Memecoins will continue to lose market share to AI agent coins: Dragonfly VC

AI agent tokens will continue outperforming memecoins in 2025, but their momentum may fizzle out by 2026, according to a venture capitalist.

“Memecoins will continue to lose market share to ‘AI agent’ coins. I consider this a migration from financial nihilism to financial over-optimism,” Dragonfly Capital managing partner Haseeb Qureshi said in a Jan. 1 X post.

“It will die off eventually,” says VC

Qureshi said the “AI agent craze” will probably persist through 2025, but it won’t last forever. As more advanced AI products come along, people will lose interest in social media chatbots.

“It will die off eventually. This is not the long-term disruption to watch out for from AI, but it will be CT’s fixation because it is the most social,” he said.

AI agent chatbots have become popular in the crypto industry, offering crypto users insights and market price predictions.

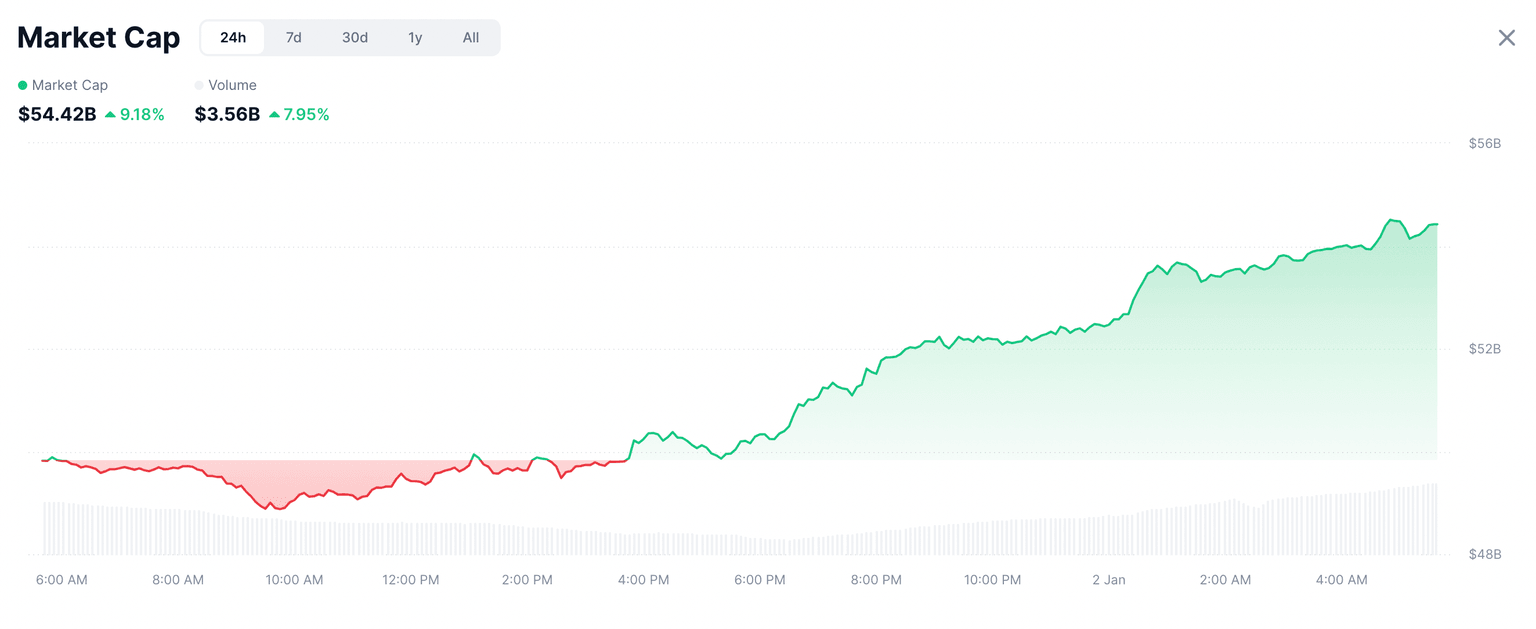

Over the past 24 hours, total memecoin trading volume dropped almost 21.5%, while trading volume among the top AI and data tokens rose by 7.95%, according to CoinMarketCap.

The total market cap for top AI and data crypto tokens is $54.4 billion. Source: CoinMarketCap

While the total market cap for top AI and data tokens dipped 1.66% over the past 30 days, the total memecoin market cap saw a 17.7% decline over the same period.

However, Qureshi cautioned that AI tokens and agents are still vulnerable to bad actors:

Current agents can easily be manipulated into saying crazy things that damage their brands, or can be jailbroken to steal all of their resources.

Qureshi said the AI agent chatbot “Aixbt” is “already pretty good at aggregating data about different projects.”

Still, with many more likely to emerge, its long-term relevance remains uncertain.

“By next year and the next generation of agents, maybe Aixbt will hallucinate a little less, go a little deeper, have a little smarter takes. But how much will you even notice? It’ll probably feel the same to most people,” Qureshi said.

In 2026, there will be a ‘sudden reversal’

Qureshi forecasts that by 2026, there will be a “sudden reversal.”

“Crypto takes a while to get bored of the shiny thing,” he said.

“The chatbots will become so ubiquitous that people will get turned off by them. Sentiment will reverse,” he said.

In the past week, the top AI performers among the top 100 cryptocurrencies were Virtuals Protocol (Virtuals), up 57.3%; Bittensor (TAO $517.25), gaining 10.6%; and Theta Network (THETA $2.37), rising 6.11%.

Crypto trader Mckenna told their 94,700 X followers in a Jan. 1 post that they were “confident we will see a whole new array of AI liquid opportunities that emerge in 2025.”

“Pay attention, and you will get paid,” Mckenna said.

Bitwise CEO Hunter Horsley recently said the rise of AI agents is reminiscent of the beginning of the corporation era two centuries ago.

“I think it perfectly parallels the 19th-century advent of the corporation: able to enter contracts itself, hire humans, own things, and outlive people,” Horsley said.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.