Optimism price sees 53% increase in two months, but profits remain bleak

- Optimism price witnessed considerable growth over the past two months to trade at $1.73.

- This motivated investors to bet on a further rise, which was squashed, resulting in the highest long liquidations since October.

- Optimism investors have not been charting profits despite the price rise due to a lack of accumulation.

Optimism price had a slow but significant rally over the past two months, which likely profited investors, but by the looks of it, gains were limited since investors did not positively accumulate enough.

Optimism price rally leads to demand shortfall

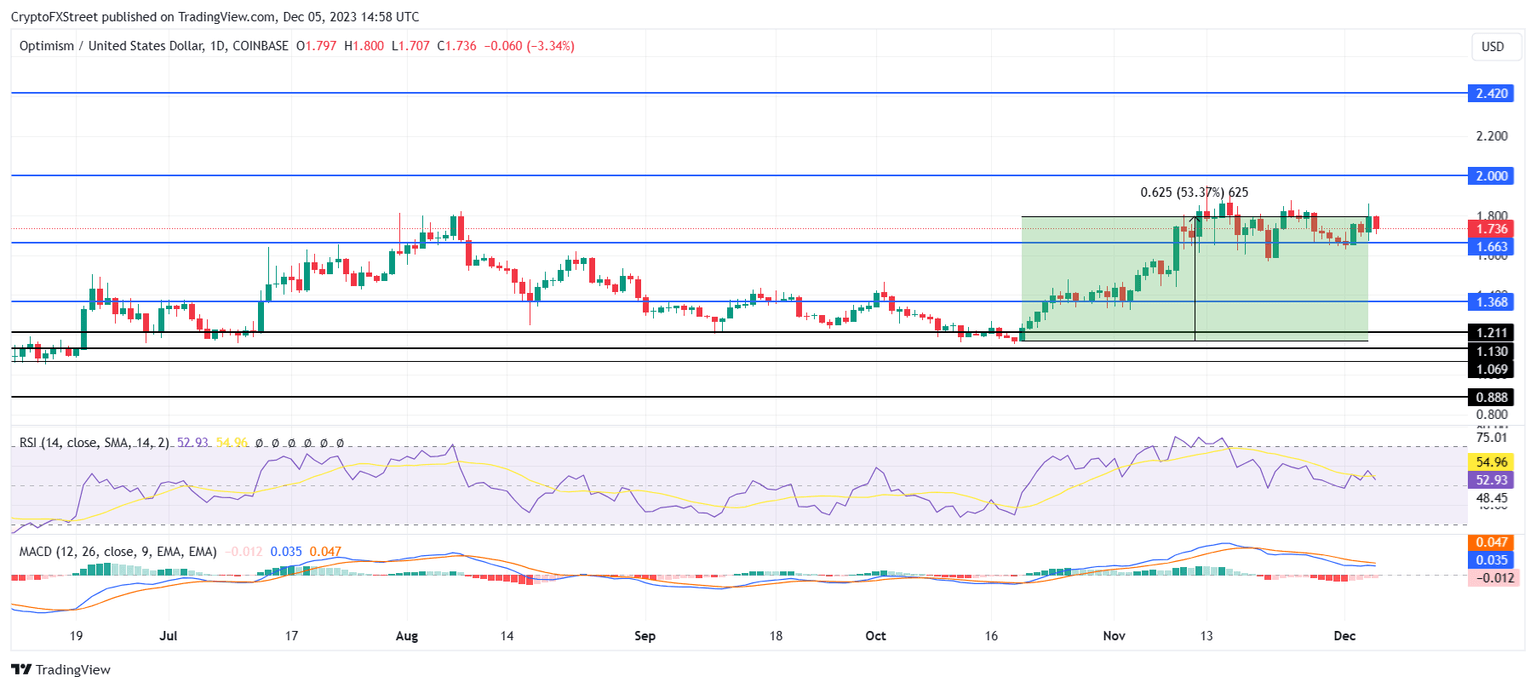

Optimism price increasing by 53% over the past two months had a positive impact on investors as well as traders, with the latter confidently betting on the rally to continue. Trading at $1.73 at the time of writing, the altcoin is currently testing the $1.66 support level as it has been for the past month on multiple occasions.

Generally, sideways movement is considered a prelude to a potential rally in the price action of an asset. This is evident from investors’ recent behavior. Furthermore, price indicators suggest that this pattern could prove to be right once again. The Relative Strength Index (RSI) above the neutral line suggests bullishness is still persistent in the market.

The Moving Average Convergence Divergence (MACD) indicator also exhibits waning bearishness as evidenced by the receding red bars on the histogram. The MACD line crossing over the signal line would confirm a change in momentum to bullish.

Around this phase, OP could potentially rise beyond $1.80, which is essential for the altcoin to breach the resistance level of $2.00. Flipping it into support would prove profitable for investors over the longer term as well.

OP/USD 1-day chart

However, if the market cools down and bearish cues dominate the price action, Optimism price could end up testing the $1.66 support again. Furthermore, losing this support line and falling through $1.50 would invalidate the bullish thesis, resulting in OP tagging $1.36.

Fewer profits, more losses

Following the rally and cooldown, the anticipation of a continued increase in the value of OP kept investors optimistic. This resulted in traders holding large, long positions awaiting a push beyond $1.80.

This optimism was shattered over the past 24 hours, when Optimism price ended up declining over 4% during intra-day trading hours on Tuesday. In the span of 12 hours, over $1.51 million worth of long liquidations were registered. While long liquidations exceeding short liquidations are rather common, yesterday’s liquidations were the largest recorded numbers in nearly two months since October.

Optimism liquidations

While some, like these traders, have not been able to churn any profits, other investors did not fall too far from the tree either. The lack of accumulation is one of the biggest reasons behind investors failing to capitalize on the 53% rally. This is visible in the fact that in the last three weeks, only 39 million OP worth $66.3 million was bought by whales.

These addresses holding between 10 million and 100 million OP have a history of influence on price action. Their accumulation has resulted in a price rise, and selling has led to a price crash. Holding 346 million OP at the moment, their movement will dictate what one can expect from Optimism price going forward.

Optimism whale accumulation

Thus, if they act positively and accumulate more, the price rise would also bring more profits to investors.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B20.17.22%2C%252005%2520Dec%2C%25202023%5D-638373964485811760.png&w=1536&q=95)