Litecoin price could see a small pump to $150 as indicator flashes buy signals

- Litecoin price fell by almost 22% in the past 48 hours after a widespread sell-off.

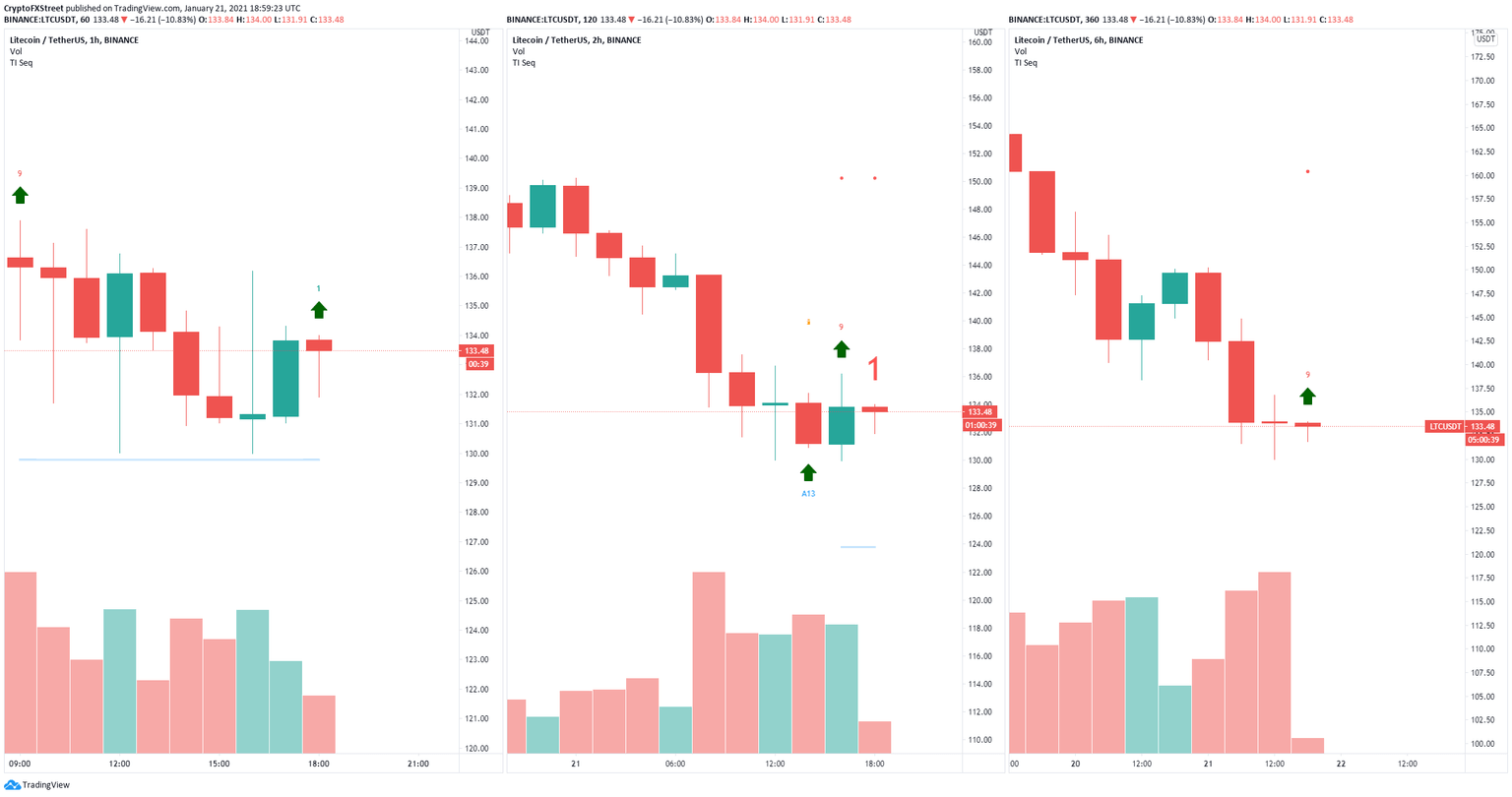

- LTC bulls are hopeful as the TD Sequential indicator has presented various buy signals.

Litecoin had a significant sell-off in the past 48 hours following Bitcoin’s bearish run towards $30,000. The entire cryptocurrency market lost more than $100 billion in the past 24 hours, but LTC could jump up again.

Litecoin price aims for $150 in the short-term

On the 1-hour, 2-hour and 6-hour charts, the TD Sequential has presented simultaneous buy signals which give a lot of credence to the bullish outlook. Considering the magnitude of the sell-off, bears didn’t have enough time to establish clear resistance levels on the way down.

