Maker price sets eyes at fresh 2023 highs as investors' absence results in 18% rally in a week

- Maker price recovered nearly all of its losses from the August crash following an 18% rally in the last four days.

- The altcoin is close to breaching the barrier at $1,336, which is the current year-to-date high.

- Interestingly, most of the increase took place at a time when investors' participation fell to a four-month low.

Maker price rise over the past few days has seemingly made its investors very happy as the altcoin emerged as one of the best-performing assets in the crypto market. Close to recovering its recent losses, it seems like the rally could send MKR to the new year-to-date highs, provided profit-taking stays at a minimum.

Maker price continues to go up

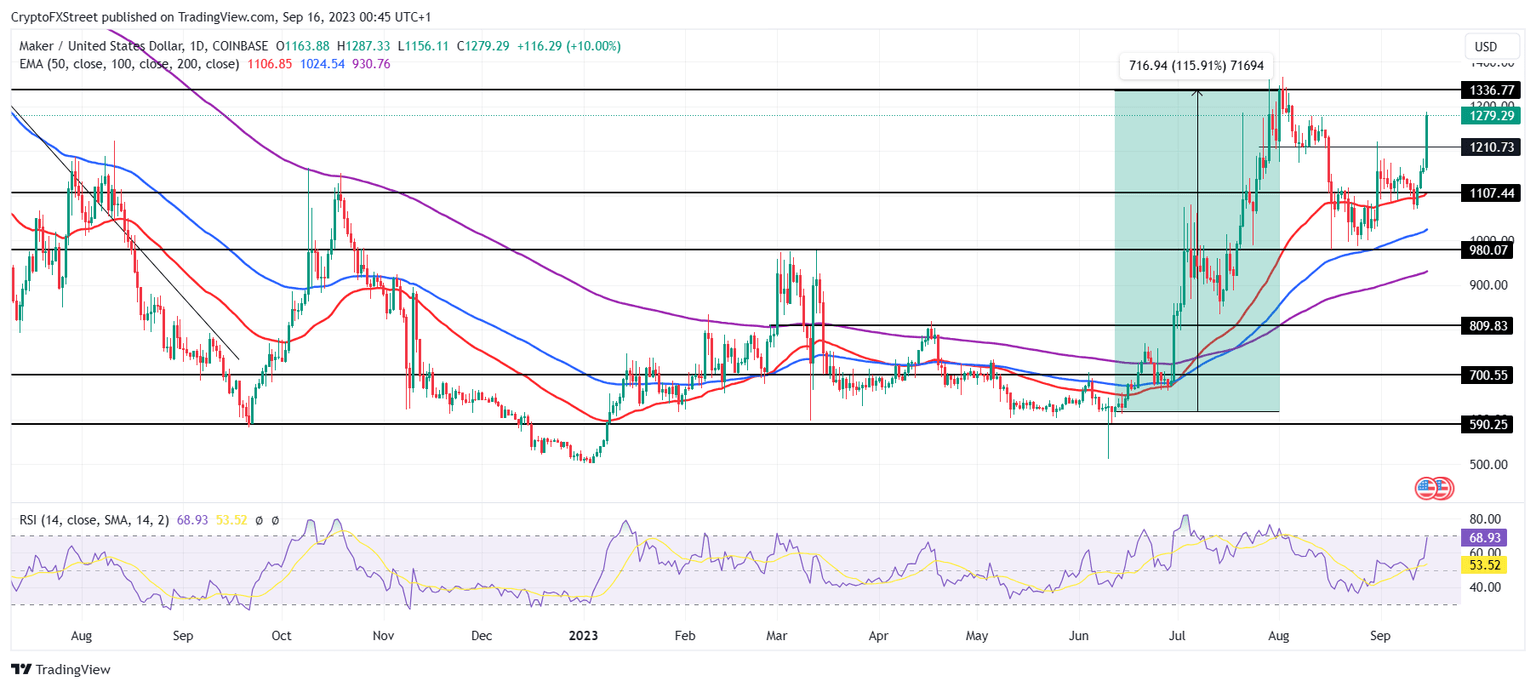

Maker price over the past four days has risen by more than 18.2% to trade at $1,279, rising from $1080. Most of this rise came in the last 24 hours as MKR shot up by about 10%, nearing the barrier at $1,336. This resistance level also marks the present 2023 high for the cryptocurrency, which was hit last month.

