IOTA recognized as a contributor to the EU’s CityxChange Project, IOT/USD faces bearish correction

- The European Commission had initiated the CityxChange program as part of the Horizon 2020 project.

- IOTA has been recognized as a critical project that made “CityxChange” a huge success.

- IOTA is using Tangle in areas like project management and development.

European Union “CityxChange” project has recognized IOTA (MIOTA) as one of the key platforms that have contributed to its massive success. For the uninitiated, in 2018, the European Commission had launched the EU’s CityxChange program as part of the Horizon 2020 project. The project aimed to fund research efforts in green energy and transport ecosystems.

IOTA has been recognized as key innovator in the EU H2020 +CityxChange project to bring #DLT innovation in the energy trading marketplace. Stay tuned for more technical details on how #IOTA is being used in the project solutions. https://t.co/Uwiqn3g2G6@plusCities @EU_Commission

— IOTA (@iotatoken) August 5, 2020

CityxChange project aims to build a robust renewable energy marketplace where peer-to-peer (P2P) trading within a city is easy and frictionless. This is where IOTA plays an important role.

The EU project is divided into several work packages, with each of them focusing on different areas of a renewable energy-based smart city of the future. IOTA is exploring Tangle’s use cases in multiple areas such as project management, development and planning.

CityxChange leverages IOTA for the development of automatic communication energy-positive buildings that don’t require third-parties to function.

To allow such P2P communications without third-party interference, there is a need to maintain trust between producers and consumers. IOTA’s Tangle technology promotes trust by ensuring the integrity of vital info shared between actors.

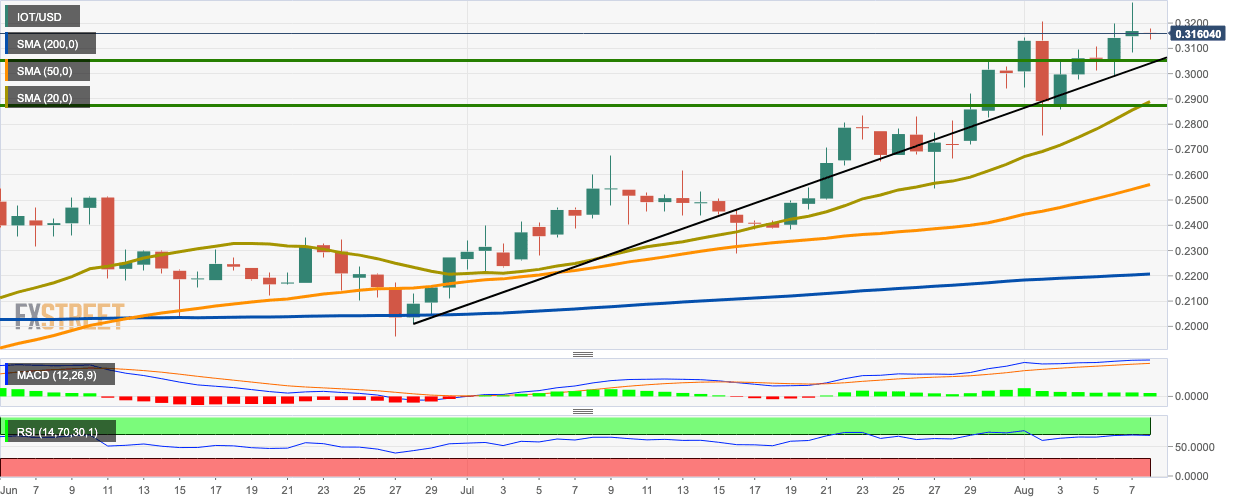

IOT/USD daily chart

IOT/USD faces bearish correction following two consecutive bullish days. The price has gone down from $0.316 to $0.315.The MACD shows sustained bullish momentum, while the RSI is trending along at the edge of the overbought zone.

IOT/USD has healthy support levels at $0.3054 and $0.287 (SMA 20).

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.