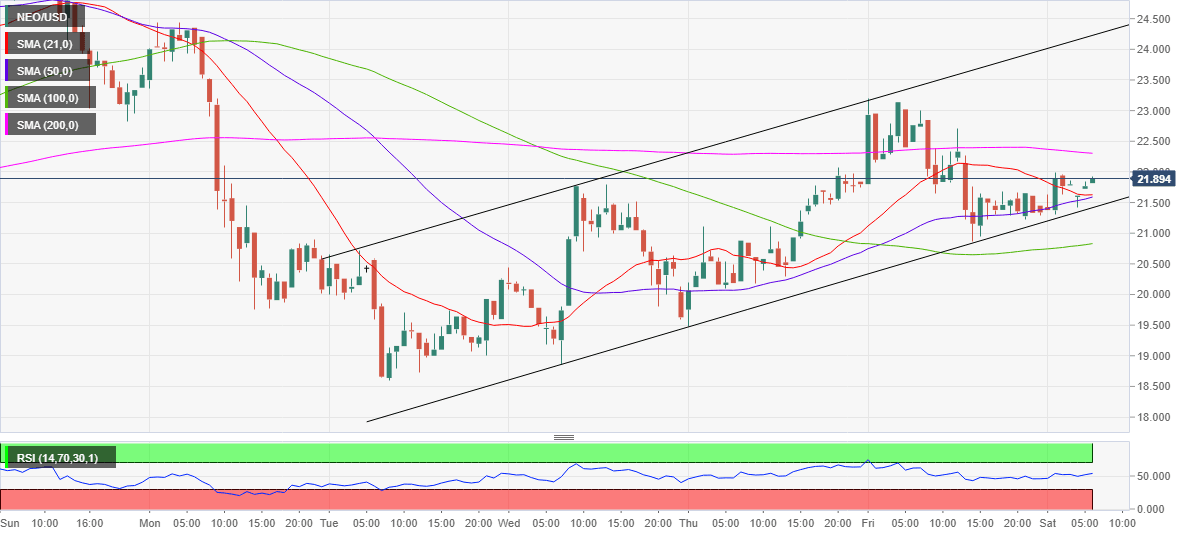

NEO Technical Analysis: A test of 200-HMA likely on NEO’s road to recovery

- NEO/USD remains trapped between 50 and 200-HMA.

- Hourly RSI has ticked higher above the midline.

- 200-HMA is likely to be tested in the near-term.

NEO (NEO/USD) witnessed good two-way businesses on Friday, having finally settled in the red after fading a spike above the $23 mark.

So far this Saturday’s trading, the buyers have regained control, allowing a tepid bounce in the spot. At the time of writing the No. 19 coin rises 2.4% to $21.82.

Looking at it technically on the hourly chart, the price is trending upwards after bottoming out last Tuesday at $18.60, carving out a potential rising channel formation. Meanwhile, the sellers continue to lurk above $23, leaving the rates in a familiar range.

The NEO bulls have managed to defend the 50-hourly Simple Moving Average (HMA) at $21.60 on Saturday, despite the overnight drop to near the $21 region.

Over the last hour, the spot caught a fresh bid-wave and recaptured the 21-HMA, now at $21.61, opening doors towards the horizontal 200-HMA resistance at $22.30.

A sustained break above the latter is needed to take on the $23 barrier once again.

Alternatively, a rejection at the 200-HMA hurdle could reinforce the bearish bias, as the critical support at $21.60 could be put at risk. That level is the confluence of the 21 and 50-HMAs.

Further down, the rising trendline support at $21.41 will be challenged. Acceptance below which would validate a rising channel formation, with the next downside target seen at the horizontal 100-HMA at $20.83.

To conclude, the spot is set to extend the bounce to 200-HMA, with the uptick in the hourly Relative Strength Index (RSI), currently at 53.90, also backing the upside potential in the near-term.

NEO/USD: Hourly chart

NEO/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.