Pi Network Price Forecast: Whale activity near record low flashes bullish potential

- Pi Network has maintained a consolidation phase over the last couple of weeks.

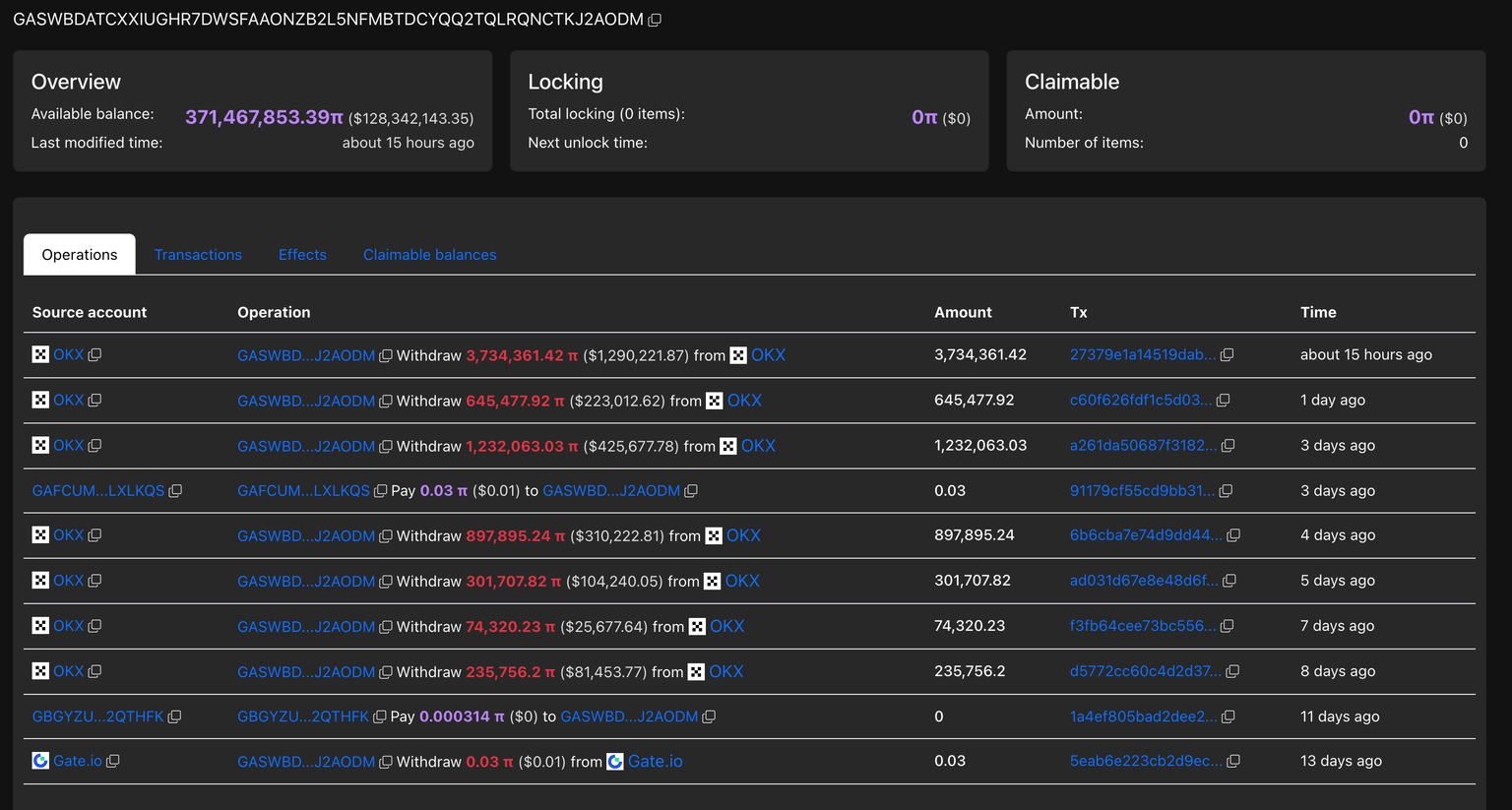

- The largest Pi token whale acquired 3.73 million coins on Monday, expanding the holding to 371 million PI.

- The CEXs’ wallet reserves record a net outflow of 2 million PI tokens.

Pi Network (PI) trades above $0.34 at press time on Tuesday, extending the sideways trend. Capitalizing on low prices, the largest Pi token wallet address by holding acquired 3.73 million additional PI tokens on Monday.

Declining CEXs' reserve signals a demand surge

PiScan data shows that a large wallet investor, commonly referred to as a whale, withdrew 3.73 million PI tokens from OKX exchange on Monday, expanding the hodling to 371 million tokens.

Whale wallet address. Source: PiScan

Adding to the increased PI token demand, Centralized Exchanges (CEXs) wallet reserves have declined by 2 million tokens over the last 24 hours. Typically, an outflow from CEXs indicates an increase in retail demand.

CEXs wallet balances. Source: PiScan

Pi Network stands at a crucial crossroads

Pi Network edges higher by nearly 0.5% at press time on Tuesday, extending a sideways trend above $0.34. The mobile mining cryptocurrency flattens out within a larger falling channel pattern on the daily chart.

A potential bounce back in the PI token, underpinned by retail demand, could target the upper resistance trendline near $0.3700.

Momentum indicators flash mixed signals on the daily chart as PI stands at a crucial crossroads. The Relative Strength Index (RSI) at 44 moves flat below the halfway line, indicating muted buying pressure.

Additionally, the Moving Average Convergence Divergence (MACD) sustains an uptrend, hovering above its signal line, suggesting a bullish shift in trend momentum.

PI/USDT daily price chart.

Looking down, a potential drop below the August 1 trough of $0.3220 would mark a fresh record low, potentially targeting the $0.3000 round figure.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.