Pump.fun Price Forecast: PUMP posts double-digit gains ahead of Binance listing

- Pump.fun gains over 15% on Wednesday, with bulls eyeing further recovery.

- Binance.US approves PUMP deposits and is set to commence PUMP/USDT trading on Wednesday.

- Among DeFi protocols, Pump.fun is the second behind Hyperliquid in terms of revenue generation over the past 30 days.

Pump.fun (PUMP) recovers above the $0.005000 psychological level on Wednesday, extending the rebound from the downturn seen in late August. At the time of writing, PUMP adds over 15% gains on the day, underpinned by the platform’s rising revenue and the Binance.US listing approval.

Binance approves PUMP trading pair in the United States

Binance.US announced the PUMP deposit features for its users in an X post on Tuesday. Additionally, the users are able to trade PUMP against USDT (the USD stablecoin issued by Tether) starting from 11:00 GMT.

This announcement will bring additional liquidity to the PUMP trading pairs by tapping into the interest among US investors.

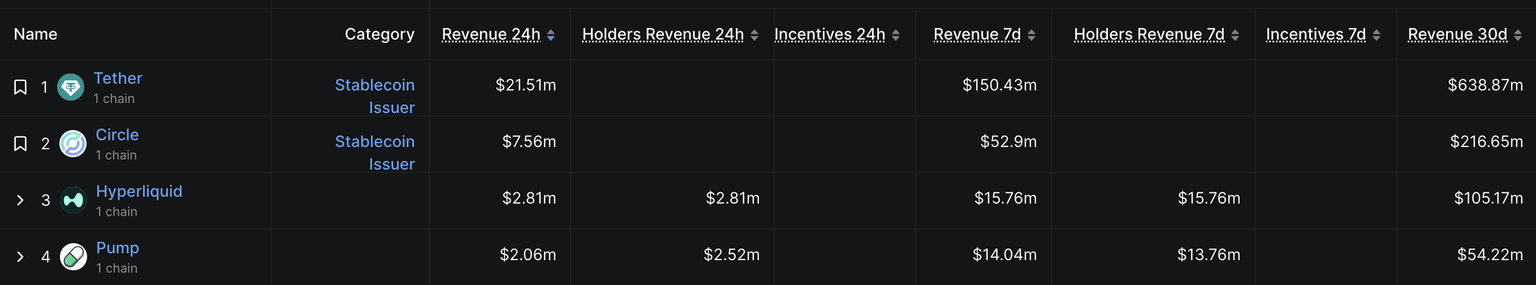

Pump.fun becomes the second-largest protocol by revenue generation

DeFiLlama data shows that Solana's Pump.fun protocol is second only to Hyperliquid (HYPE) in terms of revenue generated over the last 24 hours, excluding stablecoins. The meme coin launchpad generated over $2.52 million following Hyperliquid’s $2.81 million revenue.

The trend of Pump.fun securing the second position based on revenue over the last 30 days, suggesting a steady demand for the protocol.

