Meme Coins Price Prediction: Dogecoin, Shiba Inu, Pepe decline as whales stay wary

- Dogecoin’s pullback gains traction as large wallet investors offload.

- Shiba Inu retracts below $0.00001000 psychological level, with bears eyeing the $0.00000911 support level.

- Pepe risks further losses as retail interest and whale holdings decline.

The blue chip meme coins, such as Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE), fail to extend the recovery run from Monday as the broader cryptocurrency market takes a hit. The declining futures Open Interest, large wallet investors' holdings, and bullish momentum point to an extended correction in DOGE, SHIB, and PEPE.

Dogecoin, Shiba Inu, and Pepe holders lose confidence

Large wallet investors, commonly referred to as whales, are known to set the trend in cryptocurrencies based on their inflows and outflows. The top meme coins, DOGE, SHIB, and PEPE, are at risk of extended corrections as cohorts with ample supply are losing confidence.

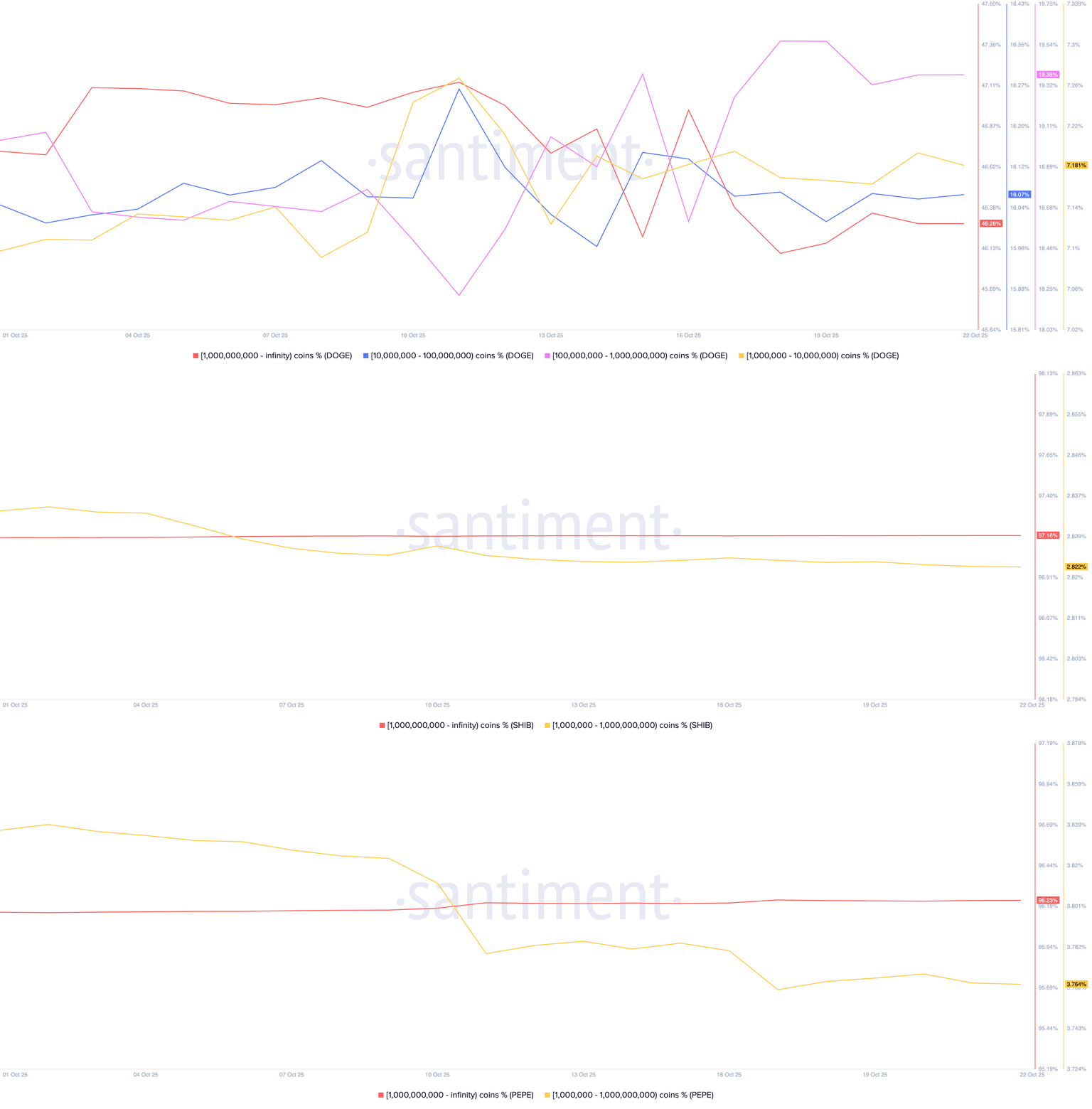

Santiment data shows that the DOGE investors with over 1 billion tokens have offloaded their holdings to 46.28% of the available supply from 46.75% on October 1.

At the same time, Shiba Inu investors with 1 million to 1 billion SHIB have reduced their holdings to 2.822% from 2.83%, while cohorts with over 1 billion SHIB remain muted with 97.16% of the supply.

On the other hand, Pepe investors with 1 million to 1 billion PEPE reduce their exposure to 3.764% from 3.84%. Meanwhile, investors with over 1 billion PEPE now control 96.23% of PEPE supply, up from 96.15% on October 1.

Meme coins supply distribution. Source: Santiment.

Overall, a risk-off sentiment is evident among meme coin whales as the broader market becomes more volatile.

Risky market pushes down meme coins' retail interest

Typically, a rise in market volatility leads to a selling spree in meme coins as they largely move on community sentiment, making them prone to speculation. A decline in retail interest could signal further correction for the meme coins.

CoinGlass data shows that the DOGE, SHIB, and PEPE futures Open Interest (OI) is down by 2%, 5% and 6%, reaching $1.85 billion, $76.02 million, and $209.67 million, respectively. The notional value of all outstanding futures contracts is considered as OI, and a decline suggests a reduction in risk exposure either by deleveraging or closing positions.

Meme coins derivatives data. Source: CoinGlass

