Market Wrap: Bitcoin underperforms ether; crypto tax ahead?

Bitcoin dipped below $40K as traders digest proposed crypto taxes.

Cryptocurrencies were mostly higher on Monday as bullish sentiment continues into August. Bitcoin underperformed other major cryptocurrencies and is down about 3% over the past 24 hours compared to a 2% rise in ether over the same period.

Buyers remain active despite ongoing regulatory crackdowns in China. On Sunday, the People’s Bank of China (PBoC) said it will keep applying high regulatory pressure on crypto trading, mostly due to concerns about financial risk.

Traders are also digesting the 58-page “Digital Asset Market Structure and Investor Protection Act, proposed by Rep. Don Beyer’s (D-Va.), seeking to create an exhaustive regulatory regime for digital assets. The U.S. Senate is also advancing a $1 trillion infrastructure bill with a crypto tax provision, which could be a source of market anxiety.

For now, a breakdown on intraday charts “suggests that bitcoin may fall back to the mid-range at around $36,000, or lower, before the rally continues,” wrote Marcus Sotiriou, trader at the U.K.-based digital asset broker GlobalBlock, in an email to CoinDesk

Latest prices

Cryptocurrencies:

- Bitcoin (BTC) $39,164.5, -5.06%

- Ether (ETH) $2,604.8, -2.05%

Traditional markets:

- S&P 500: 4387.15, -0.18%

- Gold: $1812.9, +1.44%

- 10-year Treasury yield closed 1.173%, compared with 1.236% on Friday.

Meme stock rotation

Over the past month, popular “meme stocks” have sold off as bitcoin rallied. This inverse relationship was noted in The Daily Shot newsletter a few months ago, and indicates a pattern of buying and selling across high yielding traditional and crypto markets.

It is possible that traders will flock to meme stocks if bitcoin pulls back from overbought levels.

Chart shows the divergence between meme stocks and bitcoin performance in July.

Source: The Daily Shot

Bitcoin call buying

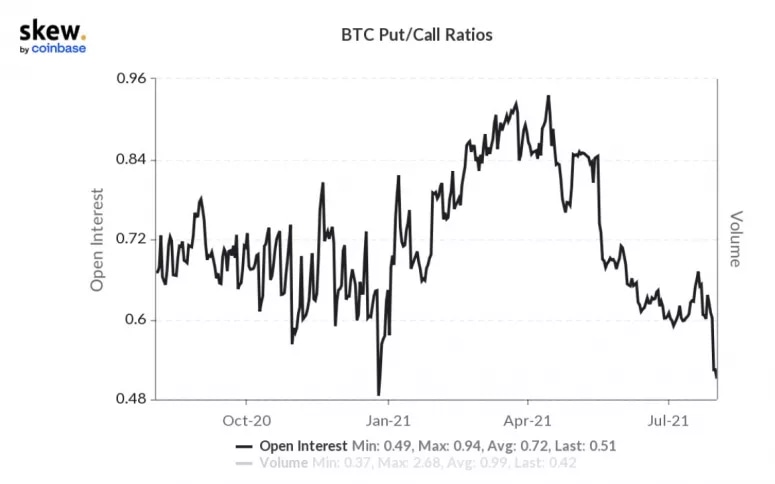

The bitcoin options market has been heavily skewed towards call buying over the past month, which could signal the return of bullish sentiment.

“Now that the large spot price sell-off already occurred in May, there aren’t as many gains to be protected via put buying,” wrote Gregoire Magadini, co-founder and CEO of Genesis Volatility, in a Telegram chat.

“Combine the lower spot prices with lingering high-ish implied volatility, and bitcoin puts start to look very unattractive,” Magadini wrote. “It makes more sense to buy the dip with call structures than to position oneself using puts.”

The chart below shows the bitcoin put/call ratio at the lowest level since January, which preceded a brief 25% pullback in the bitcoin spot price.

Chart shows bitcoin options put/call ratio.

Source: Skew

Crypto fund outflows continue

Digital-asset investment products had their fourth straight week of net outflows, even as cryptocurrency markets staged their biggest rally since early this year.

Net outflows across all digital-asset funds totaled $19.5 million, according to a report Monday by CoinShares.

Bitcoin-focused funds had outflows totaling $19.7 million, partly offset by net inflows to funds focused on other categories, including multi-asset funds, wrote CoinDesk’s Lyllah Ledesma.

Chart shows weekly digital asset fund flows.

Source: CoinShares

July crypto comeback

Cryptocurrencies rebounded in July after a sluggish May and June. AAVE, an open-source and non-custodial protocol that runs on the Ethereum blockchain, outperformed major crypto currencies with a 33% gain in July. Bitcoin was not far behind with a 20% gain compared to a 12% gain in ether.

Chart shows July returns for the CoinDesk 20.

Source: CoinDesk Research

Ether developments

Ether looks to extend its record daily winning streak in the run-up to a planned upgrade on Ethereum’s blockchain that could significantly reduce the cryptocurrency’s supply growth.

Aside from bitcoin’s price recovery from $30,000, ether may have received a boost from Ethereum’s upcoming 11th backward-incompatible upgrade, or hard fork, slated to happen on Aug. 4, CoinDesk’s Omkar Godbole reports.

The so-called London hard fork contains four Ethereum Improvement Proposals (EIP), of which EIP-1559 will activate a mechanism that would burn a portion of fees paid to miners. Once it takes effect, increased network usage will result in a higher amount of ETH being burned, thereby curbing the cryptocurrency’s supply growth over time.

Meanwhile, 27 of 40, or 68%, of crypto experts surveyed by Finder believe that ether will one day overtake bitcoin as the largest cryptocurrency by market cap; 58% of the panelists believe that the “flippening” could happen within the next five years.

The price of ether is expected to reach $4,596 per ETH by the end of this year, according to the average forecast from 27 experts on Finder’s panel who gave their price predictions.

Other markets

Most digital assets on CoinDesk 20 ended lower on Monday.

Notable winners of 21:00 UTC (4:00 p.m. ET):

tezos (XTZ) +3.1%

chainlink (LINK) +0.59%

Notable losers:

polkadot (DOT) -6.91%

the graph (GRT) -6.04%

stellar (XLM) -5.24%

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.