MicroStrategy purchased 9,000 Bitcoin in Q3, plans to acquire more BTC revealed

- MicroStrategy bought nearly 9,000 Bitcoin for its stash in Q3.

- The firm now holds $7 billion worth of the leading cryptocurrency.

- The business intelligence company is prepared to purchase even more BTC in the future.

Nasdaq-listed firm MicroStrategy has added nearly 9,000 Bitcoins to its holdings in the third quarter of 2021, taking its total holdings of the leading cryptocurrency to $7 billion.

MicroStrategy Bitcoin stash exceeds $7 billion

The business intelligence company revealed its purchase of 8,957 BTC in its third-quarter report on October 28. Since the same period last year, MicroStrategy has increased its Bitcoin holdings by nearly 200%.

The firm continues to categorize Bitcoin as an “intangible asset,” and the company is required to report an impairment loss when the BTC value falls below its cost basis.

MicroStrategy revealed a carrying value of $2.406 billion for Bitcoin holdings with an impairment loss of $754.7 million since its acquisition. However, this is only considered as a paper loss.

Michael Saylor, the CEO of MicroStrategy, reiterated that he continues to hodl Bitcoin and said, “You do not sell your Bitcoin.”

The Nasdaq-listed firm’s Bitcoin holdings have exceeded $7 billion, as the company’s stash is now at 114,042. The firm stated that it purchased the flagship cryptocurrency by raising capital through its at-the-market equity offering.

MicroStrategy further stated that it would continue to evaluate opportunities to raise even more capital to execute its Bitcoin strategy. Saylor added that the firm is open to partnerships that will allow the firm to purchase more BTC.

Bitcoin price attempts to break above resistance

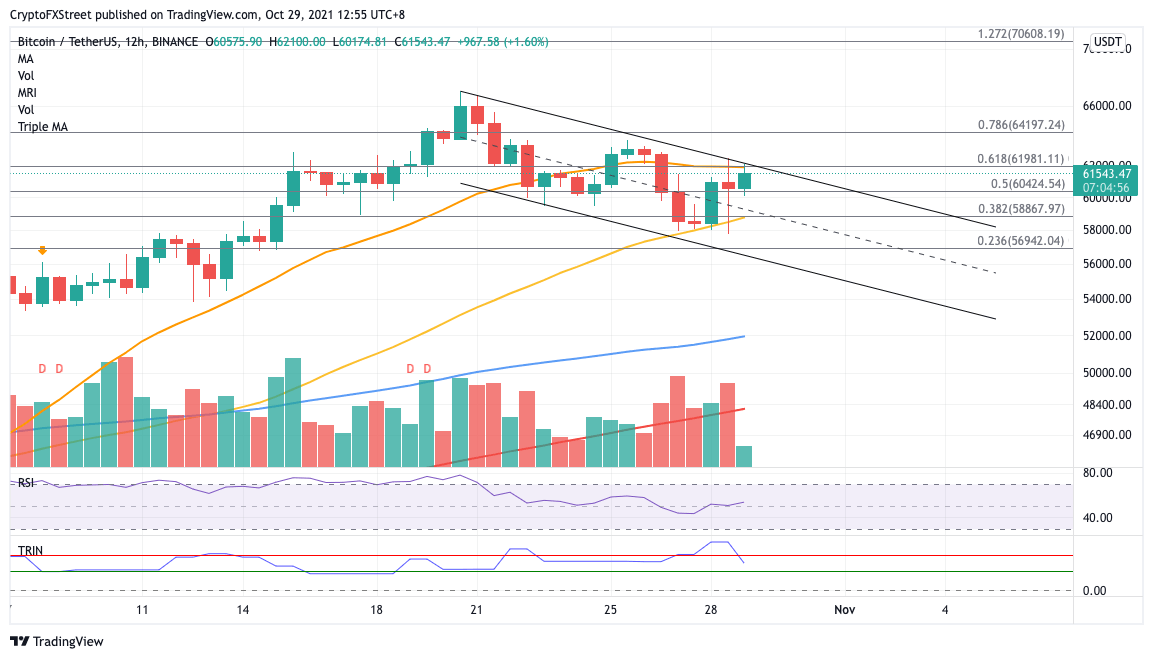

Bitcoin price is nearing the upper boundary of the prevailing descending parallel channel on the 12-hour chart. Slicing above the governing resistance trend line could be a win for the bulls.

Bitcoin price must break above $62,250, the topside trend line of the governing technical pattern to target bigger aspirations. The first resistance for BTC is at the 61.8% Fibonacci retracement level, coinciding with the 21 twelve-hour Simple Moving Average (SMA) at $61,981.

An additional obstacle will emerge at the aforementioned upper boundary of the channel at $62,250, then at the 78.6% Fibonacci retracement level at $64,197.

BTC/USDT 12-hour chart

However, if selling pressure increases, Bitcoin price would discover immediate support at the 50% Fibonacci retracement level at $60,424, then at the 38.2% Fibonacci retracement level at $58,867, corresponding to the 50 twelve-hour SMA.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.