MATIC price breaching this key level could trigger a 50% rally and turn 1.15 billion MATIC profitable

- MATIC price is facing a supply wall at $1.24, where nearly 30,000 investors bought $1.34 billion worth of MATIC.

- Polygon whales have been active over the last month accumulating significantly, supporting the probability of recovery.

- On the other hand, network adoption has declined to suggest Polygon is losing traction among users.

MATIC price currently resides among the few altcoins that have failed to mark any growth over the last two months. The altcoin, in particular, has been facing a barrier for the last month and a half, clearing which is crucial to initiate a bounce back to a price point last tagged by the cryptocurrency in February 2022.

MATIC price needs to clear this

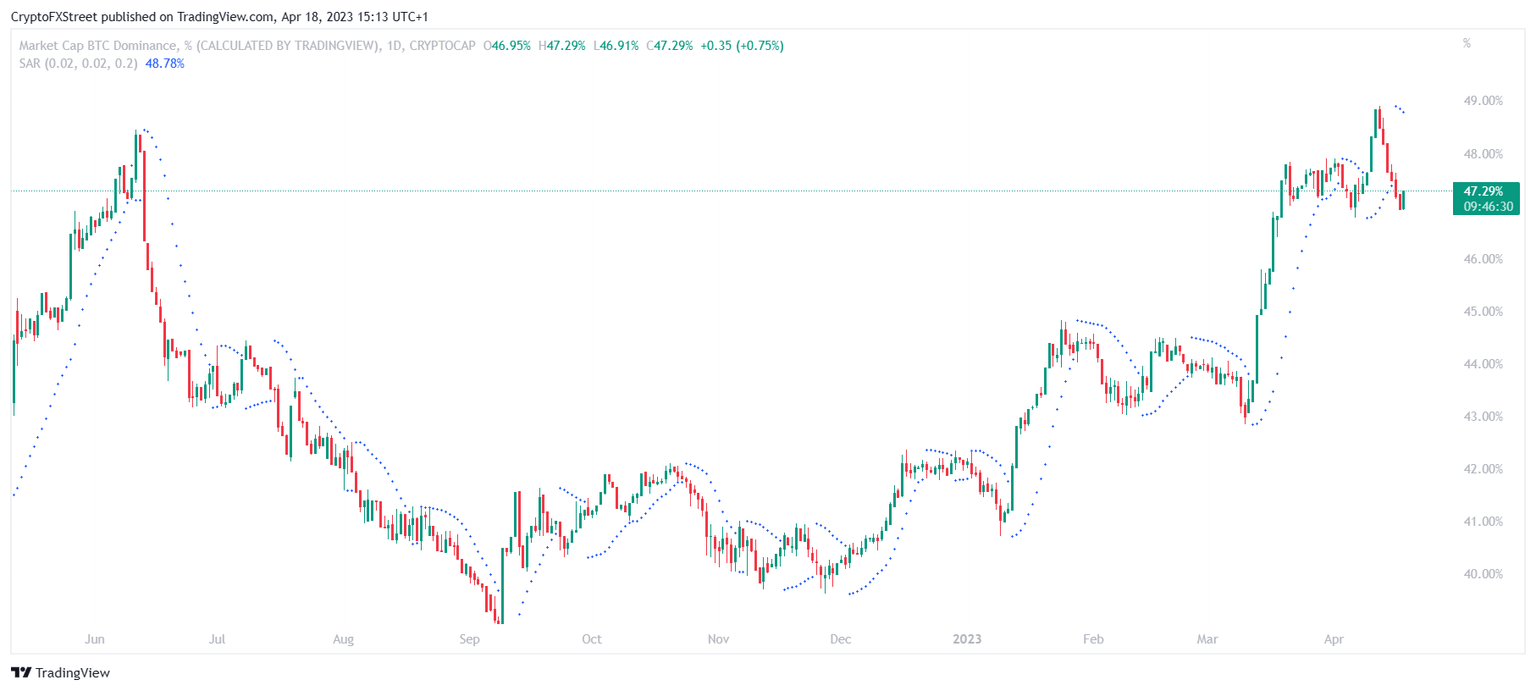

MATIC price, trading at $1.17, has been looking for a bullish signal since the beginning of March. A key reason behind the lack of growth is the uncertainty surrounding the long-awaited alt season as Bitcoin’s dominance continues to signal otherwise. However, over the last week, BTC dominance has dropped to 47.32%, which is reigniting hopes for the alt season.

Bitcoin dominance

When this season arrives is up for speculation, but the optimism could be a driving factor in MATIC price’s recovery. According to analysts, an explosion in the altcoin would be possible if only the altcoin could maintain a sustained rally above the $1.24 mark. This particular price point is the average cost at which nearly 30,000 addresses bought about 1.14 billion MATIC tokens worth $1.34 billion.

MATIC GIOM

Thus, breaching $1.24 would not only turn these tokens profitable after a month, but a daily candlestick close above it could also trigger a 53% rally to $1.80. On the way, MATIC would encounter two other supply walls at $1.42 and $1.64, which collectively would unlock 265 million MATIC worth $310 million.

Although to achieve this, the token would need to see some demand at the hands of the investors and whales. The latter, at the moment, is showing signs of bullishness as the cohorts holding 100,000 to 1 million MATIC have noted a 7.4% increase in supply.

Similarly, larger wallet addresses holding anywhere between 1 million to 10 million MATIC have been accumulating as well. Their supply has shot up by 35% from 128 million to 173 million MATIC.

MATIC whale accumulation

The altcoin might still face some resistance at the hands of the investors as the project is not seeing much traction in the market presently. The Network Growth, which indicates the rate of adoption, i.e., the formation of new addresses on the chain, has dropped by 37% from 130,000 to 81,000.

MATIC network growth

While this is not an explicitly bearish sign, it does highlight some skepticism at the hands of investors.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B19.29.59%2C%252018%2520Apr%2C%25202023%5D-638174247435147060.png&w=1536&q=95)

%2520%5B19.41.57%2C%252018%2520Apr%2C%25202023%5D-638174247610126963.png&w=1536&q=95)