Luna Classic Price Prediction: Why selling LUNC here would be a grave mistake

- Luna Classic price has formed the classic inverse head-and-shoulders pattern, hinting at a 25% upswing to $0.000232.

- Investors need to note that this outlook is possible if LUNC can overcome the initial hurdle at $0.000186.

- Invalidation of the pattern will occur if the altcoin breaks below the $0.000156 support level.

Luna Classic price is in the last leg of completing a bottom reversal pattern. If the development comes to fruition, this setup could trigger an explosive move for LUNC holders.

Luna Classic price ready to make hay

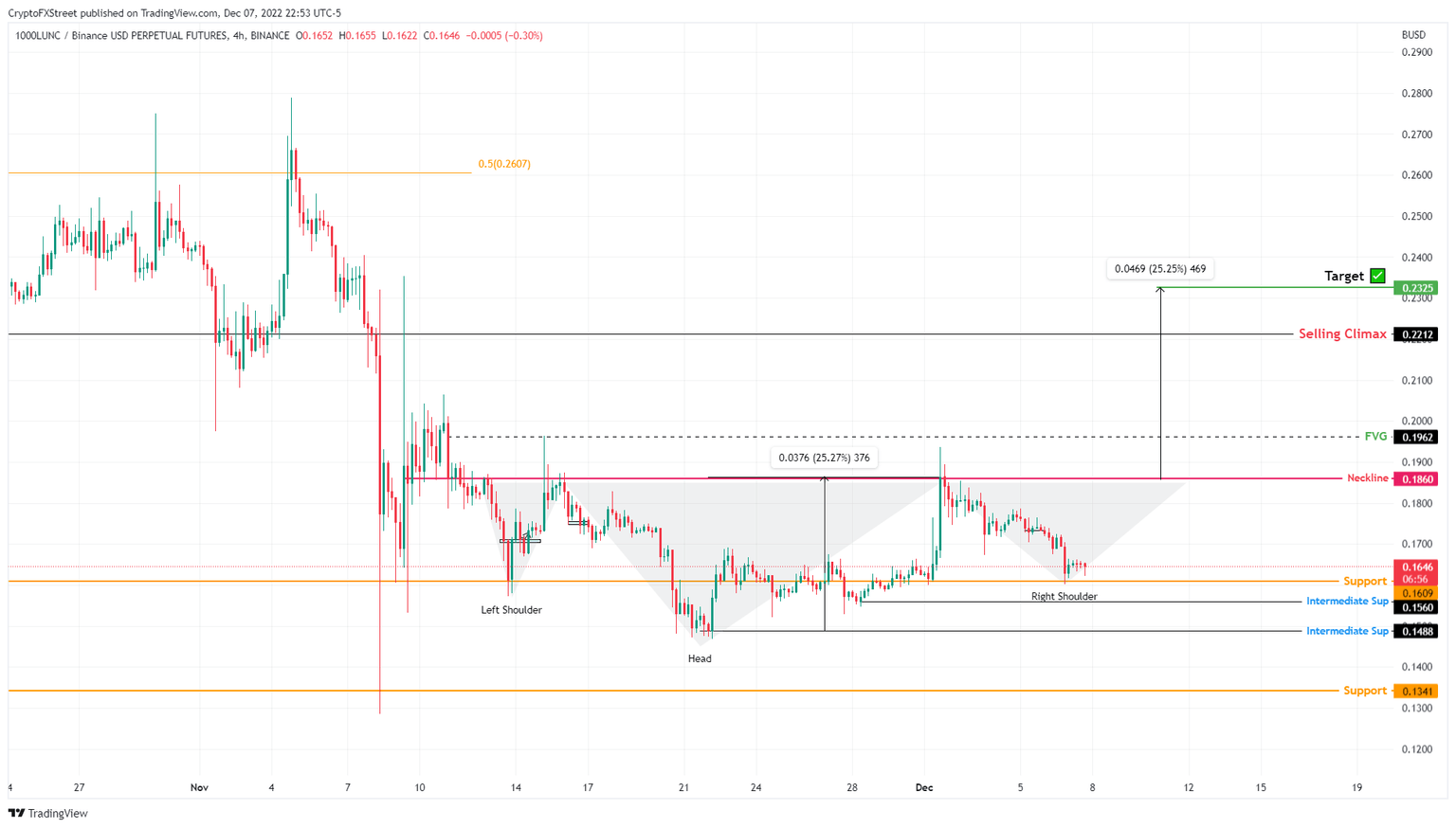

Luna Classic price has set up an inverse head-and-shoulders pattern on the four-hour chart, suggesting the possibility of a recovery rally. This technical formation contains two valleys of comparable depths on either side of a deeper valley. The one at the center is called the head, and the ones on either side are termed shoulders. Hence the namesake.

A horizontal resistance level connects the peaks of these valleys and is known as the neckline. If Luna Classic price can produce a four-hour candlestick close above this hurdle at $0.000186, it will confirm a breakout from the inverse head-and-shoulders.

This technical formation forecasts a 25% upswing to $0.000232 obtained by measuring the distance between the head’s lowest point and the peak to the right, and then adding it to the breakout point at $0.000186.

From the current position, this run-up, if successful, would yield early investors a 41% gain. However, the potential upswing is not as simple as it seems. The path is sprinkled with hurdles at $0.000192 and $0.000221. Overcoming these blockades is necessary for LUNC to reach its target at $0.000232.

LUNC/USDT 4-hour chart

Investors should note that the bullish outlook makes logical sense, but considering Bitcoin’s indecisiveness, a breakout might not happen. If Luna Classic price produces a four-hour candlestick close below $0.000156, it will invalidate the bullish thesis.

This development could see Luna Classic price slide to the immediate support level at $0.000148 or the subsequent variant at $0.000134.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.