NEO Price Analysis: NEO/USD continues to flex bullish muscles in a Bitcoin bear market

- NEO bulls are intentional in changing the general direction of the market upwards.

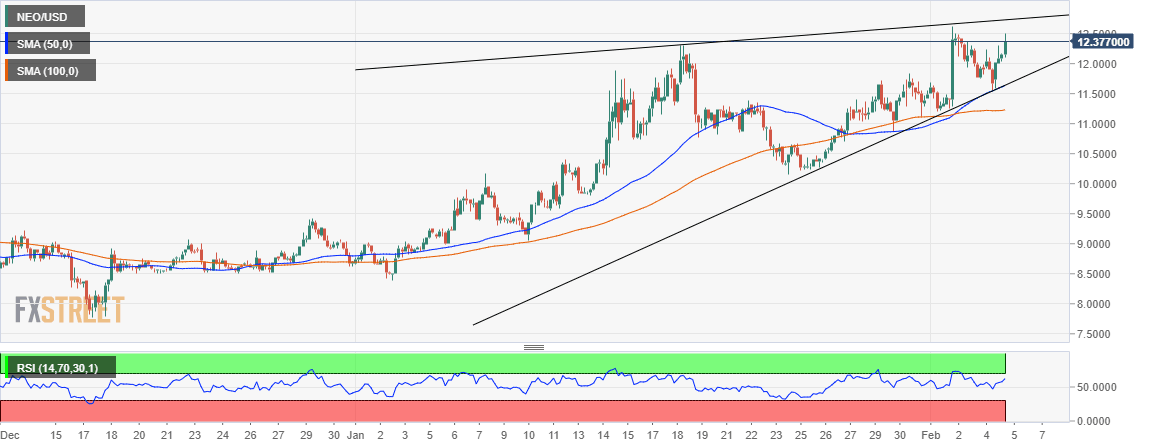

- NEO defends the support at $11.50 aided by the 50 SMA support.

NEO is bulls seem to be unbothered by the bear pressure going around the market. It is has corrected upwards almost 2% on the day. Moreover, the bulls are not afraid to poke on the bears in their fight for a break above the resistance at $12.50.

Looking at the general mood in the market, we can easily tell that Wednesday trading is likely to be dominated by increased selling activity. For instance, Bitcoin is trading at $9,164 after declines stopped within a whisker of the support at $9,150.

NEO price technical picture

NEO is exchanging hands at $12.38 after rising 1.98% on the day. The bullish momentum is supported by both the ascending trendline and the 50 SMA in the 4-hour range. If NEO manages to clear the resistance at $12.50 (which has already been tested twice), there is a possibility that the move will result in significant gains towards $15.00.

Short term technical analysis confirms the bulls’ presence and influence over the price. The RSI in the same 4-hour at 63 is pointing and trending upwards. Its return in the overbought region (above 70) will signal an increasing bullish grip and further upward movement. Besides a break above the rising wedge pattern will open more room for growth.

NEO/USD 4-hour chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren