Japan set to ease 30% crypto tax whereas US FSOC demands congressional action on digital assets

- Japan Liberal Democratic Party approved an earlier proposal to initiate tax reform to promote the growth of crypto in the country.

- The United States Financial Stability Oversight Council suggested taking action against crypto, citing FTX collapse.

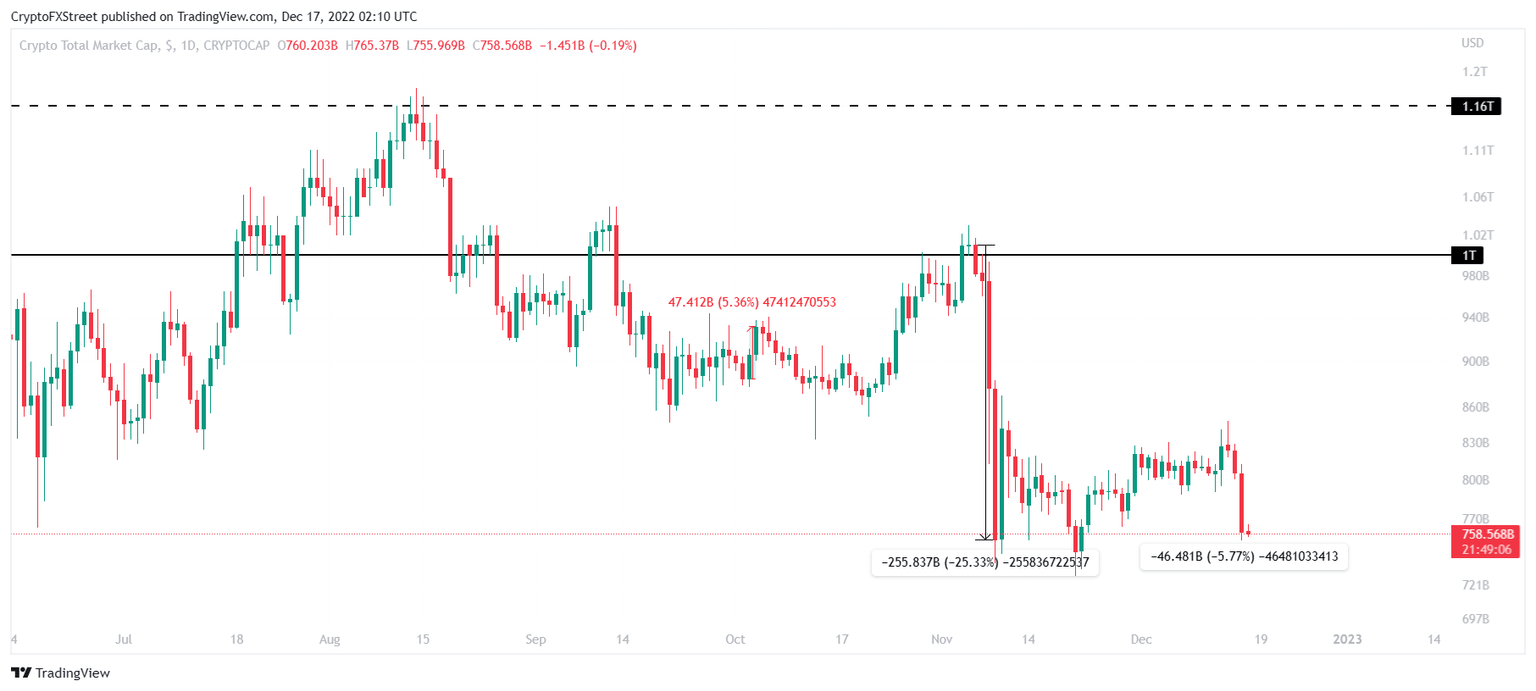

- The crypto market lost about $46.4 billion in the last 24 hours as digital assets’ value dipped by 5.7%.

On the one hand, Japan is doing its best to ensure crypto remains a vital part of the country’s economic growth. On the other hand, the United States is finding ways to ascertain maximum control over cryptocurrencies in the country. Both the suggestions have come at a time when the crypto market is still healing from FTX’s downfall, struggling to recover.

Japan eases tax rules

Japan’s Liberal Democratic Party’s (LDP) tax committee, in a meeting on December 15, deliberated on tax reforms. This included a discussion on the 30% crypto tax as well, which has been a hindrance to the country’s faster economic growth.

Consequently, the committee decided to move forward with an older proposal that aims at removing taxes on crypto companies’ gains from issuance or custody tokens. At the moment, these companies pay a 30% corporate tax on their holdings.

This has resulted in many companies leaving the country and relocating their business elsewhere.

Thus with the ease in taxes, Japan hopes to facilitate the growth of the tech as well as finance sectors.

United States demands regulation

The United States Financial Stability Oversight Council (FSOC) released its annual report on December 16. The Council suggested legislation granting federal financial regulators explicit rulemaking authority in its report.

This would be exercised on the spot market for crypto assets, barring tokens that had already been identified as securities.

Citing the collapse of FTX, the Securities and Exchange Commission Chai Gary Gensler, in regards to the report, stated,

“Risks from this speculative, volatile, and what I believe is a largely noncompliant market put investors at risk. This is why bringing intermediaries and issuers of crypto securities tokens into compliance is so important. While the risks from the crypto markets generally do not appear to date to have spread to the traditional financial sector, we must remain vigilant to guard against that possibility.”

According to the FSOC, while FTX’s downfall did impact the crypto market negatively, the broader US financial system remained unaffected.

Crypto market nosedives

While the bearish effect of FTX’s unbecoming remains visible in the crypto space, their visibility on crypto assets is evident as well. In the last 24 hours, the total crypto market capitalization has reduced by 46.48 billion.

Total Crypto market capitalization

Bitcoin and other bigger cryptocurrencies led the decline as digital assets combined lost 5.7% on December 16. This invalidated all recovery noted over the last one and a half months since FTX’s collapse of November 6, which wiped out over $255.8 billion from the market in three days.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.