Neo price could see a massive 70% move if it can defend this critical support level

- Neo price sits at a critical support level above the lower trendline of an ascending parallel channel.

- Bulls have defended this level several times in the past and aim for a rebound again.

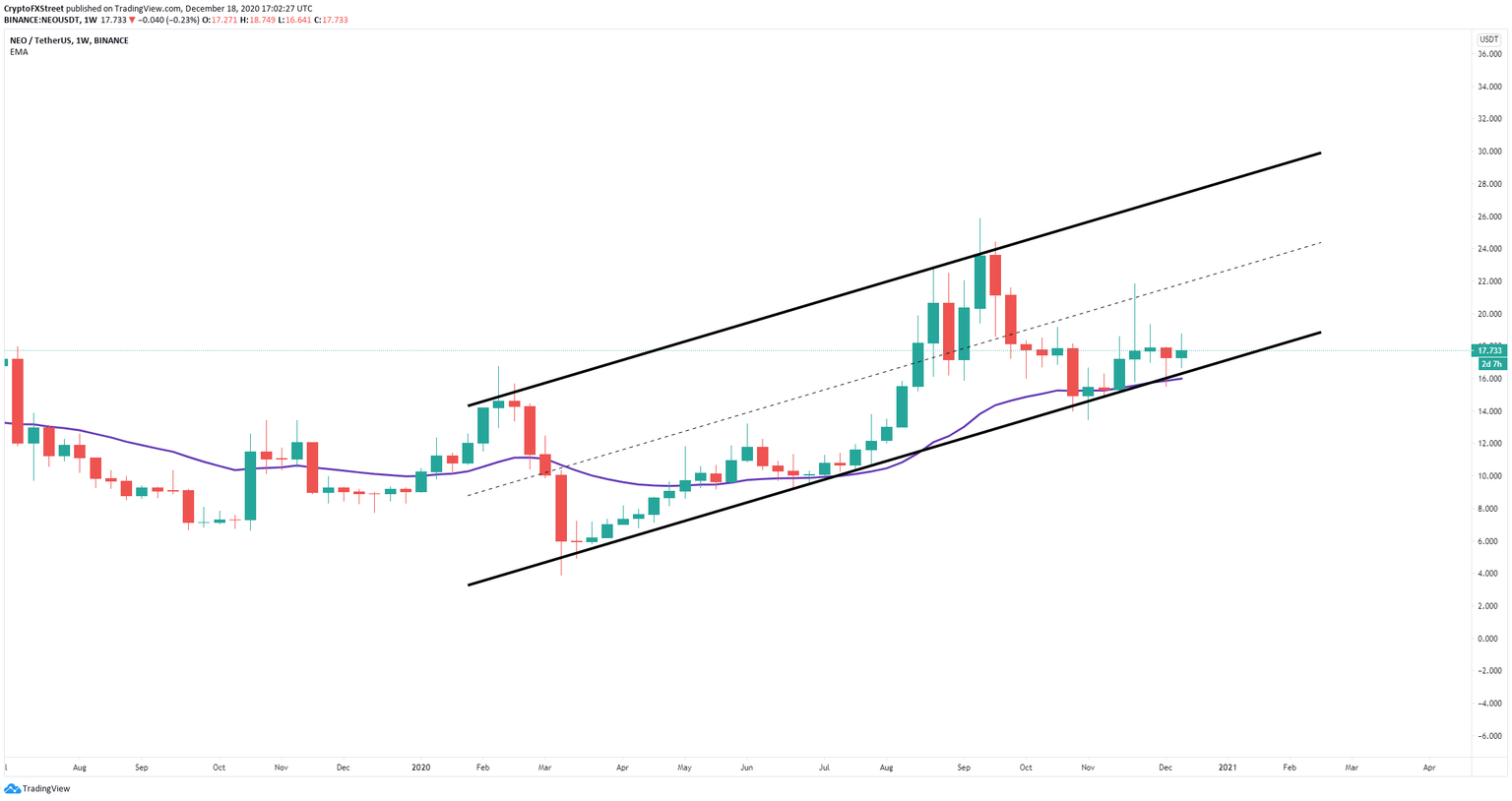

Neo price formed a long-term ascending parallel channel on the weekly chart and it’s currently sitting right above the lower boundary support of the pattern. If bulls can defend this critical level, they will aim for a massive 70% move.

Neo price on the verge of a colossal rebound

NEO is currently trading at $17.7 inside a weekly ascending parallel channel and has defended the lower trendline support again in the past week. Additionally, the 26-EMA also coincides with the support level at $16.5, adding more strength to it.