Pump.fun revenue. Source: DeFiLlama

PUMP eyes breakout run to record high

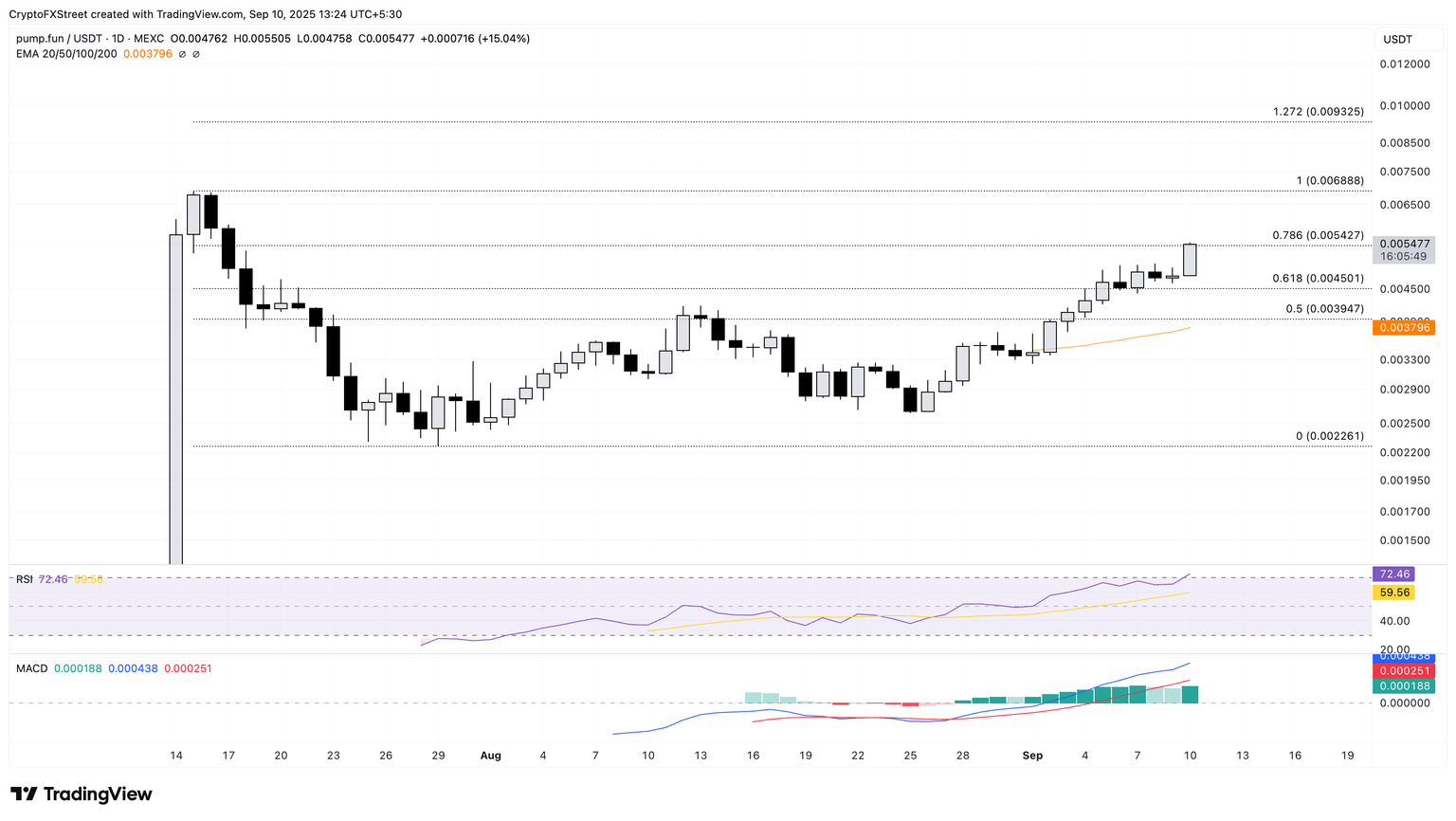

PUMP edges higher by 15% at press time on Wednesday, reclaiming the $0.005000 psychological level.

The intraday rise approaches the 78.6% Fibonacci level at $0.005427, which is retraced between the $0.006888 peak from July 15 to the $0.002261 low of July 29.

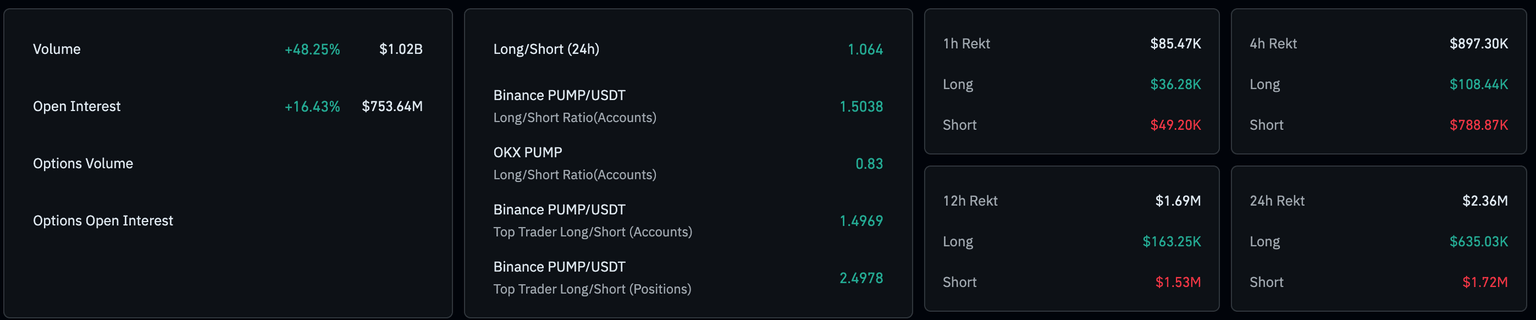

CoinGlass data shows that the PUMP Open Interest (OI) has increased by 16% over the last 24 hours, reaching $753 million. This increase in OI refers to heightened capital inflows in PUMP derivatives as traders anticipate an extended recovery.

PUMP derivatives. Source: CoinGlass

If the recovery run marks a decisive close above $0.005427 level, PUMP could extend the rally to the $0.006888 record high.

Adding to the bullish potential, the Relative Strength Index (RSI) on the daily chart is at 72, into the overbought zone, suggesting that the buying pressure is high. However, investors must remain cautious as overbought conditions pose the risk of trend reversal.

Additionally, the Moving Average Convergence Divergence (MACD) and its signal line hold a clean uptrend in motion, accompanied by successive green histogram bars indicating a rise in bullish momentum.

PUMP/USDT daily price chart.

Looking down, if PUMP falls from the $0.005427 level, it could retest the 61.8% Fibonacci level at $0.004501.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.