Lido Price Forecast: LDO eyes further gains as BitGo enables native ETH staking via Lido

- BitGo announced Ethereum staking support via the Lido protocol on Thursday.

- Lido's total value locked (TVL) increased by over $9 billion so far in July, indicating a rise in DeFi activity.

- The technical outlook suggests a continuation of the rally as bullish momentum increases.

Lido DAO (LDO) edges higher by over 5% at press time on Friday, extending its five consecutive days in the green. LDO gains momentum following BitGo's announcement on Thursday of native Ethereum (ETH) staking via Lido for its institutional clients. The Total Value Locked (TVL) and technical data indicate increased interest in Lido, suggesting a potential extended rally.

BitGo announces native Ethereum staking via Lido

BitGo pioneers native Ethereum staking as the first US custodian with over 2,000 institutional clients across Europe and Asia, as announced on Thursday. Clients could stake ETH directly on the BitGo custody platform to mint the Ethereum liquid staking token, stETH, via Lido Protocol’s decentralized infrastructure.

With the new features, clients can deploy stETH in decentralized finance (DeFi) services or redeem stETH while easily monitoring their decisions on BitGo.

BitGo holds over $100 billion in digital assets and $48 billion in staked assets. On the other hand, over $25 billion of staked Ethereum, held in Lido accounts, accounts for more than 25% of all staked Ethereum, reflecting the rising institutional interest.

Kean Gilbert, Head of Institutional Relations, Lido Ecosystem Foundation, said,

“By enabling native ETH staking using Lido directly through regulated custody, BitGo unlocks the full institutional value of stETH’s deep liquidity, providing institutions with a regulated and capital-efficient pathway to manage their digital asset strategies.”

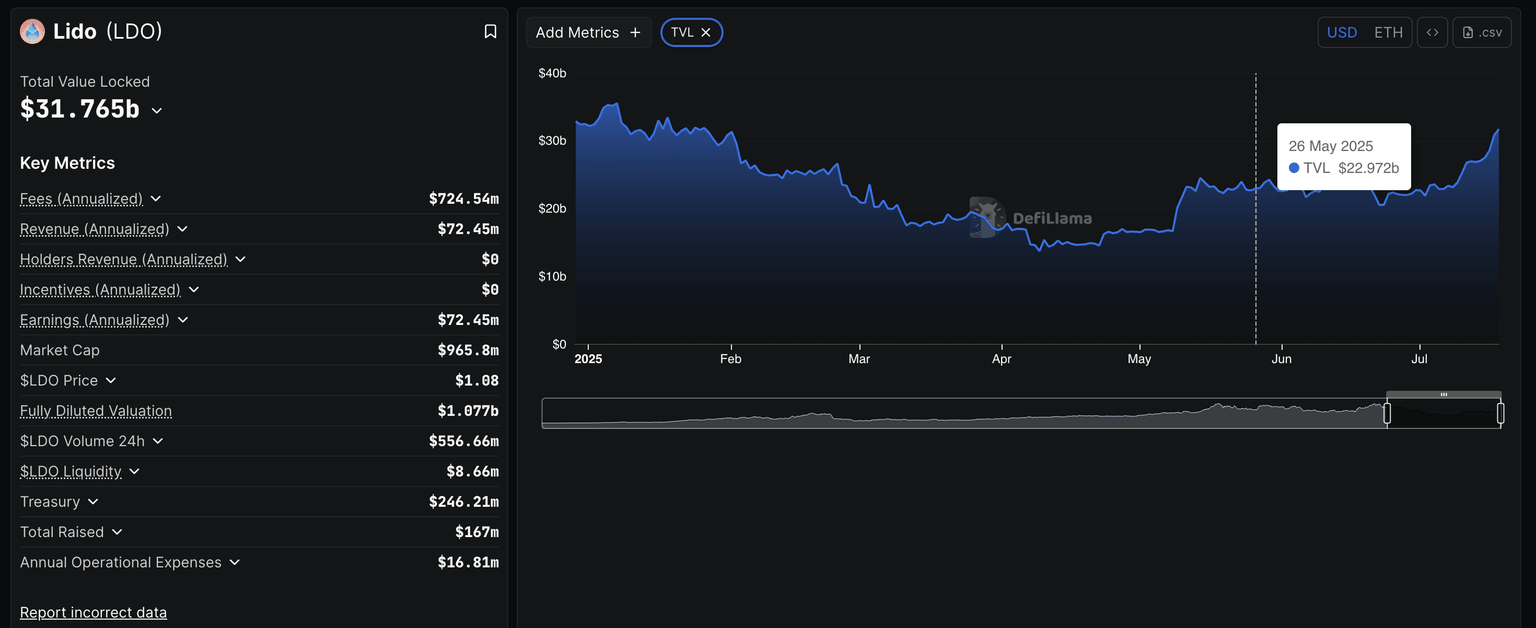

Lido adds over $9 billion in Total Value Locked

Total Value Locked (TVL) refers to the US Dollar value of assets locked or staked on a protocol. DeFiLlama data shows the Lido TVL at $31.76 billion, up from $22.97 billion on July 1, indicating increased interest in the protocol in the DeFi space.