The altcoin would be able to mark fresh year-to-date highs if this level is breached, however, it is important to test it as a support floor as well. This would ensure that the rally achieved by MKR is sustained. However, looking at the Relative Strength Index (RSI), it seems like that may be a tad bit difficult for the cryptocurrency.

The indicator is currently on the verge of slipping into the overbought zone beyond the 70.0 mark. A breach into this area suggests that the market is overheated and would need to cool down. This cooldown is followed by corrections, which could be harmful to Maker price rise.

MKR/USD 1-day chart

However, if the breach of the resistance level at $1,336 fails, Maker price could decline to test the support levels at $1,210 and $1,107, which also coincides with the 50-day Exponential Moving Average (EMA). Losing the latter support level, though, could send MKR towards $1,000 and lower, invalidating the bullish thesis.

This could also happen if MKR holders choose to take profits following the recent rally.

Investors' absence - A boon for Maker

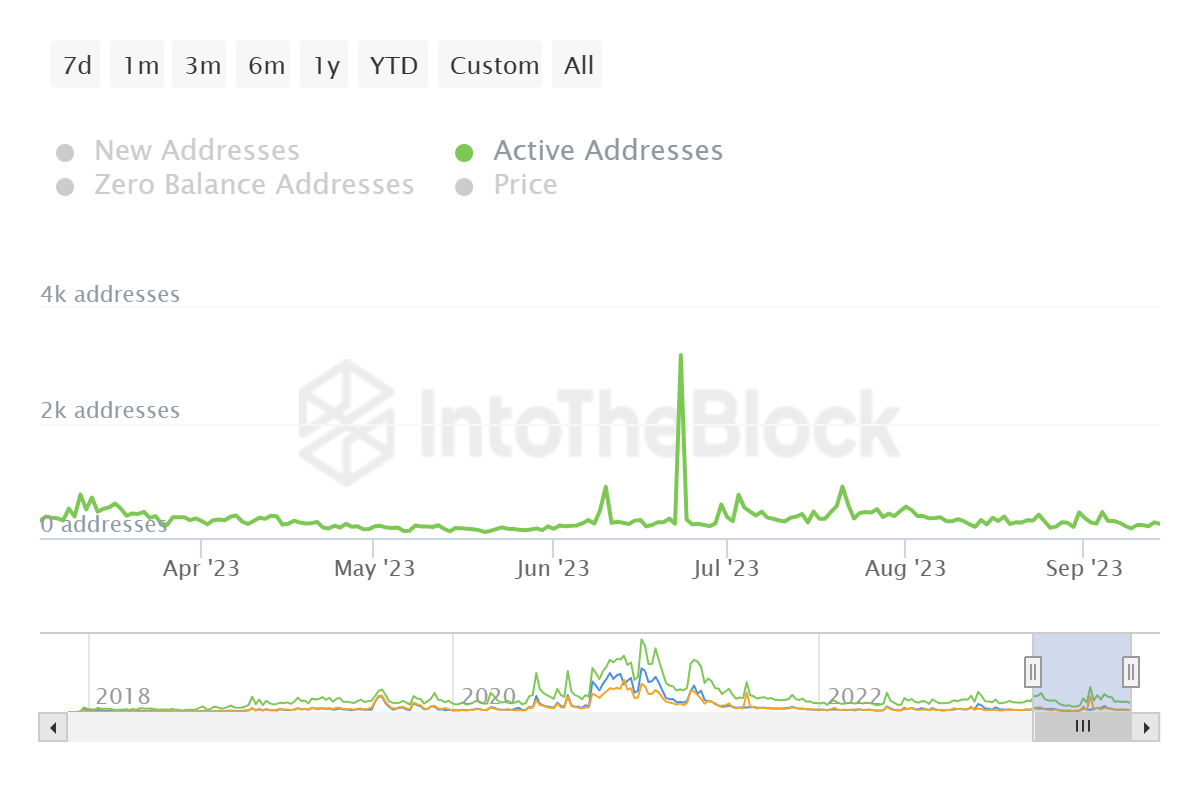

Over the past few days, as Maker price recorded a significant push in its market value, a key component to any cryptocurrency was seemingly missing - Active participation from investors. The active addresses conducting transactions on the network fell from 272 to 167 at its lowest, marking a four-month low.

Maker active addresses

However, this translated into an 18% rally for MKR, as selling was potentially at a minimum during this period. Going forward, a similar stance from MKR holders would prove to be highly beneficial to the altcoin.

If profit-taking remains low, the cryptocurrency would have room to secure the $1,336 resistance as support and chart a new 2023 high, in turn bringing larger profits to investors.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.