NEO/USD weekly chart

A successful rebound from the lower boundary of the ascending parallel channel can drive NEO price towards the middle trendline at $22.5 and as high as $28.3, the upper trendline resistance level.

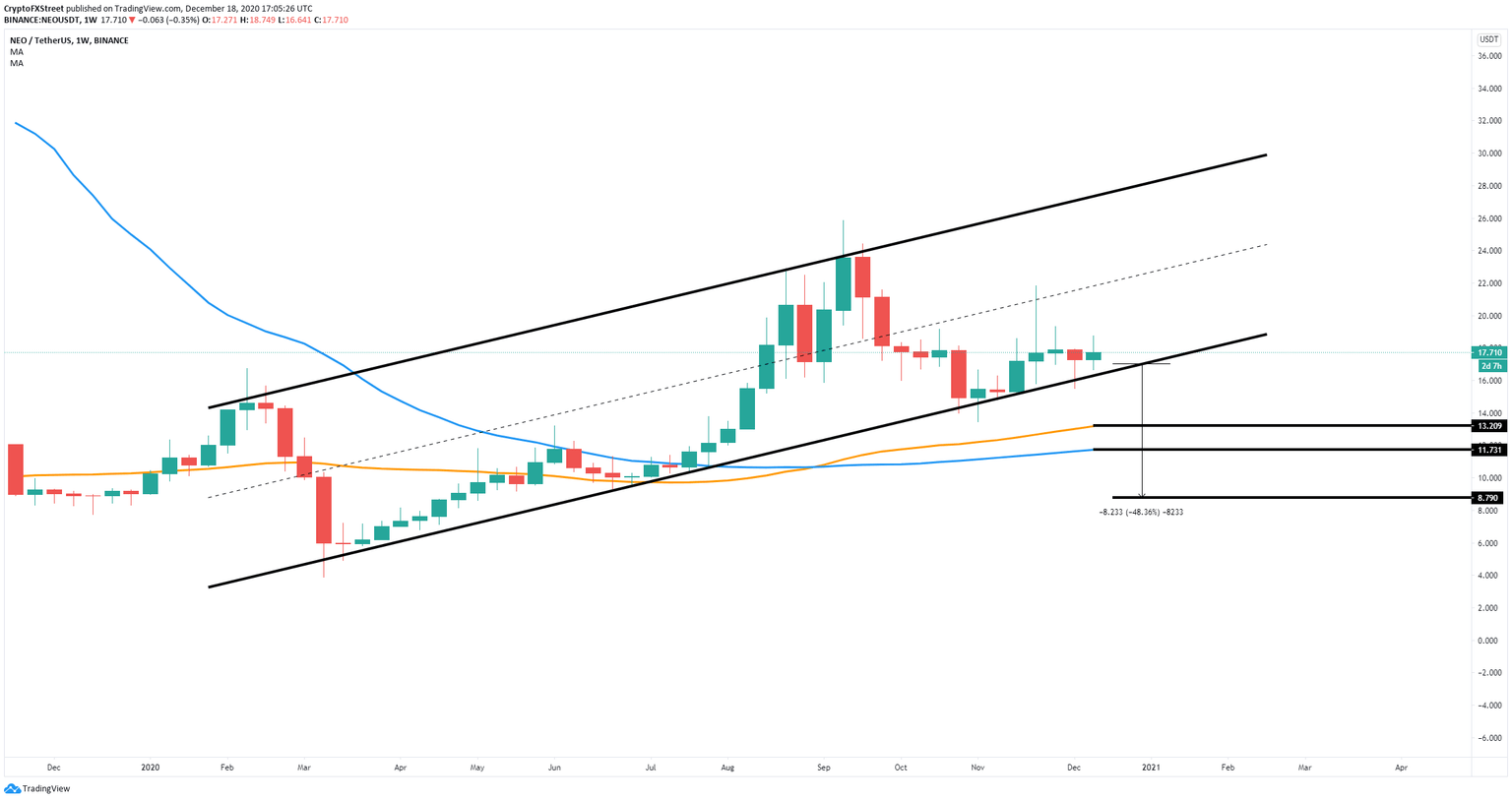

NEO/USD weekly chart

However, a breakdown below the critical support level at $16.5 would be an extremely bearish sign with the potential to drop NEO price towards $13.2, the 50-SMA, $11.7, the 100-SMA, and as low as $8.8 in the long-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.