Optimism risks decline as OP Foundation sells $90 million worth of tokens ahead of unlock

- Optimism Foundation disclosed the private sale of nearly $90 million worth of OP tokens to an anonymous buyer.

- The OP tokens sold privately are subject to a two-year lock-up period.

- OP price could decline in response to the sale and the upcoming unlock event on March 29.

The Optimism Foundation said on Friday that it has sold 19.5 million OP tokens, worth around $90 million at current prices, to an undisclosed buyer. OP price has broadly stabilized at around $4.57 after the news, clinging to recent gains, but the sale could hit the coin’s price as Optimism is gearing up for a token unlock event at the end of March.

Also read: Three factors that could catalyze a significant surge in Optimism in the upcoming weeks

Optimism Foundation’s private sale receives critique from crypto influencers

Optimism Foundation announced on Friday through an official statement on its website that the Layer 2 project has entered into a private token sale of nearly 19.5 million OP tokens. The tokens are subject to a two-year lockup period during which the purchaser is allowed to delegate them to unaffiliated third parties to participate in governance.

The tokens sold to the private buyer came from the OP Token treasury, which is a part of the Foundation’s original working budget of 30% of the initial OP token supply. The Foundation informed the community that over the next few days there will be several transactions to move OP from the Token Treasurys.

Since this was a private sale, the purchaser has not been disclosed.

Optimism Token Sale announcement. Source: Optimism

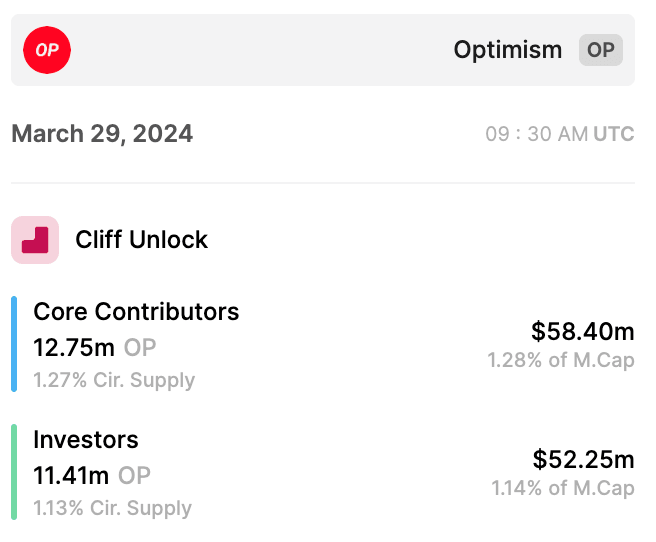

OP has a scheduled token unlock for March 29. According to data from Token.unlocks.app, 24.16 million OP tokens, worth approximately $110.65 million, will be released. The token unlock event could negatively influence the Layer 2 token’s price, as 2.40% of the asset’s circulating supply will be released. It is a typical trend that increase in circulating supply of an asset contributes to selling pressure on the asset and influences price negatively.

OP token unlock details. Source: Token.unlocks.app

OP price is $4.547 at the time of writing, the Layer 2 token is at risk of decline in response to these developments. However, the news failed to trigger a significant downside move, and the token is set to close the week with a price gain of 15%.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.