Options strategy: Straddles on crypto

In brief

Options trading has become the fastest-growing part of the crypto derivatives space.Thanks to the rapid rising of institutional interest and diversified selection of options, contracts form exchanges. Traders and investors of all levels are now able to take advantage of the proven options spread trading strategies, which have been widely used among traders in the traditional financial world. Among all the strategies, long straddles could be one of the most used, and perhaps one of the most effective strategy out of all, especially on an asset like Bitcoin (BTC).

Advantage of applying options strategies

Options strategies are basically buying or selling multiple options contracts at the same time. These methods could also be combined with the underlying in different ways to enhance investment positions, hedge risk exposures, and profit from anticipated market moves in a cost-effective approach.

Traders acrossasset classes have been using these proven strategies in their trading, especially those in the derivatives space.What makes options standout from the crowd perhaps is the nonlinear characteristic of it. Unlike futures (a linear derivative), the payoff of options contracts not only determined by the changes of the underlying but also depends on the changes of time, volatility, and the strike price in relation to the sport price.

In our previous publications, OKEx highlighted the edges of options trading over futures. We believe options allow skilled investors to capitalize on their views and beliefs more effectively and comprehensively. Learn more about the basics of crypto derivatives here.

What is a Straddle, and why?

In general trading, a straddle means having two transactions on the same asset with positions that offset one another. In options trading, a long straddle strategy means buying a call options and a put options of the same underlying with the same strike price and the same expiration. On the other hand, a short straddle strategy involves selling a call options and a put options with the same strike and expiration.

Whether the straddle is long or short, the adoption of these strategies depends on the trader’s view of the underlying, and the overall portfolio strategy of the investor.

So, why traders want to adopt a straddle strategy?Long straddle strategy could be a choice when tradershave been anticipating a sharp price move of the underlying, but the direction of the movement is uncertain.

On the other hand, traders may want to use a short straddle strategy when they believe the price and the volatility of the underlying will remain steady within a specific timeframe.

How’s that work?

Long straddle strategycould be useful, especially for an asset class with high volatility, like cryptocurrency. That’s because markets often experience sudden price increase or decrease, and that’s part of the volatile nature of crypto asset after all. Regardless of whether long or short, having unprotected positions in crypto trading could be risky, and that is where derivatives like options contracts come in.So,let’s take long straddle as an example, and we explain how this strategy works?

We take BTCUSD options contracts on OKEx as an example. Assume the price of BTC at$9500. If a trader believesBTC pricesare due for a shape move, but not sure which direction it will go,he could adopt a long straddle strategy by buying in a call options and a put optionswith the same strike price and expiration at the same time.

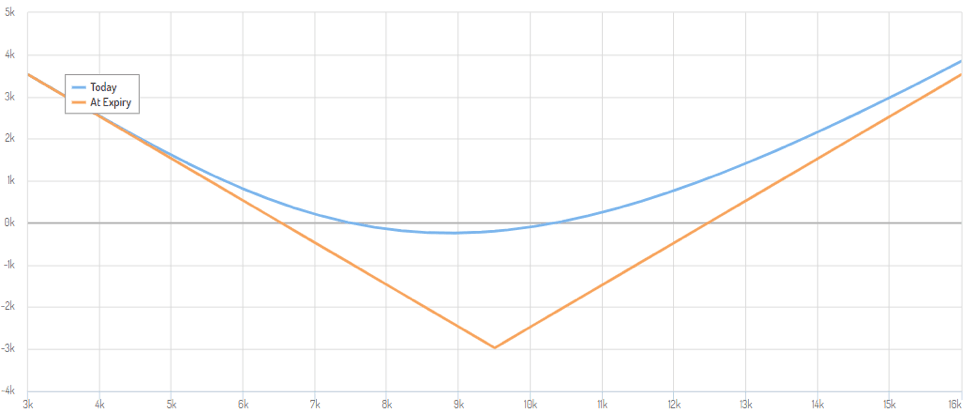

Let’s construct the strategy with a call options (BTCUSD-20200925-9500-C), and a put options(BTCUSD-20200925-9500-P). Both with a strike price at $9500 and expire on September 25, 2020. The P&L profile of such a combination could be something like this.

Figure 1: BTC options long straddle strategy (Source: OKEx)

Pros and Cons

One of the pros of having a long straddle strategy is that the maximum gain on the upside of this trade could be unlimited, that’s because theoretically, the price of BTC could go all the way up without ceiling. At the same time, the downside profit potential could be limited since BTC is unlikely to go below zero. The best-case scenario of this trade could be BTC prices surge or plunge significantly, and the profit of this trade will be the difference between BTC price and the strike price, minus the premium paid for both options.

On the flip side, the worst-case scenario of this trade is that BTC price holds steady, causing implied volatility to decline. By the time of expiry, if BTC price is the same as the strike price of the two options, it means the two options will become at-the-money. Therefore, they will have no intrinsic value, and all the premium paid will be lost. That’s the maximum loss of this trade.

IV and Time Decay: Two Factors to Watch

Implied volatility and time decaycould be the two most important factors to consider when it comes to a long straddle strategy. A successful long straddle strategy is highly dependent on the increase in the IV. That's because IV is one of the key elements in options pricing. The rapid rise of the IV tends to increase the value of the two options in the straddle and potentially allow investors to close the straddle for a profit before the options expire.

Meanwhile, time decay is another element that could hugely influence the result. Since a long straddle consists of a long and a put options. When first enter the trade, at least one of the contracts would be at-the-money. If the underlying BTC price maintains stagnant for an extended period of time, it could cause the total value of this position to decrease significantly. Moreover, the closer to the expiry, the higher the rate of time decay.

Conclusion

With the increasing popularity of options trading in the crypto derivatives space, traders and investors can now seek profit from these alternative ways of trading. The different combinationsof buying/selling calls and puts with different strikes and expiries could help market participants to get protection from the downside risks and enhance their potential returnsto better meet their portfolio objectives.

Author

Cyrus Ip

OKEx

Cyrus Ip has the privilege to work with OKEx as a Research Analyst, where he found some of the brightest talents in the crypto space.