Nasdaq futures chalk out golden cross near record high, offering bullish cues to Bitcoin

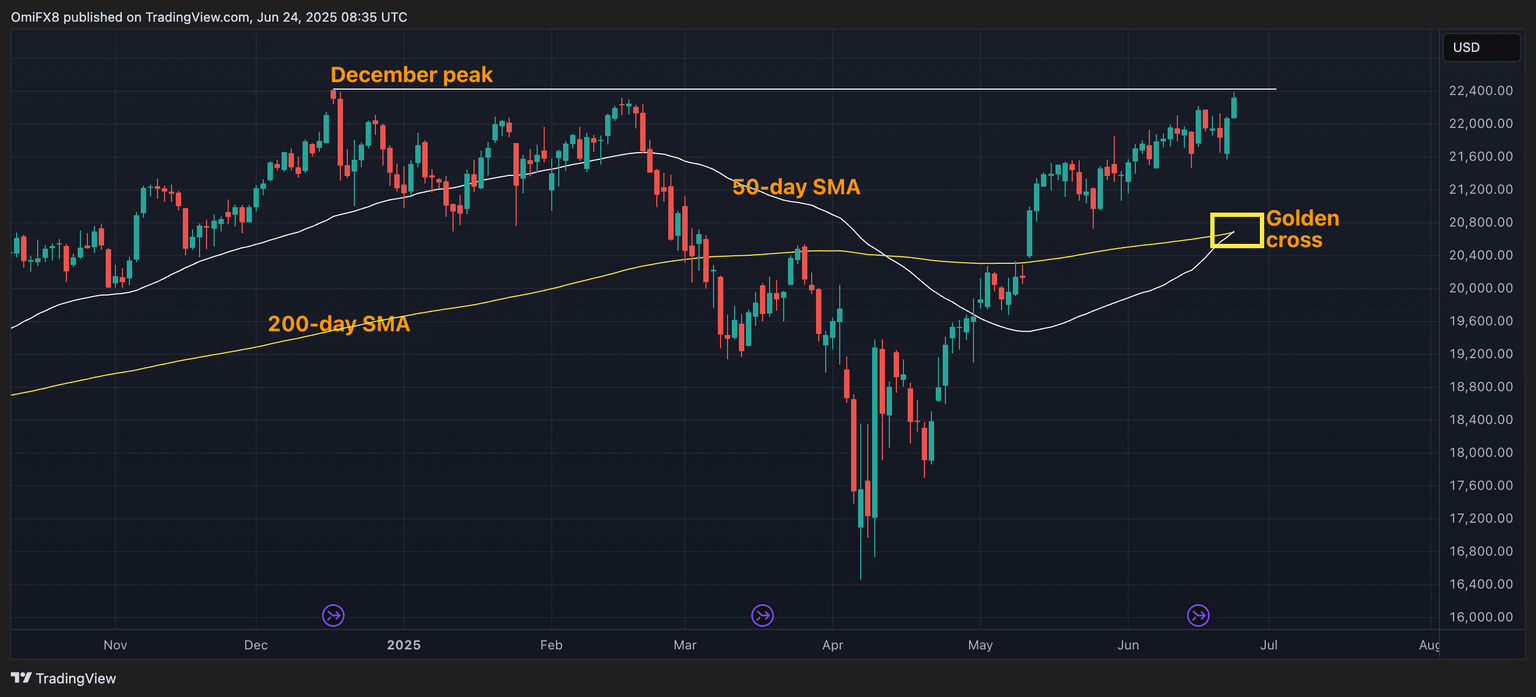

E-mini Nasdaq-100 (NDX) futures rose over 1% Tuesday, narrowly missing the record high $22,425 hit Dec. 17, according to data source TradingView, a sign that might embolden Bitcoin (BTC) bulls because the two tend to move in tandem.

More evidence comes from the daily chart of NDX futures, which flashed a bullish golden cross, with the 50-day simple moving average (SMA) moving above the 200-day line.

A golden cross is a sign that the short-term trend is now outperforming the broader momentum with the potential to evolve into a major uptrend.

According to an analysis by CNBC, the golden cross is a reliable indicator for the futures, with the index rising over 70% of the time after one appears. The index surged 34% to 18,328 in a year after the occurrence of the previous golden cross on March 13, 2023.

Note that BTC's rally has stalled above $100,000 since it chalked out a golden cross on May 23. The moving average-based indicator has a mixed record of predicting price trends in the Bitcoin market.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.