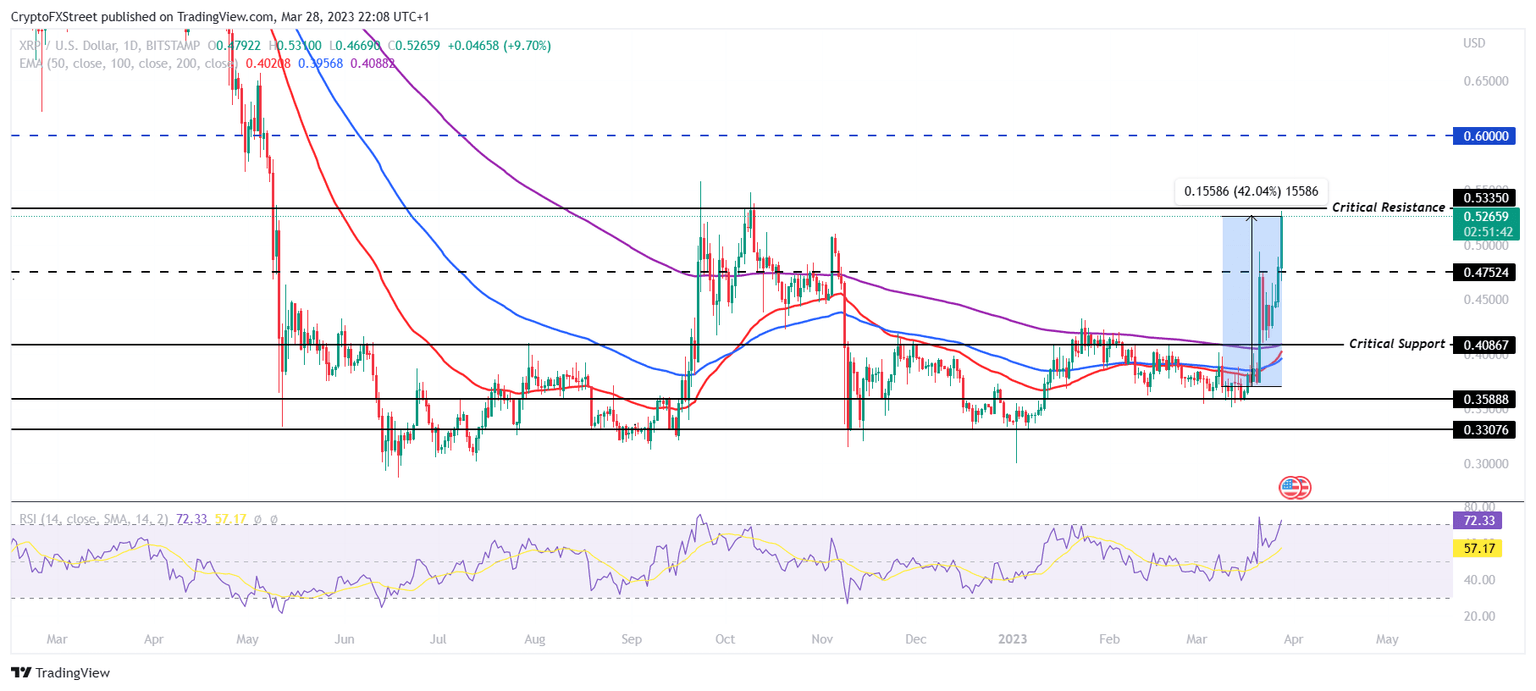

After rising by more than 42% in the span of 20 days, XRP price has climbed back to test the critical resistance at $0.533. Trading at $0.526 at the time of writing, the altcoin is already at a five-month high and would register a ten-month high if it manages to breach the barrier at $0.533.

Flipping the same resistance into support would also cement the recent rally and provide XRP price the opportunity to initiate a further rally. However, the Relative Strength Index (RSI) indicates that the market is overheating as the indicator is in the overbought zone above 70.0.

XRP/USD 1-day chart

Thus if corrections arrive and XRP declines, it would need to keep above the support level at $0.475. Slipping through it would result in a test of the critical support at $0.408, and falling through it would invalidate the bullish thesis as well as push XRP price to March lows of $0.358.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B02.35.19%2C%252029%2520Mar%2C%25202023%5D-638156388385661293.png&w=1536&q=95)

%2520%5B03.35.10%2C%252029%2520Mar%2C%25202023%5D-638156388714316310.png&w=1536&q=95)