MATIC price fails to breach $0.7, leaving over 100k investors stuck in losses

- MATIC price did rise to $0.71 during the intra-day trading hours, but broader market cues resulted in a pullback.

- This bullish momentum failing might result in a slowdown in the gradually receding network-wide losses.

- More than 100k investors with 1.3 billion MATIC in losing positions are still waiting for a recovery.

MATIC price has had a rather disappointing day, with the mixed signals from the broader market impacting the altcoin significantly. This most certainly did not sit well with the investors as they were expecting a much larger recovery on the back of Bitcoin breaching a critical barrier.

MATIC price whipsaws

MATIC price failed to hold on to a 6.5% rally due to the broader market cues beating down on the digital asset. Most of the crypto market enjoyed green candlesticks over the past two days owing to the Bitcoin price crossing the $30,000 mark. The same bullishness was expected by Polygon investors, but they would be disappointed as no such gains materialized for them.

The layer-2 token whipsawed and failed to close above the $0.70 mark, trading at $0.66 at the time of writing. The altcoin had only recovered by a little over 13% over the week, and the slowdown in its rise, naturally, will have affected MATIC-holders' profits.

MATIC/USD 1-day chart

Since mid-June, ‘network-wide realized losses’, an on-chain metric, were on a decline giving room for eventual profits. In the past 24 hours, less than a million MATIC tokens faced losses and had the token achieved today’s 6.5% recovery, these losses would have flipped into profits.

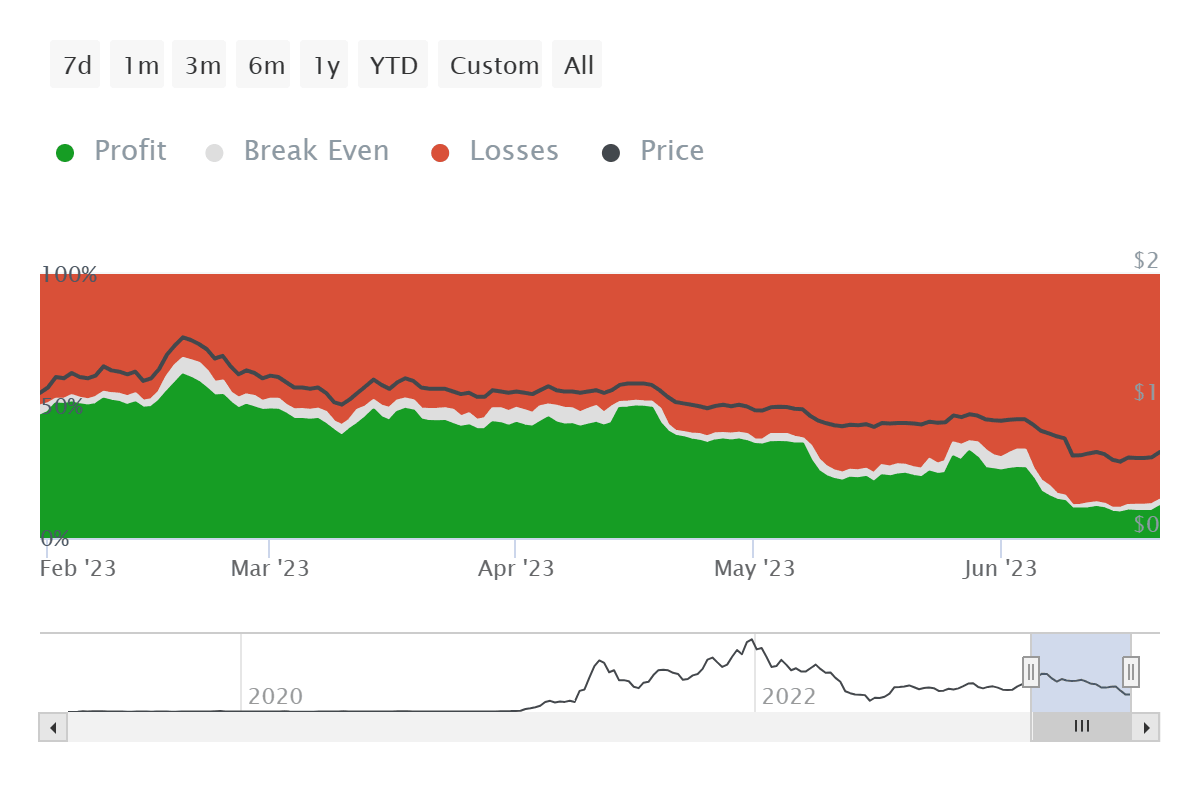

MATIC network-wide losses

However, the failure to do so has left nearly 100k addresses in anguish since these investors became the victim of the early June crash. Collectively they hold about 1.3 billion MATIC tokens worth $858 million, and their losses increase the concentration of investors that are currently underwater.

Even if MATIC price is not successful in leading the recovery, Polygon is successful in leading the list of most loss-bearing token holders as their concentration has risen to 87%, amounting to nearly half a million addresses.

MATIC investors in loss

If MATIC price does not begin recovering from its recent crash soon, a sell-off can be expected from these addresses. On the other hand, even if the altcoin does recover, MATIC holders could still opt to sell to break even and minimize the potential of future losses.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B21.02.39%2C%252022%2520Jun%2C%25202023%5D-638230514351719794.png&w=1536&q=95)