Mt. Gox may release 150,000 Bitcoin into the market drastically increasing the downward pressure

- Mt. Gox's Trustee to submit the rehabilitation plan by December 15.

- The potential distribution of 150,000 BTC may lead to panic selling.

Mt. Gox was an infamous Japanese cryptocurrency exchange that went broke in 2014, leaving its users penniless. After years of legal battles, Trustees appointed by the Tokyo District court are set to distribute about 150,000 BTC among its creditors. They were supposed to submit the rehabilitation plan in February 2019 and start compensating creditors for losses; however, the court has repeatedly moved the deadline upon the request from the Trustee.

December 15 is the latest deadline in the Mt. Gox rehabilitation process. By that date, the Trustee shall provide the rehabilitation plan and distribute 150,000 from the company's wallet to compensate users for losses.

Bitcoin on the verge of a massive sell-off

As the story goes, the injection of such a colossal amount of Bitcoins now worth over $2.85 billion may lead to a sharp sell-off as Mt. Gox users might rush to cash out on their assets. Even if some of them sold their debts to third parties, and some decided to hold the coins, the selling pressure is going to be enormous.

The catastrophe won't happen overnight, as the plan still needs to be approved by the court, and the distribution won't start immediately anyway. However, the fact that the Mt. Gox saga moves from the sticking point and enters its final phase may become a strong bearish signal for the market.

As noted by on-chain analytics resource CryptoQuant, multiple creditors who lost money in the Mt. Gox debacle were forced to wait for their money for years. No wonder if they are tempted to sell them for profit, even at the risk of crashing the market.

Mt. Gox rehabilitation plan deadline is Dec 15, 2020.

— CryptoQuant.com (@cryptoquant_com) December 8, 2020

It could be a $BTC bearish signal as supplying 150,000 BTC to the market, so we collected their address labels!

Set a real-time Mt.Gox Outflow alert https://t.co/kNV3oPFMf4#mtgox pic.twitter.com/pmTWgNbYh8

The market is ripe for a correction

Last week was characterized by low trading activity and range-bound trading. Once BTC hit a new all-time high and attempted to break above $20,000, the volatility subsided, and the coin entered a period of consolidation.

As FXStreet previously reported, Bitcoin's long-term picture implies that the market is ready for a deep bearish correction with a potential target at $13,000.

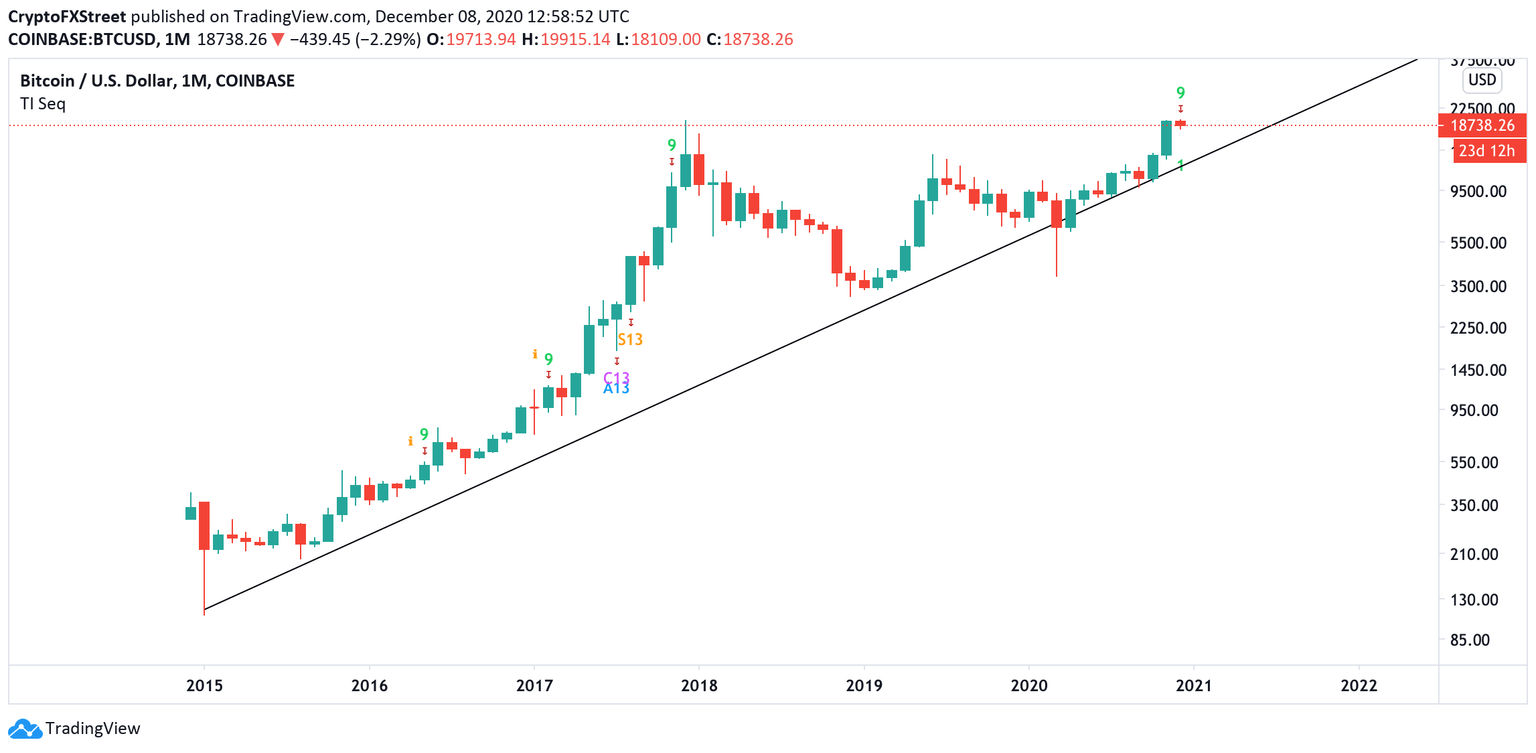

Technically speaking, the TD Sequential indicator has presented a sell signal, in the form of a green nine candlestick, on the monthly chart. If the bearish formation is confirmed, we may see a sell-off for one to four red candlesticks with the critical support created by a significant upside-looking trendline at $13,600. Note that the previous sell signal appeared right before the major collapse that resulted in the crypto winter.

BTC monthly chart

Mt. Gox rehabilitation plan may serve as a critical bearish trigger that will set the ball rolling. However, if the deadline is delayed for another month or two, a relief rally may push the price towards the recent ATH and allow BTC to test the psychological $20,000. Additionally, new institutional players like MicroStrategy might enter the market soon, increasing their cryptocurrency exposure.

Author

Tanya Abrosimova

Independent Analyst