Lido TVL. Source: Coinglass

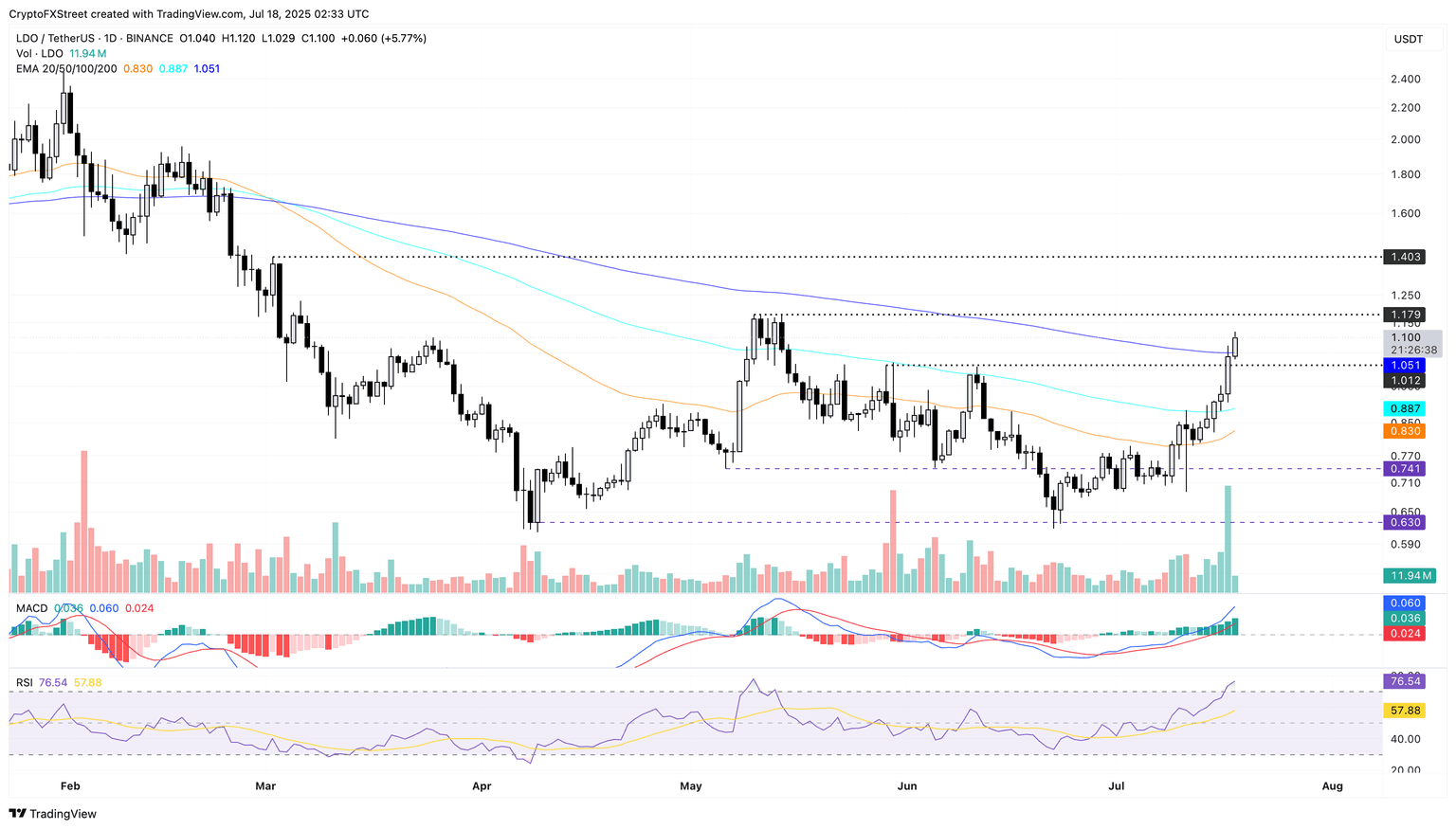

LDO eyes further gains as bulls surpass 200-day EMA

LDO appreciates over 5% on the day, extending the 12% gains from Thursday, during which bulls reclaimed the $1.000 psychological mark. The intraday gain crosses above the 200-day Exponential Moving Average (EMA) at $1.051.

The bullish run inches closer to the $1.179 resistance level marked by the high of May 10. A decisive push above this level could stretch the uptrend to the $1.403 level etched by the March 2 high.

The Moving Average Convergence/Divergence (MACD) indicator displays a significant surge in green histogram bars, accompanied by a rising trend in the MACD and its signal line, indicating increased bullish momentum.

The Relative Strength Index (RSI) reads 76 on the daily chart as it enters the overbought zone, indicating increased buying activity.

LDO/USDT daily price chart.

If LDO loses steam for a daily close below the 200-day EMA at $1.051, it could retest the $1.000 psychological mark, followed by the 100-day EMA at $0.887.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.