LTC Buy Signals

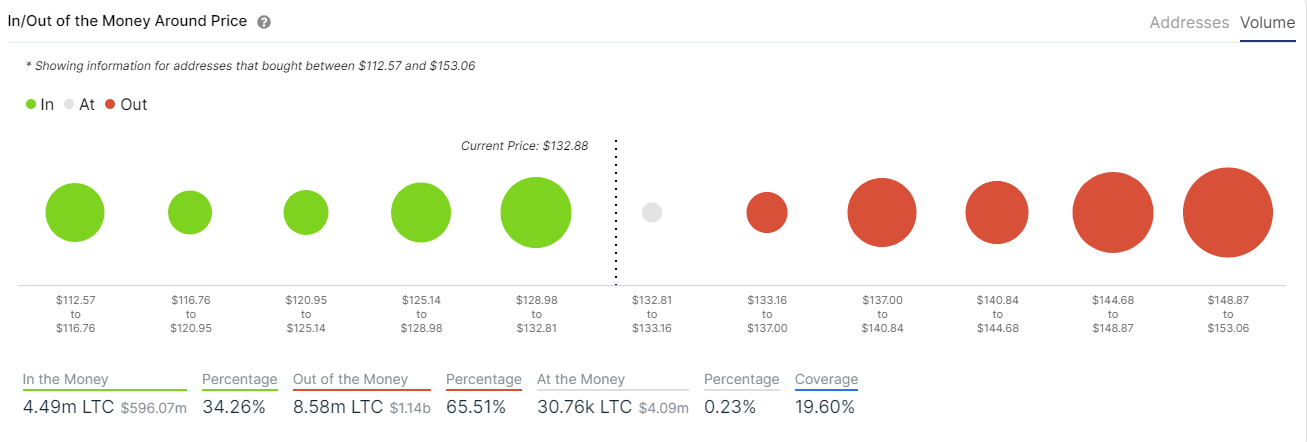

This means that Litecoin price could at least climb towards $150 as it seems to be the nearest interesting resistance point. The In/Out of the Money Around Price (IOMAP) chart seems to indicate the same as it shows the most important resistance area to be located between $148 and $153.

LTC IOMAP chart

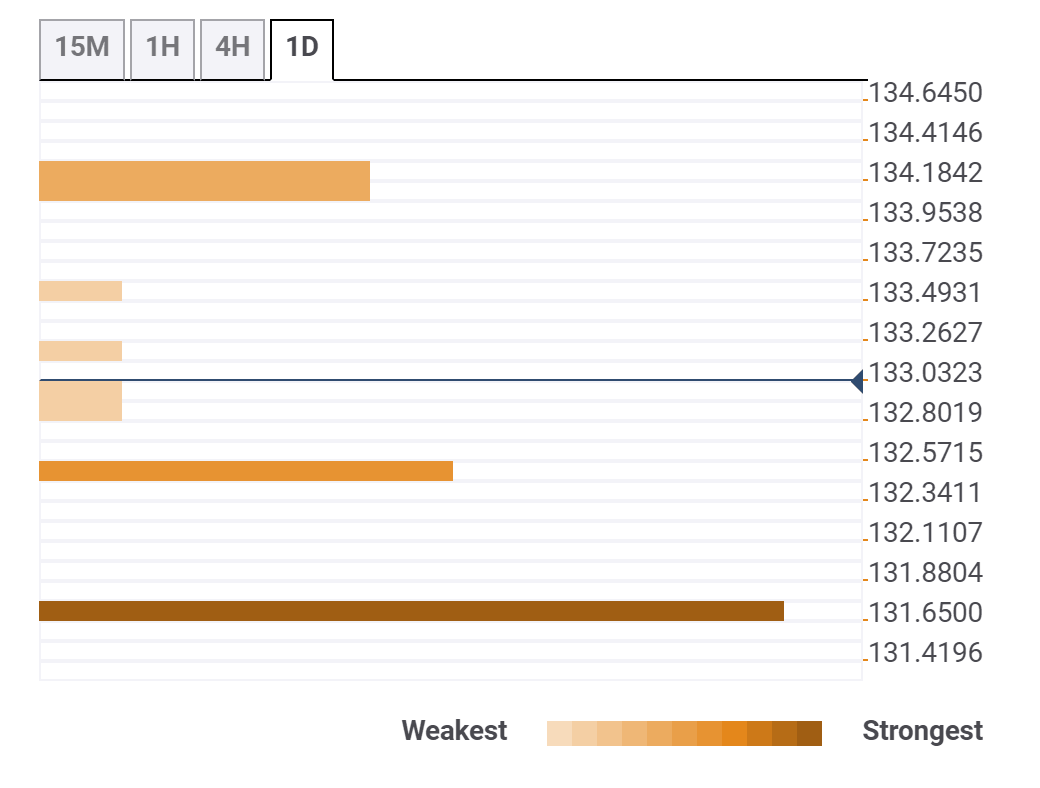

In the shorter time-frame, the Confluence detector shows a strong resistance level around $134 which coincides with the previous hourly high and the 10-SMA on the hourly chart. On the way down, there is a robust support level at $132 where the hourly 5-SMA and the previous 15-minutes low converge.

LTC Confluence levels

Additionally, there is an even stronger support level located at $131.6 which coincides with the 4-hour lower Bollinger Band.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.