Litecoin Price Forecast: LTC whales go into a buying spree, eying up $260

- Litecoin price remains contained inside an ascending parallel channel.

- LTC whales have purchased a lot of coins in the past three weeks.

- The digital asset defended a critical support level and aims for a rebound.

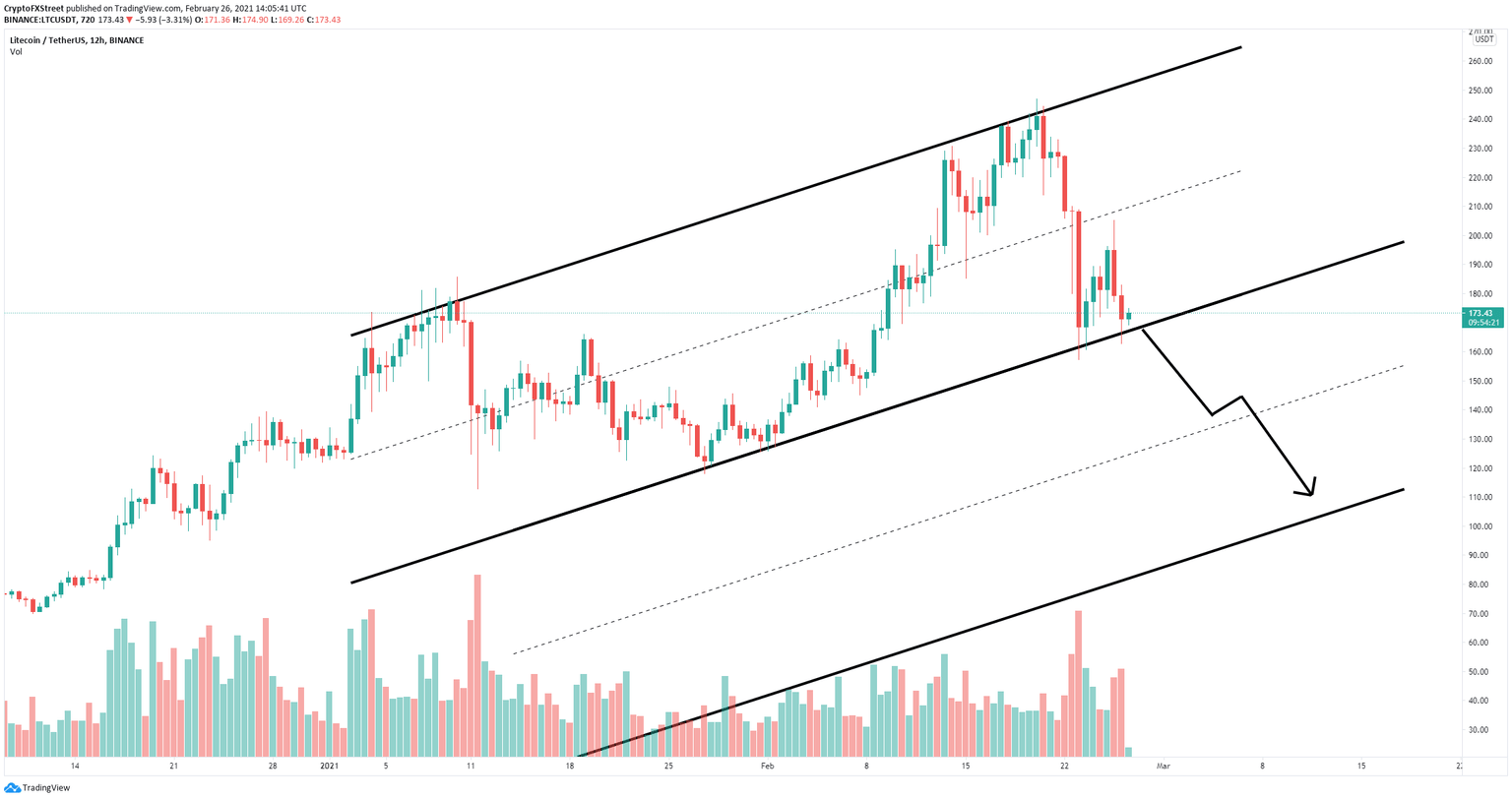

Litecoin price remains bounded inside an ascending parallel channel on the 12-hour chart after a significant sell-off from $247 down to $157. It seems that LTC whales have taken advantage of the recent dip to buy even more.

Litecoin price aims for a jump towards $260

On the 12-hour chart, Litecoin price has defended a critical support trendline which is part of the ascending parallel channel. LTC aims for a significant rebound towards $214 and eventually to the upper boundary of the pattern at $260.

LTC/USD 12-hour chart

If Litecoin can defend the key support level at $170, the odds of a rebound will increase. Additionally, the number of whales holding between 100,000 and 1,000,000 coins has increased by five in the past three weeks which indicates large holders want to accumulate even more LTC.

LTC Holders Distribution chart

On the other hand, the bears could still gain strength, especially if they can crack the key support level at $170. A breakdown below this critical point would be notable.

LTC/USD 12-hour chart

Litecoin price could easily fall towards $140 before a brief pause and eventually down to $110 in the long-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.03.49%2C%252026%2520Feb%2C%25202021%5D-637499452508488947.png&w=1536&q=95)