New SHIB investors bring deposits to the network but fail to trigger a rise in Shiba Inu price

- Shiba Inu price, akin to the meme coin leader Dogecoin, is still consolidating above $0.00000845.

- Network growth is currently at a month and a half high, suggesting SHIB is gaining traction in the market.

- However, the overall participation is still at a low, which might counter the new investors’ bullishness.

Shiba Inu price is still facing consolidation after nearly a month of no major gains, and it seems like this might be the case for a while. Even though the network is observing bullish interest from new investors, the lack of bullishness from existing SHIB holders might act as a barrier to recovery.

Shiba Inu price makes no move

Shiba Inu price trading at $0.00000869 has virtually made no significant increase in the last three weeks as the meme coin is currently changing hands at the same value as it did on May 11. Consolidated within $0.00000908 and $0.00000845, the altcoin has tested the lower range as support more frequently than it has attempted to breach the upper range acting as the resistance level.

SHIB/USD 1-day chart

While a part of this lack of recovery can be attributed to the broader market conditions and lack of bullishness in the crypto space, the same cannot be said for Shiba Inu. This is because the network has seen significant growth over the last couple of days.

The network growth indicator thatsuggests the rate at which new addresses are formed, is currently at a month and a half high. This suggests that the meme coin is gaining traction.

Shiba Inu network growth

Furthermore, this bullishness is not empty addition of addresses either, as the network has seen a surge in active deposits. After nearly two months of decline, the active deposits rose again. This could also mean that investors are selling, but since the balance on exchanges has not changed much, it points in a more bullish direction.

Shiba Inu active deposits

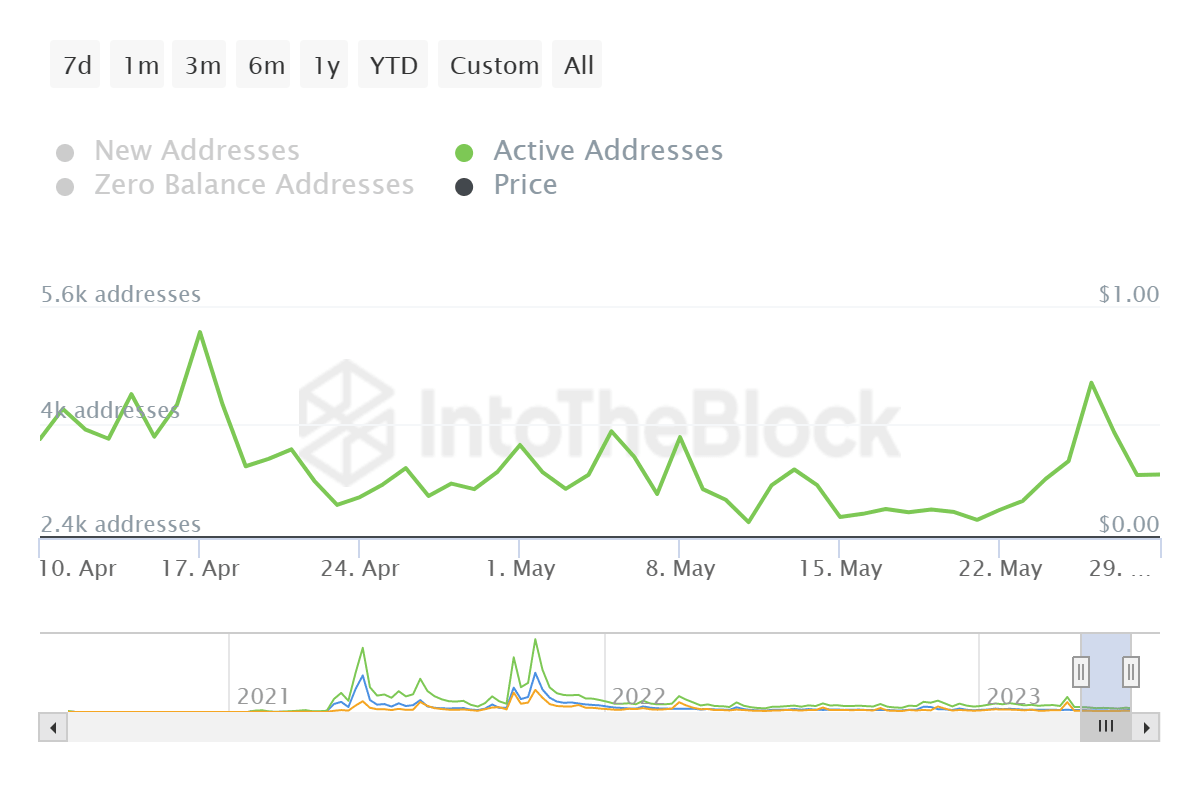

Thus despite new investors sharing an optimistic outlook, Shiba Inu is still failing to make any recovery. One of the reasons behind this is the lack of participation from its 1.22 million addresses. The active Shiba Inu addresses have averaged under 3k for the month of May, also conducting no notable number of transactions on-chain.

Shiba Inu active addresses

Put simply, unless Shiba Inu finds support from its existing bunch of holders, even new investors won’t be able to trigger a rise in price.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B06.10.58%2C%252031%2520May%2C%25202023%5D-638210967234798572.png&w=1536&q=95)

%2520%5B06.11.26%2C%252031%2520May%2C%25202023%5D-638210967406174721.png&w=1536&q=95)