Oasis Network price experiences volatility in advance of $14 million worth of ROSE token unlock

- Oasis Network price has dropped almost 10% in 24 hours, as forecasted, bringing the $0.06837 support level into sight.

- ROSE could record some volatility over the coming days, with a massive token unlock on the calendar for the network,

- On November 18, 200 million ROSE tokens worth $13.97 million will flood markets in a cliff unlock.

Oasis Network (ROSE) price could record significant volatility over the coming days after starting the weekend with a massive dump. It contravenes the broader market optimism, with all signs pointing toward the bearish catalyst on the network’s calendar – a cliff token unlock.

Also Read: Oasis Network Price Prediction: ROSE could correct 10% before next run north

Oasis Network to unlock almost 200 million ROSE tokens

Based on the Oasis Network’s vesting calendar, the ecosystem will be unlocking 196 million ROSE tokens worth approximately $13.97 million on November 18. The tokens will be allocated to the foundation, community members, core contributors, project partners, and the reserve.

A token unlock is a bearish fundamental event as it increases the supply of tokens in the market. While tokens going to the foundation and the reserve may be stored, community members, core contributors and project partners are likely to cash in to avoid being caught in the exit liquidity.

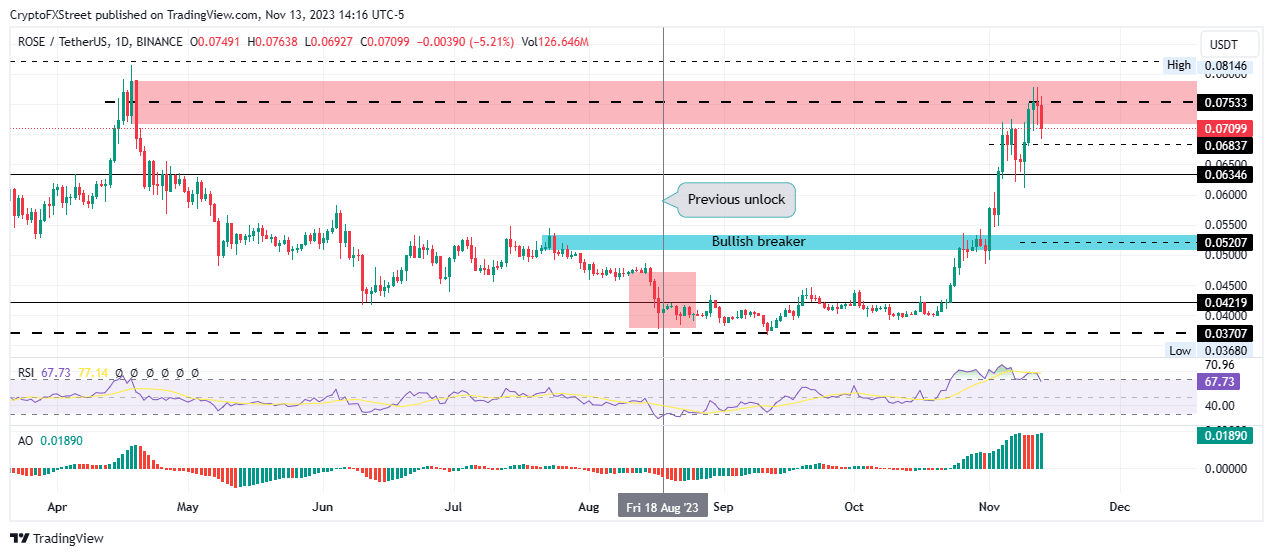

In the previous unlock on August 18, Oasis Network dropped ahead of the event before registering volatility for the next couple of weeks. At the time, the network unlocked 170 million ROSE tokens worth $12.19 million to the community, core contributors, partners, and the reserve.

ROSE Unlocks

Over the next few days following the August unlock, Oasis Network price recorded increased volatility, characterized by a unique mix of green and red candlesticks consolidating below the $0.04219 support level.

Oasis Network price volatility sets in

Oasis Network price is likely to record increased volatility over the next few days, potentially consolidating below the $0.04219 support level. Based on the technical outlook, the cryptocurrency could recover north after the 10% slump. This comes as the Relative Strength Index (RSI) remains above the 50 level, while the Awesome Oscillator (AO) is still in positive territory and showing green histogram bars.

Increased buying pressure could see Oasis Network price break the midline of the supply zone at $0.07533 to confirm the continuation of the intermediate trend. In a highly bullish case, the gains could extend for ROSE to tag the $0.08146 range high. Such a move would constitute a 15% climb above current levels.

ROSE/USDT 1-day chart

On the flip side, increased selling pressure below current levels could see Oasis Network price break below $0.06837 or lower, slipping below $0.06346. In a dire case, the slump could confirm the continuation of a downtrend by breaking and closing below the midline of the bullish breaker at $0.05207, bringing the $0.04215 support level within sight.

Notably, the RSI is actively tipping south to show that while bulls remain in control, buyer momentum is dropping. If left unchecked, bears could soon recover the ROSE market.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.