Technical outlook: Dogecoin, Shiba Inu, and Pepe risk further losses

Dogecoin fails to hold above the $0.2000 psychological support, resulting in a new lower high on the 4-hour chart, which forms a declining trendline connected with Thursday’s high. At the time of writing, DOGE edges lower by nearly 1% on Wednesday, extending the 2.87% loss from the previous day.

The ongoing correction approaches the $0.1781 support level marked by the October 12 low.

The technical indicators on the 4-hour chart suggest a bearish shift in trend momentum as the Moving Average Convergence Divergence (MACD) crosses below its signal line, which confirms a drop in bullish momentum.

Additionally, the Relative Strength Index (RSI) at 45 on the same chart indicates that selling pressure is gradually increasing, with space for further correction before reaching the overbought zone.

DOGE/USDT 4-hour price chart.

A potential bounce back in DOGE should surpass Tuesday’s high at $0.2056 to confirm the trendline breakout, which could target the R1 Pivot Point level at $0.2172.

Shiba Inu trades below the $0.00001000 psychological mark at press time on Wednesday, risking a downcycle within a falling channel formed on the 4-hour chart. The immediate support for SHIB lies at the S1 Pivot Point at $0.00000911, slightly above the falling channel’s base trendline.

The momentum indicators on the 4-hour chart signal a downside risk as the MACD converges with the signal line, indicating a decline in buying pressure. Furthermore, the RSI at 45 is moving below the midpoint line, indicating a decline to a neutral level.

SHIB/USDT 4-hour price chart.

To reinforce an uptrend, SHIB should close above the 100-period Exponential Moving Average (EMA) at $0.00001073 to confirm the channel breakout. The overhead resistances for SHIB are the R1 and R2 Pivot Points at $0.00001116 and $0.00001225, respectively.

On the other hand, PEPE ticked lower by 3% on Tuesday after three consecutive days of recovery, reigniting a correction phase. At the time of writing, PEPE trades below $0.00000700 level on Wednesday, eyeing the S1 Pivot Point level at $0.00000619.

Similar to other blue-chip meme coins, the momentum indicators flash a decline in buying pressure with a bearish crossover in MACD and signal line, and RSI at 43.

PEPE/USDT 4-hour price chart.

On the upside, if PEPE exceeds Tuesday’s high at $0.00000738, it could extend the uptrend to the R1 Pivot Point at $0.00000788.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.