REX Shares rolls out first US spot ETFs for XRP and Dogecoin

- The REX-Osprey XRP and DOGE ETFs, which track the price of Dogecoin and XRP, went live on Thursday.

- REX Shares announced plans to launch the products last week in a filing with the SEC.

- The firm had previously launched a Solana ETF providing exposure to the price of SOL.

REX Shares and Osprey Funds have rolled out the first US-listed spot ETFs for Dogecoin (DOGE) and XRP on the Cboe exchange, trading under the tickers DOJE and XRPR, respectively.

REX Shares launches first-ever US spot XRP and DOGE ETFs

REX Shares and Osprey Funds announced the launch of the REX-Osprey DOGE ETF and REX-Osprey XRP ETF, the first US-listed products offering spot exposure to the price of DOGE and XRP, according to a statement on Thursday.

XRPR and DOJE are designed to provide seamless access through traditional brokerage accounts, holding the underlying assets directly or through related products.

The firms had filed a prospectus for the funds last week, alongside several other crypto-focused applications. The prospectus included ETFs tied to BTC, ETH, SOL, BONK and TRUMP.

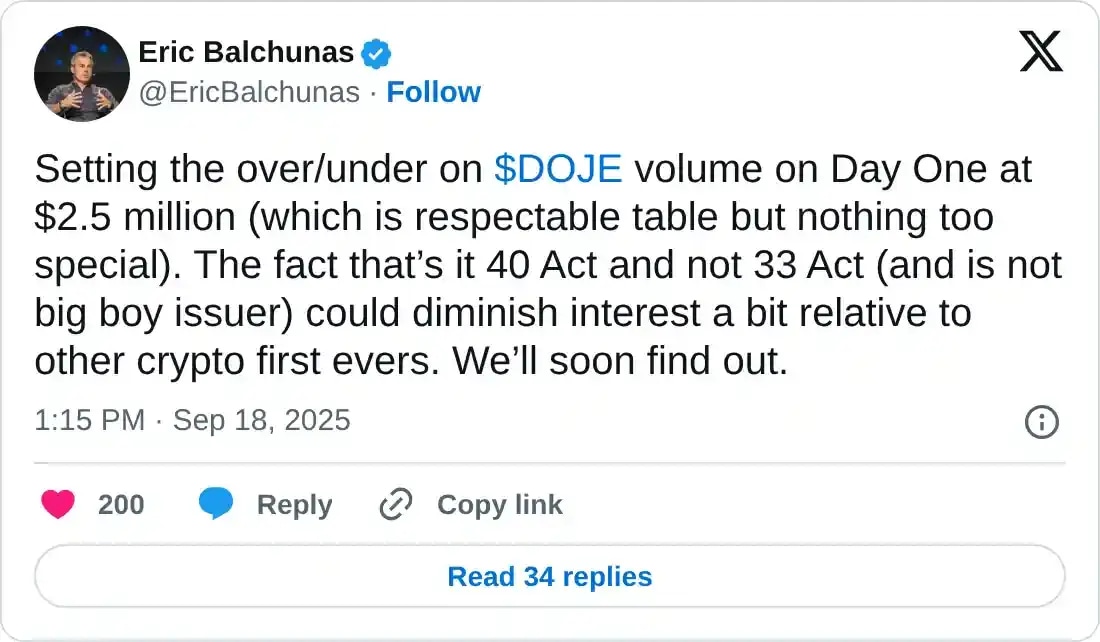

Bloomberg senior ETF analyst Eric Balchunas projected that the DOJE ETF could see up to $2.5 million in first-day trading volume, a modest debut by industry standards.

REX-Osprey previously launched a Solana staking ETF (SSK) in July, marking the first time such a product was introduced to US investors. Unlike most ETF applicants that file under the Securities Act of 1933, REX-Osprey submitted its funds under the Investment Company Act of 1940.

Other firms seeking approval for Dogecoin and XRP ETFs include Grayscale, 21Shares, Bitwise, WisdomTree, Franklin Templeton, Canary, CoinShares, and ProShares.

The SEC has postponed decisions on several ETF applications in the past month. However, it approved generic listing standards for spot commodity-based trust shares and ETFs, allowing exchanges to list products that meet the required criteria without needing to file a Form 19b-4 application.

The new standards could also lower approval timelines from 240 days under the previous process to 75 days.

XRP and DOGE are trading at $3.10 and $0.282, up over 2% and 3% in the past 24 hours, respectively.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi